- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- questions regarding score decrease

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

questions regarding score decrease

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

Two quick thoughts:

(1) You ask more than once about strategies that will help you build credit over time. The AZEO strategy (All cards Zero Except One, with the remaining card reporting a smallish balance) will not help you build your score. It won't hurt you in your desire for your scores to go up over time, but it won't help either. Where AZEO comes into its own is as a short-term strategy to be employed in the 40 days before an important credit pull. BBS, SouthJ, and others can explain why this is so if you are interested.

The long term strategy is to never be late, keep your total utilization under 29%, and keep each card at under 49%. Coupling that with strategies for removing derogs is the simplest long term strategy.

(2) You mention that you are paying $360 per year to monitor your scores, just as part of the long term desire to track your rebuilding efforts. And you base that on the idea that the myFICO credit monitoring product is the most likely to give you real FICO scores. This is a common mistake. There are many strategies and tools out there that will permit you to frequently pull your reports and even get FICO 8 scores at zero or almost zero cost. BBS uses this approach himself and he can walk you through it.

Of course, you may enjoy the pleasure of the myFICO product, which is fine. If the $360 per year makes you happy, then that's a slam dunk. But I just wanted to alert you in case you would be even happier paying only a few dollars a year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

@Anonymous wrote:

The long term strategy is to never be late, keep your total utilization under 29%, and keep each card at under 49%. Coupling that with strategies for removing derogs is the simplest long term strategy.

I will also add to CGID's insightful post to be smart about applying for credit. Basically, apply for the products that you need or find great value in relatively early on so that clock can start on their aging process. Avoid unnecessarily applying for credit as time goes by, as doing so will continually drop your AAoA and reset your AoYA to zero. Allowing your file to age with minimal applications is a good strategy for long-term growth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

As far as using MyFICO for credit monitoring for $360/yr. The banks and Lenders use it why shouldn't I? Yes there are cheaper alternatives out there and from reading from my research they aren't always the most accurate either.. To be able to see and monitor my credit score and get quarterly credit reports ,to me, IS worth the money spent.. I will not pay for it forever but until I'm confident that the steps I'm taking are working and I can see that progress for myself I don't feel it's a wasted expense. I have truthfully had more issues trying to pull my reports from the 3 bureaus individually than I'd like to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

@Anonymous wrote:

As far as using MyFICO for credit monitoring for $360/yr. The banks and Lenders use it why shouldn't I?

The banks don't use the myFICO Ultimate credit monitoring tool that you are paying $360/year for. They use FICO scores (with a few exceptions) but FICO scores can be obtained easily at almost no cost in many ways. And there are plenty of tools that give you frequent free reports. (The $30/mo myFICO Ultimate product, in contrast, only gives you a report every 90 days.)

I am not pushing you to cancel your myFICO Ultimate subscription -- just want to make sure you know all your options so that you can if you choose pay much less. That's a choice and there is no single right answer for all people.

Here's an analogy that might help. Suppose you were buying Advil at $5 a bottle, because you were under the impression that this was the real anti-inflammatory that doctors prescribe. It would be helpful information to know that the "Advil" label doesn't get you anything that isn't in generic ibuprofen -- which you might be able to get for far less. It would still be an ok choice to pay for Advil, but a friend would still want to provide you with that information (ibuprofen = Advil) so that you could explore the far cheaper alternative if you wanted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

BBS can walk you through it. The zero-cost or ultralow-cost strategy involves using more than one tool. The person assembles a toolkit of different tools that let him do the thing he most needs at that time.

Typically he joins Credit Karma purely for its ability to pull fresh EQ and TU reports as often as once every 7 days. Karma's alerts can be nice too (e.g. an alert for a new account, a new inquiry, etc.). The person ignores Karma's scores.

There are a few different free products that will give you EX reports and EX FICO 8 scores.

Some people incorporate any free FICO scores they get from their credit cards as well. Free TU FICO 8 scores are very common.

Then, when you feel a need to get all three FICO 8 scores (EX, EQ, TU) along with a nice 3B report -- all drawn at the same instant -- you sign up for the $1 trial offer at Credit Check Total and then cancel it shortly after obtaining the report and scores. You can repeats the trial as many times as you like, though in your case I can't see much of a need beyond doing it quarterly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

@Anonymous wrote:

What other services out there allow you to get a free report every 3 months and alerts you of updates and changes to your FICO score as they happen?.

The myFICO Ultimate product does not alert you of changes to your FICO score as they happen. Often changes happen to your score that are not alerted. What the product does is alert you of a subset of changes that happen to your report -- and when that change happens, it pulls your FICO 8 score. But as I say many changes happen to reports that are not alerted, and even when no change appears to have happened to your report your FICO 8 score can change (and this also is not alerted).

This is a constant problem in the forums which BBS is trying to fix as he and others advise the people who make the myFICO tool. A visitor to the forums is bewildered by an alert he gets accompanied by a score change, and in 99.9% of the cases it's because the score changed at least once, perhaps multiple times, and the subscriber was not notified. (It's a bit ironic that BBS is helping myFICO correct problems in a tool that he sees no value in purchasing himself and he is helping them for free.)

PS. Just for the record, I see a huge value in the Ultimate product when a person is preparing to buy a house.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

@Anonymous wrote:

As mentioned before I was totally unaware that keeping even a small balance on BOTH cards would have a negative effect on my score. Lesson learned.

While this is true, there are two points that I'd like to make.

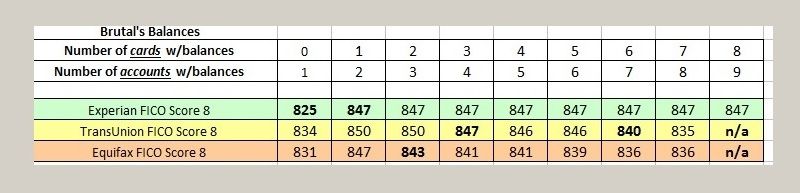

One, the negative effect should be quantified. Are we talking 3 points? 5? 10+? The impact of 50% of cards/accounts with a balance verses 100% of cards/accounts with a balance can vary from person to person, profile to profile. Below is a table from last year where I went from no cards with a balance to all of my cards with a balance. The difference on my profile for going from 50% cards/accounts with a balance to 100% is EX 0, TU -11, EQ -5. This is of course FICO 8 scores and other models (like the mortgage ones) can be impacted more.

Second, while it may have been mentioned already, it's worth repeating: Any negative effect with respect to you allowing both of your revolvers to report a small balance as opposed to only one will only impact your score adversely until you go back to just one out of the two with a small reported balance. Since utilization is a single point in time metric, all that matters is what the algorithm sees on your CR at the moment a score is produced. There is no long term benefit of having just 1 of 2 cards report a balance monthly. To help illustrate my point, you could have both cards with a reported balance all year and then in December drop to 1 of 2 with a reported balance and your score would be exactly the same in December as it would if you went all year with 1 of 2 with a reported balance. You can test this yourself if your profile is stable, moving back and forth between 1 verses 2 (out of 2 total) cards with a reported balance and your score should yo-yo +X, -X, +X, -X etc. Any time you don't see +X or -X exactly, it simply means something else changed on your report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: questions regarding score decrease

BBS just gave you a great way of thinking about your CC balances.

And not only is the scoring factor "number of accounts reporting a balance" a pure snapshot in time, but so is CC utilization. So I will heighten BBS illustration, namely....

Suppose you have ten credit cards and for 24 consecutive months you have all of them reporting a balance, and your total CC utilization is the 40-47% range every month, with some cards going as high as 68% -- and then at the end of that two year period you pay all to zero except one with the remaining card at $15 .

Your score would be no different at month 25 than if you had all those zero balances and the single card with the small balance every single month throughout those two years.

That's what I meant when I said that keeping your CC balances ultralow (or zero) does not help you build your score over time. You can get its benefit at the last minute.

Now if I were you I'd steer a middle course. Utilization in the 40-percent range consistently might be a little high, since you are rebuilding. That's why I recommended keeping your total U under 29% and each card individually under 49% -- it'll eliminate the possibility that a creditor could get worried and lower your credit limit. But aside from that, a utilization of 1% will help you no more and no less than a utilization of 25%.