- myFICO® Forums

- Types of Credit

- Credit Cards

- Curve Card - Still in Beta...accepting application...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Curve Card - Still in Beta...accepting applications via invite

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

I guess my question is how is this product sustainable for both parties (Curve and issuing lender).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

@Remedios wrote:

Why would a variety of lenders willingly give up swipe fees while paying rewards?

I guess my question is how is this product sustainable for both parties (Curve and issuing lender).

Must be something about it that is, because it has been moderately sucessful overseas first.

Biz -

Biz -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

@Remedios wrote:

Why would a variety of lenders willingly give up swipe fees while paying rewards?

I guess my question is how is this product sustainable for both parties (Curve and issuing lender).

I address this on the Reddit submission I provided, see my signature link, but at least in the United States, lenders might fight it. To copy paste the relevant portion here:

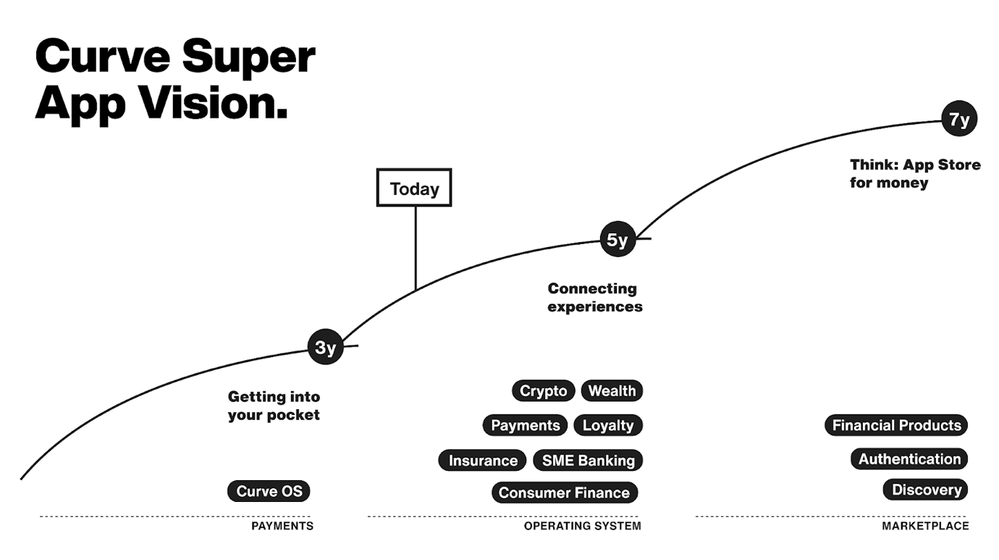

Curve's business plan

It might be worth knowing if Curve is a reliable enough company to give your transaction information to. You can decide for yourself: Curve makes money in primarily in 3 ways:

1. Card Transactions: Curve earns interchange income from each card transaction it executes as an issuer (i.e. at the purchase stage of a Curve transaction), excluding ATM transactions where Curve incurs interchange costs. Subject to the UK and European regulations on Interchange Fees, the interchange incomes vary per transaction, depending on where and how the Curve card is used and whether the customer is a business or consumer amongst other factors. This also includes other fees directly related to card transactions such as foreign exchange fees and ATM fees above certain limits.

2. Premium Subscriptions Income: Curve collects subscriptions on its paid plans on a monthly or annual basis.

3. Curve Platform: This is proving to be the most promising revenue opportunity for Curve. Curve as a platform offers and looks to add products and services, generating additional revenue streams through better and more seamless customer experience. Examples include, but are not limited to, platform fees from partners, interest income from Credit, Curve Fronted fees, and other revenue streams not related to interchange and subscription fees. Source: [Consolidated financial statements (Dec. 2020)] Interestingly, the third point has not been implemented, this is namely a projected revenue stream that shows their intent. One can extrapolate that given the Smart rules feature that is currently offered, different kinds of community created features (programmed) can be offered on their app store which would work with the Curve app. They would most likely take a cut, similarly to how Apple's app store operates. This is backed by the strategy Curve has proposed to investors:

Essentially, Visa/Mastercard are not going to mind, but I feel the lenders would. Technically speaking, Curve is a middleman, and it is my money. Lenders could address this in two ways: 1. Ban it in their TOS, 2. Out compete Curve and allow people to automate their category spending!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

So, I was just thinking about how the Curve cash sits in it's own wallet, and we can't cash it out, just use it in place of purchases. I was grumbly about "why would I want to do that instead of 3% cashback... would rather be able to use it to pay the final bills and continue to earn". Dunno why it took me so long to realize that I can just cash it out by buying gift cards at the end 😂 wonder how big my "SUB" will end up at the end of 6 months, lol.

Biz -

Biz -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

If they don't offer an ongoing rewards program, I struggle to see it in my wallet. I wonder if that will really end at 6 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

@Credit12Fico wrote:If they don't offer an ongoing rewards program, I struggle to see it in my wallet. I wonder if that will really end at 6 months.

It's a reward for being a beta tester. Over on Reddit they mentioned that they have plans down the road for tiered offers like they do in EU. If you just like having less physical cards that will move some charges to the right place, the free version will still be good for that.

Biz -

Biz -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

I got the invite earlier today, and decided to pull the trigger.

The onboarding was mostly smooth, but there are still some rough-edges that need to be worked on before this is open to the masses. It was mostly basic stuff (the link in my email was for a site with an expired certificate) and there were some hiccups on the back-end, but I was able to get signed up without too much difficulty.

I consider myself fairly well-read when it comes to credit cards, but I still found some of the settings to be less than intuitive. The two separate wallet views were perplexing at first, but I think I have it figured out. There will definitely be some "test charges" to be sure I have things right, though.

So far no HPs for the credit part of the product. For me they pulled Equifax, and they're nice enough to give you the score at the very end of the .pdf document that's attached to the welcome email.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

It is a little confusing. There is something else to be aware of. I first setup Apple Pay before my physical card had arrived with a different number than my final card came with but what was available in the app. Once I activated my physical card and its number, the Apple Pay number no longer seemed to work and the in app number now matches my physical card. As a result of this, two charges for between $300 and $400 for groceries were denied. I tried the physical card this past week and it worked fine for another about $300 transaction at a grocery store and did charge through to my Aeroplan card. I had to delete the Curve card from Apple Pay and re-add it from the app and I think it will work fine again but will verify tomorrow.

AOD Visa Signature | Curve Card | X1 Credit Card | Target RedCard | Venmo Card

AMEX: Schwab Platinum | 2 x Gold | Green | 2 x Business Platinum | 2 x Business Gold | Blue Business Plus

AMEX: Amazon Business Prime | Delta Reserve | Delta Reserve Business | Marriott Bonvoy Business

Chase: Aeroplan | Amazon Prime | World of Hyatt | World of Hyatt Business | Marriott Bonvoy Boundless

Chase: Ink Business Cash | Ink Business Preferred | Southwest Performance Business

BofA: Alaska Airlines Business | Business Advantage Customized Cash Rewards

Citi AAdvantage Executive | Barclays AAdvantage Aviator Business

U.S. Bank Business Triple Cash Rewards | U.S. Bank Business Platinum | GM Business Card

Apple Card | Navy Federal Flagship Rewards | PenFed Gold | PenFed Platinum Rewards

Capital One Platinum | Capital One QuicksilverOne | FNBO Evergreen Business

Player 2: Delta Platinum AMEX | Chase Freedom | 2 x Chase Freedom Flex | Apple Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

@Alephbet wrote:It is a little confusing. There is something else to be aware of. I first setup Apple Pay before my physical card had arrived with a different number than my final card came with but what was available in the app. Once I activated my physical card and its number, the Apple Pay number no longer seemed to work and the in app number now matches my physical card. As a result of this, two charges for between $300 and $400 for groceries were denied. I tried the physical card this past week and it worked fine for another about $300 transaction at a grocery store and did charge through to my Aeroplan card. I had to delete the Curve card from Apple Pay and re-add it from the app and I think it will work fine again but will verify tomorrow.

Ah, thanks for the heads-up on that. What you describe makes perfect sense, but it's just another example of something they need to get worked out before the product is ready for prime time. It's easy enough for us credit nerds to work out glitches on our own, but for the general public that's not always the case.

Another note that might have been mentioned previously up-thread, the Curve Card seems to be a WEMC credit card, *not* a MasterCard debit card like the Paypal Key (may it rest in peace). Not a big deal, but obviously the more lucrative debit card uses are off the table. (I confirmed this by adding my temp card to Amazon... if someone has a different experience I would love to find out I'm mistaken.)

I'm still hopeful that when Discover has their next Grocery quarter that using the Curve card at Walmart will bypass the WM exclusion like it did when using PPK. <fingers crossed> If it works that will likely be my primary 'real world' use of the card, especially since Curve doesn't yet let you add Visa and Amex cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Curve Card - Still in Beta...accepting applications via invite

@UncleB wrote:

@Alephbet wrote:It is a little confusing. There is something else to be aware of. I first setup Apple Pay before my physical card had arrived with a different number than my final card came with but what was available in the app. Once I activated my physical card and its number, the Apple Pay number no longer seemed to work and the in app number now matches my physical card. As a result of this, two charges for between $300 and $400 for groceries were denied. I tried the physical card this past week and it worked fine for another about $300 transaction at a grocery store and did charge through to my Aeroplan card. I had to delete the Curve card from Apple Pay and re-add it from the app and I think it will work fine again but will verify tomorrow.

Ah, thanks for the heads-up on that. What you describe makes perfect sense, but it's just another example of something they need to get worked out before the product is ready for prime time. It's easy enough for us credit nerds to work out glitches on our own, but for the general public that's not always the case.

Another note that might have been mentioned previously up-thread, the Curve Card seems to be a WEMC credit card, *not* a MasterCard debit card like the Paypal Key (may it rest in peace). Not a big deal, but obviously the more lucrative debit card uses are off the table. (I confirmed this by adding my temp card to Amazon... if someone has a different experience I would love to find out I'm mistaken.)

I'm still hopeful that when Discover has their next Grocery quarter that using the Curve card at Walmart will bypass the WM exclusion like it did when using PPK. <fingers crossed> If it works that will likely be my primary 'real world' use of the card, especially since Curve doesn't yet let you add Visa and Amex cards.

Yes, the card number change is annoying, but it literally tells you the number will update when you activate the physical card. Think of it as the digital card number is like a temporary online number issued sometimes. Don't expect that to change out of beta.

Biz -

Biz -