- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- inactive accounts -- effect on FICO score?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

inactive accounts -- effect on FICO score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

@Thomas_Thumb wrote:I suspect the credit card issuer needs to report the card "condition" as inactive to the CRAs - like they do for open/closed. I would anticipate "bank cards" are much more likely to be reported as inactive relative to store cards.

Fico obviously does look at the condition Open/Closed so why not inactive as well (assuming the CC issuer sends that to the CRAs). I'd be interested to know if anyone has a report that lists "inactive" in the condition field as opposed to open or closed. I have a couple accounts that were closed due to inactivity and that is stated in the comment section. However, that was long before I started looking at various credit reports.

Hi TT. Why do you suspect that? I can see why you'd think that if one couldn't imagine how FICO would make this assessment based on existing data fields. But if FICO actually wants to include Active/Inactive as part of a model (e.g. if it wants to exclude the CLs of inactive cards from the consumer's total credit limit in the utilization calculation) then it can do that with DOLA. (I.e. FICO can define "Inactive" as one where the DOLA was > ___ days ago.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

CGID - It appears to me that all revolving account status conditions are provided to the CRAs by creditors. Examples are 30/60/90/120 day lates, Open, Closed, not reported. I see inactive status as a natural add on that would be pulled into the Fico algorithm externally rather than being defined by an algorithm calculation. If an account were flagged as inactive then that might trigger a look at date of last activity relative to date last reported (an IF - THEN subroutine).

Of course Fico could make that determination based on DOLA but, I think a trigger coming from the creditor is more likely.

P.S. I have no personal data to draw from. If someone has some cards tagged as inactive, please share data & screen shots.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

@Thomas_Thumb wrote:CGID - It appears to me that all revolving account status conditions are provided to the CRAs by creditors. Examples are 30/60/90/120 day lates, Open, Closed, not reported. I see inactive status as a natural add on that would be pulled into the Fico algorithm externally rather than being defined by an algorithm calculation. If an account were flagged as inactive then that might trigger a look at date of last activity relative to date last reported (an IF - THEN subroutine).

Of course Fico could make that determination based on DOLA but, I think a trigger coming from the creditor is more likely.

P.S. I have no personal data to draw from. If someone has some cards tagged as inactive, please share data & screen shots.

@right. But the examples you give are all examples of information that aren't computable based on existing datafields that we already know are in the database. That is what I was getting at when I wrote:

I can see why you'd think that if one couldn't imagine how FICO would make this assessment based on existing data fields. But if FICO actually wants to include Active/Inactive as part of a model... then it can do that with DOLA.

In other words, we do not have to hypothesize the existence of new fields (e.g. creditor supplied boolean Active/Inactive fields) in order to explain how FICO could do that. Indeed, the DOLA would do it better than such fields.

Here's an analogous case. There's some reason to believe that FICO may have an inner model-dependent definition of what constitutes a "new" account. Suppose for example that FICO defines an account to be "new" if it is less than a year old, and then uses that to assess as a scoring factor what percentage of your accounts are New. (LexisNexis does something like this in its model.) If FICO did want to have a scoring factor like that, we would not need to hypothesize the existence of a creditor-supplied boolean flag for "Old/New" somewhere in the CRA database. Such a hypothesis would be unnecessary, because we already know of a field called Date Opened that can be used to compute the Old/New status based on whatever definition FICO wanted. (1 year, 2 year, whatever.) Indeed using Date Opened would generate the Old/New field more reliably and consistently than relying on each creditor to assess this and supply it.

So as I see it, it's an issue of Ockham's Razor. It's possible of course that creditors do indeed supply a specific boolean field fpr Active/Inactive, and I am encouraged by your interest in seeing if anyone can find out if they do this. I am just unclear why you think, if FICO does make this kind of distinction, why it would imply that they have to be getting it as a specific additional field from the creditors. I agree with Revelate that DOLA would work fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

@Anonymous wrote:

@Thomas_Thumb wrote:CGID - It appears to me that all revolving account status conditions are provided to the CRAs by creditors. Examples are 30/60/90/120 day lates, Open, Closed, not reported. I see inactive status as a natural add on that would be pulled into the Fico algorithm externally rather than being defined by an algorithm calculation. If an account were flagged as inactive then that might trigger a look at date of last activity relative to date last reported (an IF - THEN subroutine).

Of course Fico could make that determination based on DOLA but, I think a trigger coming from the creditor is more likely.

P.S. I have no personal data to draw from. If someone has some cards tagged as inactive, please share data & screen shots.

@right. But the examples you give are all examples of information that aren't computable based on existing datafields that we already know are in the database. That is what I was getting at when I wrote:

I can see why you'd think that if one couldn't imagine how FICO would make this assessment based on existing data fields. But if FICO actually wants to include Active/Inactive as part of a model... then it can do that with DOLA.

In other words, we do not have to hypothesize the existence of new fields (e.g. creditor supplied boolean Active/Inactive fields) in order to explain how FICO could do that. Indeed, the DOLA would do it better than such fields.

Here's an analogous case. There's some reason to believe that FICO may have an inner model-dependent definition of what constitutes a "new" account. Suppose for example that FICO defines an account to be "new" if it is less than a year old, and then uses that to assess as a scoring factor what percentage of your accounts are New. (LexisNexis does something like this in its model.) If FICO did want to have a scoring factor like that, we would not need to hypothesize the existence of a creditor-supplied boolean flag for "Old/New" somewhere in the CRA database. Such a hypothesis would be unnecessary, because we already know of a field called Date Opened that can be used to compute the Old/New status based on whatever definition FICO wanted. (1 year, 2 year, whatever.) Indeed using Date Opened would generate the Old/New field more reliably and consistently than relying on each creditor to assess this and supply it.

So as I see it, it's an issue of Ockham's Razor. It's possible of course that creditors do indeed supply a specific boolean field fpr Active/Inactive, and I am encouraged by your interest in seeing if anyone can find out if they do this. I am just unclear why you think, if FICO does make this kind of distinction, why it would imply that they have to be getting it as a specific additional field from the creditors. I agree with Revelate that DOLA would work fine.

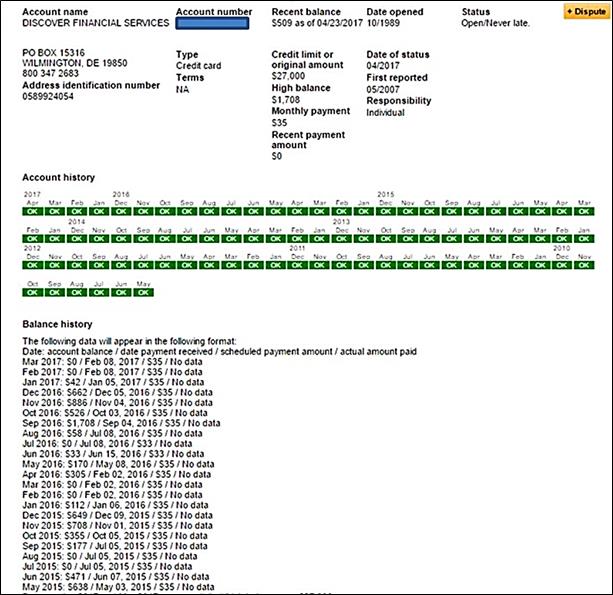

CGID - The status field has always existed - the only question is whether or not creditors can/do report inactive as a possible status. Up thread I pasted a 3B example and suggested the creditor could put that in the field labeled "condition". Below is a paste from my EX credit report from annual credit report.com. In this case inactive might be listed in the status field. Example: "open/inactive" or "inactive/never late".

I suspect Fico's customer provides the trigger and the customer is the creditor.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

Hi TT. I just did some research and I think you are right. I.e. it is possible for a card to be coded by the creditor as Inactive. Here is a case of it, though it is worth observing that it apparently happened almost 15 years ago. It would be nice to find cases of it happening a little more recently than that.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

I don't know if that's even possible with the current libraries: should be easy enough to find the Metro2 format spec and see if there's an option to even report the tradeline as inactive... I've never seen it here and if the one reference we see is from 2002, well that was back in the dark ages haha.

Good find though CGID.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

@Anonymous wrote:Hi TT. I just did some research and I think you are right. I.e. it is possible for a card to be coded by the creditor as Inactive. Here is a case of it, though it is worth observing that it apparently happened almost 15 years ago. It would be nice to find cases of it happening a little more recently than that.

Other information is difficult to obtain but can be made available if specifically

Thanks.

Thanks for searching. From what I have read what we are provided in CRA credit reports is a small subset of what they have on file.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: inactive accounts -- effect on FICO score?

Ah, I think this is in the tradeline remarks field actually, not in the tradeline data. Like CBC / CBCG I don't think this factors into scoring. Was looking at something squirrley that updated on my report post dispute (a note loan? what's that?) and found the following... which didn't really help my issue but showed where Inactive could be found in terms of on a credit report.

https://www.experian.com/assets/access/arf7-glossary.pdf

I think if there is an exclusion on inactivity, it's not based on this and this is a really rare code anyway I suspect. Other than testing it as described above I don't know of any other ways to determine it; FICO for example does mandate one account being active within the last six months to generate a FICO score, and to be absolutely certain they aren't using the inactive code referenced here... I've always made the blase assumption it just meant DOLA.