- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Why did my scores increase 30+ points on all three...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why did my scores increase 30+ points on all three CBs?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@JLK93 wrote:LOTR,

Do you have any ongoing disputes?

JLK93, I have no ongoing disputes. My last disputes were made in Oct 2016 or so regarding my PIF tax lien. EX deleted it. EQ and TU did not. Those disputes have long been completed (as far as EQ and TU are concerned) and I have not disputed it again (yet). Although, I did have a discussion with EQ last week regarding the tax lien over the phone, but I did not formally dispute it - I simply asked some questions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

Ok fico gurus out there....tell me if you think this is plausible/reasonable for the increase.

In gathering stats from the actual reports (instead of from memory - which is always dangerous of late), I noticed this tidbit of data:

Risk factor in Jan 2017: EQ: 13% TU: 5% EX: 5%

Risk factor in Feb 2017: EQ 2% TU: 2% EX: 2%

Anyone knows what may affect the *risk factor* and why it may change so drastically?

I also noticed that my % of accounts being paid as agreed increased. I assumed this was influenced by adding new accounts and having some payments reported from those new accounts. I also assume this would have then likely influenced the *risk factor*, but completely pulling that out of the air as I don't have a clue!

The only other thing that I see is the # of accounts being paid as agreed as this increased from 2 in January to 7 in February.

Anywhoo...here are some stats that may help figure out why the increase, I know some may be thinking - who cares - just take the increase and be happy. I have and am..but I would like to understand as much as I can and this one simply doesn't make any sense to me.

STATS as of Oct 2016

(before 2016 last quarter new TLs were applied for)

Fico 8 scores EQ: 684 TU: 682 EX: 723

AoOA 21 yrs 1 m

AAoA EQ: 14yr 4m TU: 13 yrs 11m EX: 13 yrs 9m

1 PR: Tax Lien (EQ and TU only), release and PIF Jan 2013

1 account being paid as agreed

Negative indicators: EQ: 1 TU: 1 EX: 1 *

Total accounts: EQ: 14 TU: 13 EX: 13 **

Inquires: EQ: 2 TU: 1 EX: 0

Open installments: 0

Age of Most Recently Open Account: 8m

Util %: EQ: 4% TU: 5%: EX: 4%

STATS as of Jan 2 2017

(after all new CC TLs reported)

(before Alliant reported)

Fico 8 scores EQ: 694 TU: 708 EX: 740

AoOA 21 yrs 4 m

AAoA EQ: 10 yrs 3m TU: 9 yrs 9m EX: 9 yrs 8m

1 PR: Tax Lien (EQ and TU only), release and PIF Jan 2013

2 account being paid as agreed

Negative indicators: EQ: 1 TU: 1 EX: 1 *

Total accounts: EQ: 20 TU: 19 EX: 19 **

Inquires: EQ: 7 TU: 2 EX: 2

Note: for TU 3 inquiries are listed, but only 2 are counted as 2 are listed twice from NFCU on same day and beta shows a count of only 2 for TU which agrees with an independent TU report

Open installments: 0

Age of Most Recently Open Account: 1m

Util %: EQ: 6% TU: 7%: EX: 6%

STATS as of Jan 12 2017

(after Alliant reported, received a 17-20 point increase)

Fico 8 scores EQ: 712 TU: 725 EX: 760

- no report pulled

STATS as of Jan 18 2017

(after a card reported a zero balance mid Jan there was a 4 pt Fico 8 EQ score increase)

Fico 8 scores EQ: 716 TU: 725 EX: 760

- no report pulled

STATS as of Feb 2 2017

(received 30-35 point increase)

Fico 8 scores EQ: 751 TU: 757 EX: 792

AoOA 21 yrs 5 m

AAoA EQ: 9 yrs 10m TU: 9 yrs 4m EX: 9 yrs 3m

1 PR: Tax Lien (EQ and TU only), release and PIF Jan 2013

7 account being paid as agreed

Negative indicators: EQ: 1 TU: 1 EX: 1 *

Total accounts: EQ: 21 TU: 20 EX: 20 **

Inquires: EQ: 7 TU: 2 EX: 2

Note: for TU 3 inquiries are listed, but only 2 are counted as 2 are listed twice from NFCU on same day and beta shows a count of only 2 for TU which agrees with an independent TU report

Open installments: 1

Age of Most Recently Open Account: 2m

Util %: EQ: 4% TU: 5%: EX: 4%

* This is from a car loan that is now closed, PIF, had three 30-day lates (Nov 2010, Feb 2011, Mar 2011)

**The missing account for TU is a closed AU user CC, closed in 2008 with a TL of $7,200

**The missing account for EX is a student loan, closed Sep 2011 (tranferred to a different servicer)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@Anonymous wrote:

Risk factor in Jan 2017: EQ: 13% TU: 5% EX: 5%

Risk factor in Feb 2017: EQ 2% TU: 2% EX: 2%

1 PR: Tax Lien (EQ and TU only), release and PIF Jan 2013

7 account being paid as agreed

LOTR,

Where are you seeing this Risk Factor?

Is the Tax Lien your only derogatory?

Could you please list all of your derogatories and their ages?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@JLK93 wrote:

@Anonymous wrote:

Risk factor in Jan 2017: EQ: 13% TU: 5% EX: 5%

Risk factor in Feb 2017: EQ 2% TU: 2% EX: 2%

1 PR: Tax Lien (EQ and TU only), release and PIF Jan 2013

7 account being paid as agreedLOTR,

Where are you seeing this Risk Factor?

On the Regular 3B report, there is a Your Risk To The Lender section which has a Risk Rate section. Also, on the Beta report, after the Credit Mix section, there is a section labeled Risk Rate. You can also just click the Fico Score link under Contents (on the left side of the screen when viewing a report) - the bottom of the screen has a Risk Rate section.

Is the Tax Lien your only derogatory?

Yes.

Could you please list all of your derogatories and their ages?

Here are my derogs and negatives:

Tax Lien: filed in Jan 2011, released & PIF Jan 2013. Age from released date: 4 yrs. Age from filed date: 6 yrs.

Three 30-Day Lates from same car loan (Nov 2010, Feb 2011, Mar 2011), So ages are (6 yrs 3m, 6 yrs, 5 yrs 11 m)

That's it as far as derogs and negatives. All are listed on January and February reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

LOTR,

Increasing from 2 cards to 7 cards could certainly cause your score increase. However, I'm confused. In your first post I seem to recall that your said you had 5 cards reporting balances last month and that 3 of the new cards were 3 months old.

How many open cards did you already have prior to opening the new cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@JLK93 wrote:LOTR,

Increasing from 2 cards to 7 cards could certainly cause your score increase. However, I'm confused. In your first post I seem to recall that your said you had 5 cards reporting balances last month and that 3 of the new cards were 3 months old.

The confusion you are experiencing is in that 1) the 2, 7 and 5 are different fico stats and 2) I was mistaken on the 3m age of the new accounts. I calculated the age from when I applied for the accounts, not when they started reporting (which differs by 1 month).

Here are the fico stats regarding the 2, 7 and 5 confusion :

January 2017

Number of accounts being paid as agreed: EQ: 2 TU: 2 EX: 2

Accounts with Balances: EQ: 5 TU: 5: EX: 5

February 2017

Number of accounts being paid as agreed: EQ: 7 TU: 7 EX: 7

Accounts with Balances: EQ: 4 TU: 5: EX: 4

How many open cards did you already have prior to opening the new cards?

I had two open CC cards prior to the adding the new TLs last quarter: one store card that I just started using in Oct 2016 (never used it prior to then) that was 6 yrs 4 m old, and 1 CC that was opened Feb 2016 that was 8 m old.

JLK93,

Now that I look at these two pieces of data, it seem that the change in # (or %) of cards reporting a balance isn't likely the cause of the increase because the TU # of cards reporting a balance did not change but it still showed a 32pt increase - unless the overall balance decrease caused it, which I guess is still possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

LOTR,

Are there any differences between the negative reason statements in February and January?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@JLK93 wrote:LOTR,

Are there any differences between the negative reason statements in February and January?

Yes.

Negative reasons that differ:

You have no recent activity from a non-mortgage installment loan.

January shows this negative applying to TU only.

February does not apply this negative to any CBs. This negative is not listed in February. This makes sense given that the Alliant non-mortgage installment reported mid-January. But remember, those point increases were already reflected in the fico scores before February's 30+ increases.

You have few accounts that are in good standing

January shows this negative applying to all three CBs.

February shows this negative applying to TU only.

Positive reasons that differ:

You have established credit history.

January shows this positive applying to TU only.

February shows this positive applying to TU and EX only.

You've limited the use of your available revolving credit.

January: Ratio of your revolving balances to your credit limits: EQ: 6% TU: 7% EX: 6%

February: Ratio of your revolving balances to your credit limits: EQ: 4% TU: 5% EX: 4%

Ofcourse, there are other negative and positive reasons listed in January and February reports, but they are the exact same for each month. I've only listed those that were different either in which CB they applied to or the data they reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

A summary of possible causes for the increase (so far):

- A dip in aggregate utilization from > 5% to <= 5%

A drop in Risk Factor from 5% and 13% to 2% across the board- A drop in % of CC usage from > 50% to <= 50%

An increase in % of accounts being paid as agreed from 92%-93 % to 94%-95%- Possible aging

- There seems to be a consensus that there is no fico point advantage at 5% aggregate or single CC utilization

- Although some points may have been gained by decreasing the % of CC used, it is doubtful it would be as much as 30-35 points

I'm hoping to get more feedback on #2 (risk factor) and #4 (% of accounts being paid as agreed). From what I can tell, these are the only two categories that affected all three CBs in a positive way.- Increase may be due to something aging, but of what? Derogs and negatives are minimal, accounted for and old enough not to have a big enough impact. It doesn't appear aging, derogs or negatives are coming into play at this point.

[edited - eliminated #2 from iv's explanation. Thanks IV!]

[edited - eliminated #4 from iv's explanation. Thanks again, IV!]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

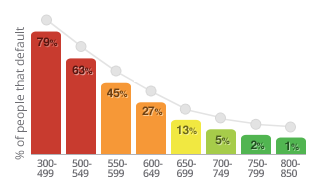

@Anonymous wrote:2. A drop in Risk Factor from 5% and 13% to 2% across the board

That's an effect, not a cause.

Moving up to a new score range causes the system to display the related risk of default associated with that score range.

It's not a factor in the score moving up, just a displayed side effect of the fact that it DID move.

See the assoicated chart from MyFICO:

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06