- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- refi + CC = 40-point drop

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

refi + CC = 40-point drop

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

refi + CC = 40-point drop

41 points, actually.

EX crested at 841 about a month ago.

Then the refi hit, dropping the score to 814.

Then the (post-refi) new credit card hit, dropping me down to 800.

I think I'll hold for a while -- I much prefer the deep green to the bilious yellow-green.

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

More info, please.

Prior to the refi, was the old loan your only open installment loan? Where did its utilization percentage sit prior to the refi when it no doubt was replaced with a ~100% utilization loan?

Were you able to grab your scores between the 841 starting point and 814 point when the new loan reported after the inquiry hit in order to quantify how much that was "worth?"

When the new installment loan reported, had the other (old) one reported closed already, was that 814 pull with both loans showing being open?

Prior to the refi and new CC, when was the last time you opened an account, that is, what was your AoYA/AoYRA?

What was your AAoA prior to the new accounts? What was it with the [new] loan factored in? How about with the CC also factored in?

I'm also under the assumption that we're speaking of EX Fico 8 here, so definitely correct me if that's not the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

Prior to the refi, I also had an open consumer loan (owing ~7K of the original 15K) and a HELoan (almost 2 years old, about 80% owing).

The refi consolidated the primary and HELoan. The old mortgage and HELoan reported closed before the new mortgage reported.

Credit card util remained negligible throughout (1 or 2 of 14 cards reporting, under 2% cumulative util, and under 8.9% util for any single card). The most recent prior new card was 11/19; I opened the consumer loan 12/19.

The first drop (mortgage) was 27 points -- 841 to 814, with a second 14 point drop when the new card reported (w/ just under a 4% card util balance, bringing me to 3 cards of 15 reporting, w/ a cumulative util of <1%).

Prior to the new mortgage, AAoA was between 6 & 7 years. AoYA was 10 or 11 months. Don't recognize the AoYRA acronym.

With the new mortgage and CC, EX reports an AAoA of 6y7m. And, yeah, we're talking EX FICO8 scores. Per Citi, the EQ Bankcard8 has so far dropped 31 points, 873 --> 842. The new credit card hasn't hit that score yet.

It's all worthwhile, tho' -- the consolidation is saving me $500/mo., with only a few $K added to the full cost of the loans -- the refi pays for itself in under a year. A good way to 'spend' FICO points.

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

AoYRA is age of youngest revolving account, which you said was Nov 2019. On a clean file such as yours, it's a scorecard assignment factor that is usually good for around 25 points when it hits the 12 month threshold. For you, that would have been on Nov 1, 2020. My question then is were your scores lower (say, 820) and did you realize a score gain on or after Nov 1 this year to ~841?

It sounds like your "before" aggregate installment loan utilization was probably somewhere in the 70%'s, give or take and that your "after" is probably somewhere in the 90%'s. That being said, I don't see how that shift would result in much of a score drop at all. An AoYRA reset to 0 months though could certainly be worthy of a drop around what you experienced.

Tough to say on AAoA. A thresholds around your AAoA has been identified at 78 months, but it doesn't appear that you crossed that. There could be another at 84 months, but I'm not sure. Even so, those AAoA threshold crossings are usually only good for minor point shifts, say 4-5 give or take from what I've seen.

I would look most closely into AoYRA for now... basically Nov 1 being the date you moved to 12 months, then the date your new card recently reported when you moved back to 0 months on that important factor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

I suspect that AAoA may be involved -- an account or two dropped off this fall, and it could've pushed me back.

An additional data point -- I just checked my FICO9 (PenFed), and it dropped from 850 --> 818. Likely a combination of the refi plus an EQ pull for a car loan (which I may or may not use, but I'd rather know whether I can but before I start to negotiate with a dealer).

It only took me most of my adult life to take control of my finances, so I might as well enjoy myself.

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

I would still like to know the real reason(s) for your significant score drop. So far I'm not seeing them. Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

FWIW, the TU drop is comparable. It crested at 850 after the mortgage payoffs but before the new mortgage hit. It's now at 815, as of two days ago (new mortgage and credit card reporting).

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

And you are certain that the significant drop came at the time the new loan reported, but before the new CC reported?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

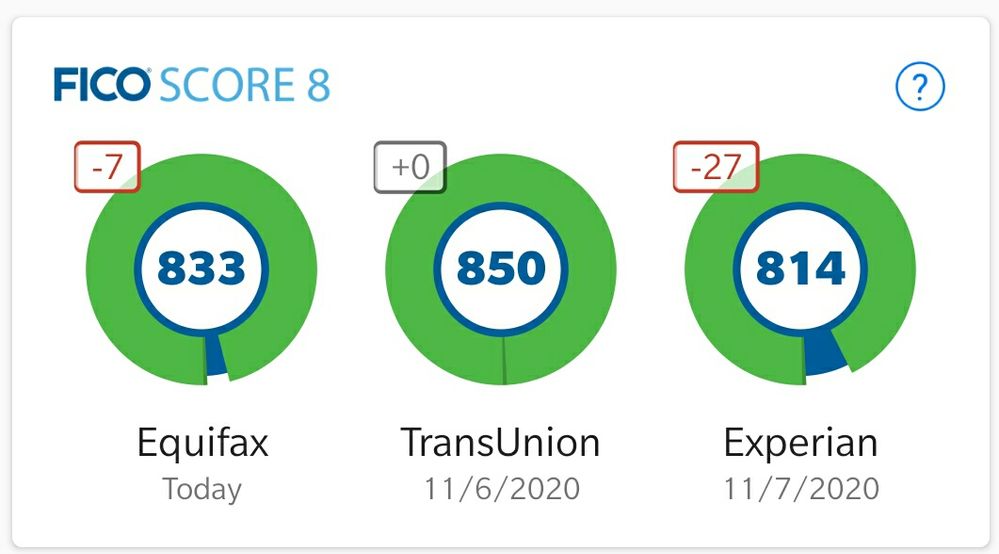

The TU drop was (at least) in 2 parts --

21 points when the new mortgage hit.

Presumably another 11 when the CC hit.

EX tends to be my canary in the coal mine -- it tends to be lower than the other two, sometimes significantly, even tho', historically, it shows a higher AAoA.

(It was 814 when TU was 850; 7-Nov was when the mortgage payoff hit EX.,)

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: refi + CC = 40-point drop

i did a refi and also got nailed 40-50 pts.....everything else credit wise was same....they nailed me when both loans showed up and when orig loan fell off....it always shows 2 loans on same vehicle for refi for cpl of weeks until its updated.....