- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why so Low???

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why so Low???

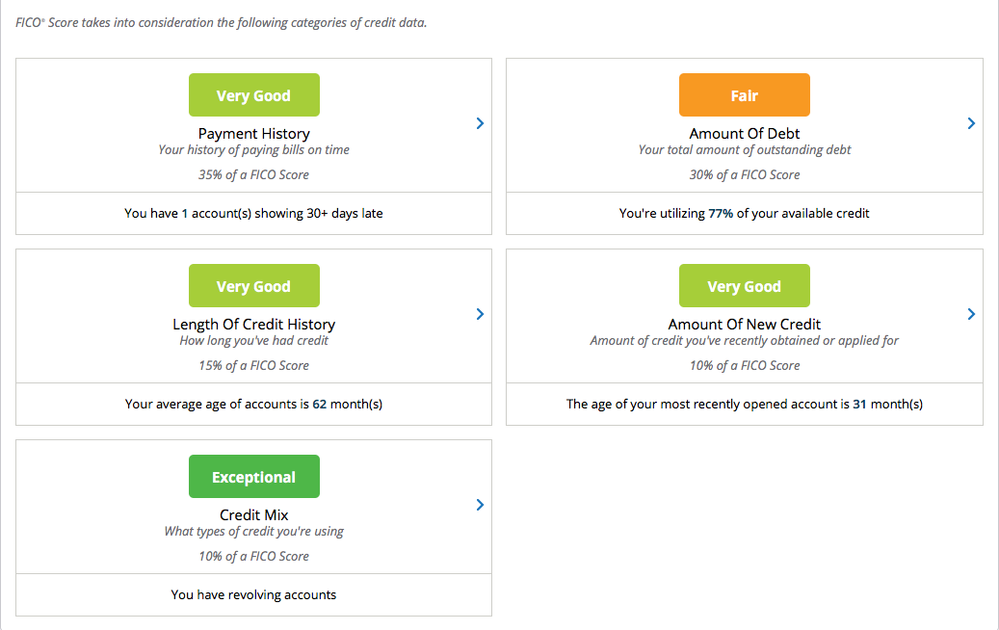

As you can see everything is very good or exceptional, except the Amount of Debt which is Fair and makes up 30% of score. So how can my score be 635 now???

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

@KeithW wrote:As you can see everything is very good or exceptional, except the Amount of Debt which is Fair and makes up 30% of score. So how can my score be 635 now???

Your screenshot explains why your score is low.

The principal reason is that you're using 77 percent of your available credit. Do you have any cards that are maxed out or very near their credit limit? How many of your cards are carrying balances? The 77 percent aggregate utilization is very high; the "gurus" in this forum suggest not using more than 8.9% of your aggregate utilization, and not exceeding 28.9% on any individual card if you want to maximize your FICO scores.

As it is, you are being penalized for exceeding several aggregate utilization thresholds; 8.9%, 28.9%, 48.9% and 68.9%. Reducing your utilization below any of the stated thresholds will yield immediately improvement in your FICO scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

I understand that hurts, but even if it was at 100% util that still is only a 30% factor. So I can't see how that one thing being "Fair" could have such an effect. Shouldn't the other 70% being positive put me up in the 700s?

I recently had two credit cards I hadn't used in quite a few years close due to inactivity, which combined had $13,000 in available credit. That tanked my utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

You should not pay any attention to labels like "very good", they are meaningless. You do have a late payment, so your payment history is definitely not "very good". Together with your 77% utilization, a Fico score of 635 is no surprise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

@KeithW wrote:I understand that hurts, but even if it was at 100% util that still is only a 30% factor. So I can't see how that one thing being "Fair" could have such an effect. Shouldn't the other 70% being positive put me up in the 700s?

I recently had two credit cards I hadn't used in quite a few years close due to inactivity, which combined had $13,000 in available credit. That tanked my utilization.

Unfortunately that's not how it works. I'm sure several of the FICO gurus will eventually respond but for now you can start by reading The Truth about Credit Card Utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

Well, i just got done scheduling payments that will bring the utilization on all of my cards with balances down to just under 70% util. I will see if that helps. I currently have 10 cards with balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

@KeithW wrote:Well, i just got done scheduling payments that will bring the utilization on all of my cards with balances down to just under 70% util. I will see if that helps. I currently have 10 cards with balances.

Fico rounds up. So make sure to go under 68.9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

Just a tip: Reporting a balance on several cards ie 10 accounts of 15 will definitely hold down your scores.

The 70% aggregate utilization may not move your score since it isn't crossing down to the next threshold of <68.9%. Shoot for that in the interim, and work on "snowballing" smaller balance credit cards to further reduce utilization while also reducing the number of cards reporting a balance.

If you can work hard on the goodwill letter to get the late removed, it will give you a very nice score bump, as you will have a clean file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

The late payment was to Ford Credit 3 years ago. Is there any risk of it being considered more recent if I write a goodwill letter or does that just apply to collections?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why so Low???

Do you have any collections?