- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Why is my FICO so much lower?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why is my FICO so much lower?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my FICO so much lower?

Hi Everyone. First time poster here. I've done some research as to why my FICO score is so much lower than my other credit scores. I understand that they are calculated differently, however, I am ultimately looking to improve my score in the short term. In short, my transunion and equifax scores have been in the 775-795 range for some time. When I look at my fico score, its typically in the 635-660 range. I've checked credit reports, and both reports are showing the same exact details. My credit report is flawless with the exception of 2 notes. The first is a short average credit length history (I'm at about 2-4 years depending on which report. Oldest account is about 8 or 9 years). The second is that I have a deragotory mark from a hospital from about 5 years ago. I've been meaning to fight this for some time as my insurance should have paid the hospital, but have also been confused with how to go about this. Would these two things lower my FICO so significantly even though it is reported on transunion and equifax? Any advice to get me in the right direction would be great. Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

Welcome to myFICO. When you say lower the your 'other credit scores', I am assuming you mean from other sites?

If you want your actual FICO scores you can get there here and also your FICO08 from Credit Check Total. The only place where you can get all of the standard flavors of FICO scores is here. In the 3B report that you purchase from this site they will have FICO 08, FICO 09 as well as various auto, mortgage and credit cards versions.

You get a FICO score for each credit bureau, Experian, Equifax and Transunion.

I imagine others will be along to comment about how to improve.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

When you say "deragatory mark", what do you mean? Is it a charge off, or what type of derog is it?

Appleman gave great advice on score variation between FICO and other score versions.

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

Also, try making a free account on creditscorecard.com, it will tell you your FICO exp score, and a brief summary of what is benefitting your score and what is harming it..

I would start from there, and just read the forums..

Total Credit Line- $89,300| Personal- $78,650 | Biz- $5,650

Current Score [F9]: EX-721 || TU-759 || EQ-768 || AAoA-2yrs7mo || uti- 1% || 100% payment history || 9 inq

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

Hey Everyone. Thanks for the replies. I'm still very confused as I've been very responsible with my credit, but can't figure out why my Experian FICO score remains so low. I went ahead and signed up for Credit Scorecard. The only negative mark is the medical collection account. Would having this one blemish on my credit report contribute to such a low score with Experian? Would removing this deragatory mark increase my credit significantly? Thanks again for the help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

@Anonymous wrote:Hey Everyone. Thanks for the replies. I'm still very confused as I've been very responsible with my credit, but can't figure out why my Experian FICO score remains so low. I went ahead and signed up for Credit Scorecard. The only negative mark is the medical collection account. Would having this one blemish on my credit report contribute to such a low score with Experian? Would removing this deragatory mark increase my credit significantly? Thanks again for the help.

Could you provide some information such as how many credit cards, open loans, mortgage loans, etc. that you have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

@Anonymous wrote:Hi Everyone. First time poster here. I've done some research as to why my FICO score is so much lower than my other credit scores. I understand that they are calculated differently, however, I am ultimately looking to improve my score in the short term. In short, my transunion and equifax scores have been in the 775-795 range for some time. When I look at my fico score, its typically in the 635-660 range. I've checked credit reports, and both reports are showing the same exact details. My credit report is flawless with the exception of 2 notes. The first is a short average credit length history (I'm at about 2-4 years depending on which report. Oldest account is about 8 or 9 years). The second is that I have a deragotory mark from a hospital from about 5 years ago. I've been meaning to fight this for some time as my insurance should have paid the hospital, but have also been confused with how to go about this. Would these two things lower my FICO so significantly even though it is reported on transunion and equifax? Any advice to get me in the right direction would be great. Thanks in advance.

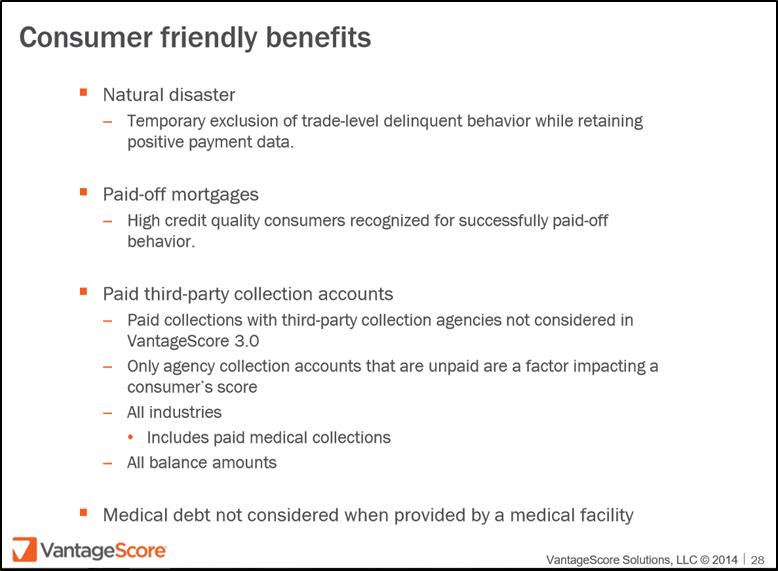

A "short" average credit history is not a flaw. It does have a limited impact on score but, is treated similarly by VantageScore 3.0 and Fico 08. So, that is not the cause of the score "offset" between the models.

The score difference almost certainly relates to the medical debt (collection?, paid?) being treated differently by VantageScore compared to Fico 08. I suspect the debt must be/have been over $100. If under $100, Fico 08 would not ding your score. If the debt is paid now but was over $100, your Fico 09 scores may be much higher than Fico 08 scores. Note: A collection debt, even 5 years old, can drop score by 100 points.

See below paste regarding VS3

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why is my FICO so much lower?

Hey Everyone. Thanks for much for the replies and all of the amazing information. Here is some additional information to help. I never paid of the item in collection. It was an error on the hospital's part (I had health insurance and they never properly billed them). I disputed it and it is noted on my account, but they never followed up with me again and I forgot about it. It's about $250 total.

Here are some details from credit scorecard:

Score: 655

Total Accounts: 6

Length of Credit: 8 years

Inqueries: 6 (I've recently signed up for a handful of cards that I pay off in full every month for travel benefits for my honeymoon. My score was still this low even before having these inqueries).

Revolving Utiliation: 1%

Missed Payments: 0

Derogatory Mark: 1 (medical bill as noted above)

Here are details from Trasnsunion:

Score: 790

Utilization 1% (credit limit ~45K)

Derogatory Mark: 1 (medical bill as noted above)

Average Length of Credit: About 4 years

Total Accounts: 11

Credit Inqueries: 1

I'm in no rush to improve my score, but I would like to make sure I'm in a good position for when the time comes to get a house and what not. It's especially frustrating when I have been very responsible with making payments, keeping my utilization low, etc. and still have a crappy fico score. If you guys think the medical derogatory mark is causing issues, what do you think the best way of getting it removed? I'm wondering if I should work it out with the hospital and then dispute with the collection agnecy and credit beaurus? Thanks again for all of the great information.

-Steve