- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- 18K+ of CLI from Disco in 4 months

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

18K+ of CLI from Disco in 4 months

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

18K+ of CLI from Disco in 4 months

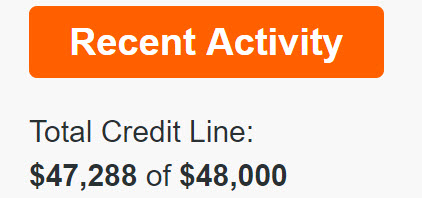

So, those that follow what I've been doing on here with Disco since getting the card know I've been trackiing them and coming up with a formula of sorts on the best CLI strategy. Since August of last year I switched from hyper hitting the CLI button to an every other month approach which has yielded better results. I thought this might be a fluke of some sort with them approving something for 6K instead of 3-4K/CLI. Well, after the first 6K I went and did my CLI for Dec and sure enough they did 6K again and even after my call rounded out my CL to 42000 instead of 41600 which was an OCD thing having the odd ending number. Anyway, Feb rolls around and finally putting them to the test hit the button again and bam 2-day like usual and it shows up this morning with 48K.

| 8/1/2016 | Manual CLI (2 Day Message) | $29,600 | $4,000 |

| 10/1/2016 | Manual CLI (2 Day Message) | $35,600 | $6,000 |

| 12/1/2016 | Manual CLI (2 Day Message) | $42,000 | $6,400 |

| 2/1/2017 | Manual CLI (2 Day Message) | $48,000 | $6,000 |

If you've followed my 1st year post about Disco you see several entries where there wasn't a CLI while hitting the button frequently. Finally switching to the every other month method has stopped the blank entries as well. If this continues for 2017 and beyond this card will just explode into a new stratosphere for a CL.

And as some say around here, If there's not a picture of it, it didn't happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

Wow. Now, that's growth! Wish my discover grew like this. It's going to get SD'd here soon.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

Im in the same boat. Discover hates me... I havent gotten a CLI since the first week of November and got a losey $500 increase...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

Congrats austinguy, that is awesome!!

@ Sean60099, your increases from Disco put you in the rock-star category compared to me lol!! Discover gives me $200-300 at a time but it's all good. At this rate, I'll have a $5K CL by 2030 lol!!

![]()

![]()

![]()

Chapter 7: Discharged November 2015

Total Revolving Credit Lines January 2016: $2600

Total Revolving Credit Lines January 2017: $148K

11/15 Fico 8: EQ-585, TU-550, EX- 551

01/17 Fico 8: EQ-695, TU-703, EX-673

Advantis CU Siggy Visa $25K, NFCU Cash Rewards Visa $4600> $22K, NFCU CLOC $15K, NFCU Go Rewards Visa $5,500, PenFed Promise Visa $10,500, PenFed Platinum Rewards Siggy Visa $5500, Redi+ Siggy Visa $5K, SPGVisa $4,500>$5250, Cap One Platinum $2K>$4K, Cap One Quicksilver $3K, Good Sam Visa $1800, Discover $1800>$2K>$2300, Lowe's $6K>$17K, Overstock $7K>$7300>$7700, Evine $1K>$5K, HSN $3750, PenFed Thrifty $500, That's right...Credit One Visa is G-O-N-E!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

AJC - once you get rid of that little blemish yours should be growing as well again.

Ysettle - just make sure you're putting something on it every month while it's in the SD like netflix, hulu, cell phone, electric bill.. .autopay the statement balance and hit the button every 2-3 months and it should take off eventually.

Sean - $500 isn't the best but, it's better than nothing. Just keep at it and you'll find some success eventually. If you really want to jumpstart things you can call Lending and take a HP for whatever amount you want it to be and if it's too high they'll counter back with what they're comfortable with.

Everyone just needs to show Disco some love and they'll return the favor eventually. Just keep working on it and eventually the floodgates open with tons of luv. I've seen posts of 15K auto CLI's but, mostly the high watermark for manual CLI's is 6-8K. I guess I'm stuck in the 6K bucket for now and they're right on the heels of AMEX now by only 2K in stepping up to their limit. It's been an amazing journey since popping the question for both AMEX / Disco 7/2015 and watching them blossom since then. Not apping and letting things age has allowed them to grow considerably. Some mention Disco likes to be your primary and not having too many accounts to compete with. I have a total of 10 accounts at this point and they're all well aged besides these two. It seems quality over quantity is at work here when it comes to scoring and growth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

@austinguy907 wrote:AJC - once you get rid of that little blemish yours should be growing as well again.

Ysettle - just make sure you're putting something on it every month while it's in the SD like netflix, hulu, cell phone, electric bill.. .autopay the statement balance and hit the button every 2-3 months and it should take off eventually.

The spend is there as I've ran over $16K thru this card since June '16. Just some so-so luv in return ($2.5K in increases since opening). I submitted for a CLI today, exactly 60 days from the last request. Flat out denied. Not even the 2 day message but instant denial.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

@Ysettle4 wrote:The spend is there as I've ran over $16K thru this card since June '16. Just some so-so luv in return ($2.5K in increases since opening). I submitted for a CLI today, exactly 60 days from the last request. Flat out denied. Not even the 2 day message but instant denial.

16K on a 6500 limit might be a little too much spend. I found with Disco less is more for some reason. Of course it's not a science but, I would pull back to a couple hundred a month or less and then hit it again in April to see if something changes with their response. Instant denials are not the norm with them usually. The other thing they might be spooked by is your total CL being so high unless your income is up there too. Maybe it's time to trim some of the co-brands to free up some room for growth. Without the special sauce recipe they're using though it's hard to pinpoint exactly what they're looking for to maximize the results.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 18K+ of CLI from Disco in 4 months

@Anonymous wrote:

I actually called into lending a couple weeks ago, as I was at a Menards and spending $6,000 and wanted to get the first year double rewards. Lending told me I was not eilgable for a hard pull as it wasnt credit that was holding my credit line back. He said they just needed to see more activity and more time with the current credit line including payments. My response was that in 8 months ive put $25,000 in both purchases and payments on the card with a $4,500 limit. They said they would like to see more before the system will alow for a manual review for a hard pull increase.

This sounds like the normal 6 month waiting period but, you're showing 8 months of history already. Maybe they're seeing something they view as a flag like opening additional accounts, CL's increasing significantly in a short period of time, or something else. Obviously you're able to do the spend and make the payments. Maybe they're waiting until you hit 720 or higher? Usually if you ask for a HP almost any lender would say sure and not care if it's approved or not. It shows they care and don't just do it to do it upon request. By comparison you setup cable tv these days and it's a HP just to verify ID to setup services.