- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- VS 3.0 AZEO vs AZE2 & tiny utilization?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

VS 3.0 AZEO vs AZE2 & tiny utilization?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

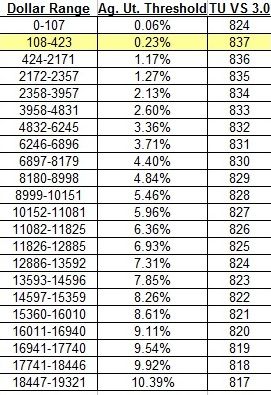

Below are the actual simulation data points for the above graph. Steady at 829 between 0.0% and 0.8%. Thus, my earlier comment on no negative impact with zero balance. Peak for this simulation (1/2019) appears to be around 5.5%.

| Ag Utilization | VS 3 Score | Ag Utilization | VS 3 Score |

| 0.00% | 829 | 10.55% | 824 |

| 0.03% | 829 | 10.92% | 823 |

| 0.40% | 829 | 11.65% | 822 |

| 0.77% | 829 | 12.21% | 821 |

| 0.96% | 827 | 13.13% | 820 |

| 2.07% | 826 | 13.50% | 819 |

| 2.63% | 825 | 14.62% | 817 |

| 3.70% | 824 | 15.54% | 816 |

| 4.44% | 823 | 16.28% | 814 |

| 5.04% | 822 | 17.39% | 812 |

| 5.74% | 831 | 18.32% | 810 |

| 6.11% | 830 | 19.43% | 808 |

| 6.66% | 830 | 20.37% | 806 |

| 7.26% | 829 | 23.31% | 800 |

| 8.33% | 827 | 24.98% | 796 |

| 9.25% | 826 | 27.76% | 789 |

| 9.62% | 825 | 30.91% | 783 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

@Thomas_Thumb wrote:VS3 does have multiple scorecards and undoubetedly each scorecard treats attributes a bit differently. Not sure how profiles are treated by scorecard.

That's the whole problem with figuring out these various scoring models - they all have a variable number of bins, which is standard for every logistic regression model. In data analytics, it's generally recommended to have between 10 and 20 bins to get the best predictors (information values). But every so often, the model (FICO/VS3) gets updated with new data (from CRA's) and the number of bins/scorecards/buckets can change out from under anyone trying to figure out exact point gains/losses.

You can even run your own 'mini-FICO simulation' using a programming environment I work in a lot called RStudio: https://www.listendata.com/2015/03/weight-of-evidence-woe-and-information.html

It appears probable that something else is triggering the 13 points up/down shift. At one time I posted a link to all VS reason codes - there are quite a few. A review of their reason codes could add insight. I can't find the link but you can likely still find the list through a search.

Here's a list of all the Vantage Score 3.0 reason codes I could find, in a nice HTML table rather than a PDF.

Taken from: http://tenantdata.com/downloads.html (An Experian PDF dated 2013)

Also from: https://www.reasoncode.org/ (The 'All Codes' link at the bottom. )

--Code--- | Vantage Score 3.0 Reason Code / Text Table |

4 | The balances on your accounts are too high compared to loan amounts |

5 | Too many of the delinquencies on your accounts are recent |

6 | You have too many accounts that were opened recently |

7 | You have too many delinquent or derogatory accounts |

8 | You have either too few loans or too many loans with recent delinquencies |

9 | The worst payment status on your accounts is delinquent or derogatory |

10 | You have either very few loans or too many loans with delinquencies |

11 | The total of your delinquent or derogatory account balances is too high |

12 | The date that you opened your oldest account is too recent |

13 | Your most recently opened account is too new |

14 | Lack of sufficient credit history |

15 | Newest delinquent/derogatory payment status on your accts is too recent |

16 | The total of all balances on your open accounts is too high |

17 | Balance on previously delinquent accts are too high compared to loan amts |

18 | Total of balances on accts never late is too high compared to loan amts |

21 | No open accounts in your credit file |

22 | No recently reported account information |

23 | Lack of sufficient relevant account information |

29 | Too many of your open bankcard or revolving accounts have a balance |

30 | Too few of your bankcard or other revolving accounts have high limits |

31 | Too many bankcard or other revolving accounts were opened recently |

32 | Balances on bankcard/revolving accts too high compared to credit limits |

33 | Your worst bankcard or revolving account status is delinquent/derogatory |

34 | Total of all balances on bankcard or revolving accounts is too high |

35 | Your highest bankcard or revolving account balance is too high |

36 | Your largest credit limit on open bankcard or revolving accts is too low |

39 | Available credit on your open bankcard or revolving accounts is too low |

40 | The date you opened your oldest bankcard or revolving acct is too recent |

42 | The date you opened your newest bankcard or revolving acct is too recent |

43 | Lack of sufficient credit history on bankcard or revolving accounts |

44 | Too many bankcard or revolving accounts with delinquent/derogatory status |

45 | Total balances too high on delinquent/derogatory bankcard/revolving accts |

47 | No open bankcard or revolving accounts in your credit file |

48 | No bankcard or revolving recently reported account information |

49 | Lack of sufficient relevant bankcard or revolving account information |

53 | The worst status on your real estate accounts is delinquent or derogatory |

54 | The amt of balance paid down on your open real estate accounts is too low |

55 | Open real estate acct balances are too high compared to their loan amts |

56 | You've been playing reindeer games on myFICO forums. |

57 | Too many real estate accts with delinquent or derogatory payment status |

58 | The total of all balances on your open real estate accounts is too high |

61 | No open real estate accounts in your credit file |

62 | No recently reported real estate account information |

63 | Lack of sufficient relevant real estate account information |

64 | No open first mortgage accounts in your credit file |

65 | Lack of sufficient relevant first mortgage account information |

66 | Your open auto account balances are too high compared to their loan amts |

68 | No open auto accounts in your credit file |

69 | Lack of sufficient relevant auto account information |

71 | You have either very few installment loans or too many with delinquencies |

72 | Too many installment accts with a delinquent or derogatory payment status |

73 | The worst status on your installment accounts is delinquent or derogatory |

74 | The balance amount paid down on your open installment accounts is too low |

75 | The installment account that you opened most recently is too new |

76 | You have insufficient credit history on installment loans |

77 | The balances on your accounts are too high compared to loan amounts |

78 | Balances on installment accts are too high compared to their loan amounts |

79 | Too many of the delinquencies on your installment accounts are recent |

81 | No open installment accounts in your credit file |

83 | Lack of sufficient relevant installment account information |

84 | The number of inquiries was also a factor, but effect was not significant |

85 | You have too many inquiries on your credit report. |

86 | Your credit report contains too many derogatory public records |

87 | Your credit report contains too many unsatisfied public records |

88 | One or more derogatory public records in your credit file is too recent |

90 | Too few discharged bankruptcies |

93 | The worst status on your student loan accts is delinquent or derogatory |

94 | The balance amount paid down on your open student loan accts is too low |

95 | You have too many collection agency accounts that are unpaid |

96 | The total you owe on collection agency accounts is high |

97 | You have too few credit accounts |

98 | There is a bankruptcy on your credit report |

| Exclusion Scores |

0001 | File/trade indicating consumer is deceased |

0004 | No information on credit report (other than maybe inquiries) |

9000 | System Exclusion |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

TT, I used the simulator to come up with a data set similar to what you provided in Post 11, except I stopped just above 10% aggregate utilization. I did not see any projected score spike the way you did in the 5%-6% or so range as you can see from my numbers:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

So I went from a $5 reported balance on a single revolver with a $10k limit to a $297 reported balance on a single revolver with a $10k limit and my score moved back from 824 --> 836. I would say that this is pretty strong evidence that a very small AZEO balance doesn't maximize VS 3.0 scores. I think I read on here that there's no penalty for all $0 balances on revolvers with VS 3.0. Does that mean no penalty verses a tiny (less than ideal) balance, or no penalty from a small but not trivial balance that is ideal from a VS 3.0 standpoint?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

VantageScore has a comprehensive list of negative reason statements. I don't recall seeing a "no recent activity on revolving accounts" penalty/reason code like what Fico has published (I'll recheck). Not sure what triggers the VS3 spike up but, location of the spike does appear to shift.

The below simulation showed a constant score from absolute zero up to about 0.8% followed by steady decline up to just over 5%. Then there is an abrupt spike up followed by second steady decline. In the below simulation, the spike up was clearly not associated with going from an all zero penalty to a balance reporting.

Location of the spike appears to be profile/scorecard dependent. Could prior utilization/balance affect how current utilization/balance is evaluated?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

List of VS3 negative reason codes (same as posted above - with individual links)

VantageScore 3.0 codesv3

04: The balances on your accounts are too high compared to loan amounts

05: Too many of the delinquencies on your accounts are recent

06: You have too many accounts that were opened recently

07: You have too many delinquent or derogatory accounts

08: You have either very few loans or too many loans with recent delinquencies

09: The worst payment status on your accounts is delinquent or derogatory

10: You have either very few loans or too many loans with delinquencies

11: The total of your delinquent or derogatory account balances is too high

12: The date that you opened your oldest account is too recent

13: Your most recently opened account is too new

14: Lack of sufficient credit history

15: Newest delinquent or derogatory payment status on your accounts is too recent

16: The total of all balances on your open accounts is too high

17: Balances on previously delinquent accounts are too high compared to loan amts

18: Total of balances on accounts never late is too high compared to loan amounts

21: No open accounts in your credit file

22: No recently reported account information

23: Lack of sufficient relevant account information

29: Too many of your open bankcard or revolving accounts have a balance

30: Too few of your bankcard or other revolving accounts have high limits

31: Too many bankcard or other revolving accounts were opened recently

32: Balances on bankcard or revolving accounts too high compared to credit limits

33: Your worst bankcard or revolving account status is delinquent or derogatory

34: Total of all balances on bankcard or revolving accounts is too high

35: Your highest bankcard or revolving account balance is too high

36: Your largest credit limit on open bankcard or revolving accounts is too low

39: Available credit on your open bankcard or revolving accounts is too low

40: The date you opened your oldest bankcard or revolving account is too recent

42: The date you opened your newest bankcard or revolving account is too recent

43: Lack of sufficient credit history on bankcard or revolving accounts

44: Too many bankcard or revolving accounts with delinquent or derogatory status

45: Total balances too high on delinquent/derogatory bankcard or revolving accts

47: No open bankcard or revolving accounts in your credit file

48: No bankcard or revolving recently reported account information

49: Lack of sufficient relevant bankcard or revolving account information

53: The worst status on your real estate accounts is delinquent or derogatory

54: The amount of balance paid down on your open real estate accounts is too low

55: Open real estate account balances are too high compared to their loan amounts

57: Too many real estate accounts with delinquent or derogatory payment status

58: The total of all balances on your open real estate accounts is too high

61: No open real estate accounts in your credit file

62: No recently reported real estate account information

63: Lack of sufficient relevant real estate account information

64: No open first mortgage accounts in your credit file

65: Lack of sufficient relevant first mortgage account information

66: Your open auto account balances are too high compared to their loan amounts

68: No open auto accounts in your credit file

69: Lack of sufficient relevant auto account information

71: You have either very few installment loans or too many with delinquencies

72: Too many installment accounts with a delinquent or derogatory payment status

73: The worst status on your installment accounts is delinquent or derogatory

74: The balance amount paid down on your open installment accounts is too low

75: The installment account that you opened most recently is too new

76: You have insufficient credit history on installment loans

77: Newest delinquent or derogatory status on installment accounts is too recent

78: Balances on installment accounts are too high compared to their loan amounts

79: Too many of the delinquencies on your installment accounts are recent

81: No open installment accounts in your credit file

83: Lack of sufficient relevant installment account information

84: The number of inquiries was also a factor, but effect was not significant

85: You have too many inquiries on your credit report.

86: Your credit report contains too many derogatory public records

87: Your credit report contains too many unsatisfied public records

88: One or more derogatory public records in your credit file is too recent

90: Too few discharged bankruptcies

93: The worst status on your student loan accounts is delinquent or derogatory

94: The balance amount paid down on your open student loan accounts is too low

95: You have too many collection agency accounts that are unpaid

96: The total you owe on collection agency accounts is high

97: You have too few credit accounts

98: There is a bankruptcy on your credit report

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

Interesting that your simulation and mine are different, TT. I would think that you and I would possess similar scorecards and thus see similar simulations. You having a spike around 5% is dramatically different than mine around .25%. I know nothing of the different VS 3.0 scorecards though, so perhaps ours are more different than I'm assuming.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

Perhaps past balance/utilization influences peak location. You typically report AZEO with a trivial balance. I let all cards in use report full monthly charges and then just pay statement balances. Typically I have 4 cards reporting monthly balances.

It would be interesting to see how NRB525's VS3 scores look on a simulation. He reports balances on multiple cards and some of those balances are nontrivial.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

@Thomas_Thumb wrote:Perhaps past balance/utilization influences peak location. You typically report AZEO with a trivial balance. I let all cards in use report full monthly charges and then just pay statement balances. Typically I have 4 cards reporting monthly balances.

It would be interesting to see how NRB525's VS3 scores look on a simulation. He reports balances on multiple cards and some of those balances are nontrivial.

Agreed that would be good to hear. I wouldn't say that I "typically" report AZEO with a trivial balance though. I have a bunch of times for testing purposes and as you know recently I did in order to grab my 28 FICO scores. I've also done the converse, where I did that test last year in taking all of my 8 revolvers to a reported balance in order to see the FICO score impact. I would say it's more typical that 2-3 of my cards have a reported balance at any given time and usually they're nontrivial with my Citi card (daily driver) showing a reported balance in the $2000-$3000 range and 1-2 other cards with a few hundred bucks reported.