- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: I NEED INPUT

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I NEED INPUT

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

Thanks @MEdWar! The only question I have is something I've never really understood. My oldest account is one of my student loans. $840 is remaining and it's deferred right now since I'm currently a student. I can pay it but I've been hesitant to because I don't quite understand what happens when it's paid in terms of AAoA. Does it still report? I cannot afford to let that account stop reporting because my next oldest is like 6years old. There's very few CCs holding my AAoA up to 2years2months as it is. My most recent loan I just took out so that it'd add some variety to my credit mix. I've read that is valuable. Thank you for the input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@Anonymous wrote:@Anonymous @MEdWar! The only question I have is something I've never really understood. My oldest account is one of my student loans. $840 is remaining and it's deferred right now since I'm currently a student. I can pay it but I've been hesitant to because I don't quite understand what happens when it's paid in terms of AAoA. Does it still report? I cannot afford to let that account stop reporting because my next oldest is like 6years old. There's very few CCs holding my AAoA up to 2years2months as it is. My most recent loan I just took out so that it'd add some variety to my credit mix. I've read that is valuable. Thank you for the input!

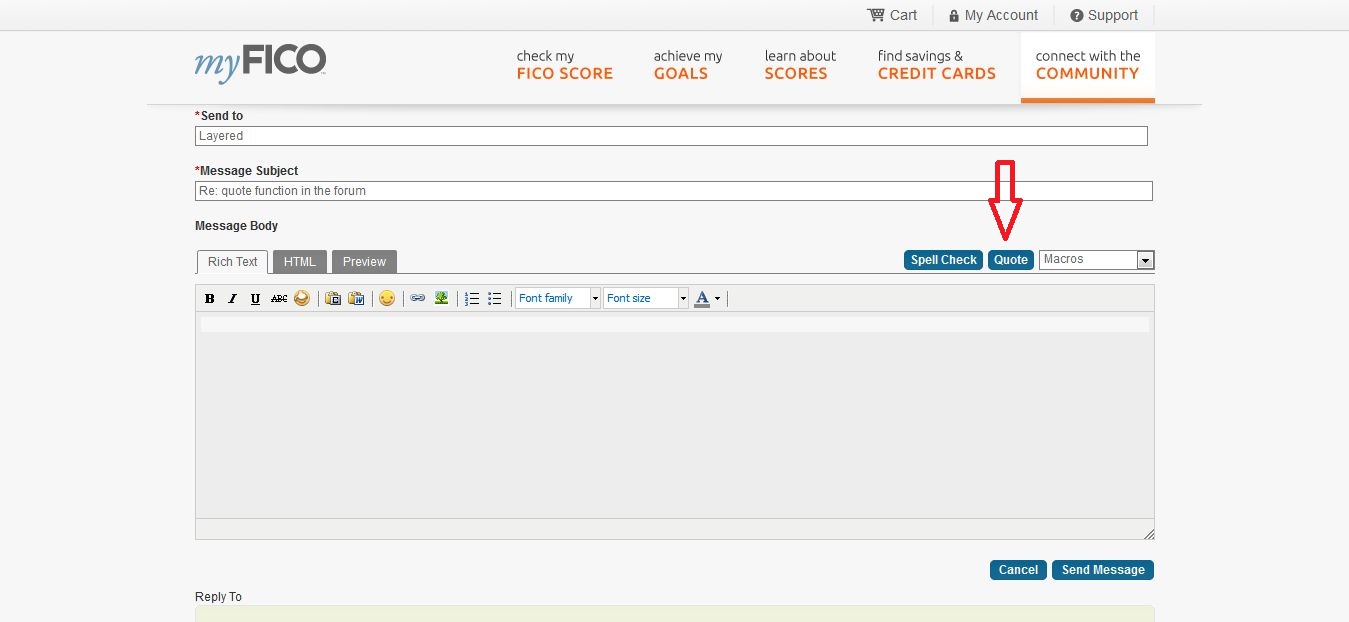

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar, next to the MACRO drop down-- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@09Lexie wrote:

@Anonymous wrote:@Anonymous @MEdWar! The only question I have is something I've never really understood. My oldest account is one of my student loans. $840 is remaining and it's deferred right now since I'm currently a student. I can pay it but I've been hesitant to because I don't quite understand what happens when it's paid in terms of AAoA. Does it still report? I cannot afford to let that account stop reporting because my next oldest is like 6years old. There's very few CCs holding my AAoA up to 2years2months as it is. My most recent loan I just took out so that it'd add some variety to my credit mix. I've read that is valuable. Thank you for the input!

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar, next to the MACRO drop down-- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

To respond to your question about the Barclay Ring from your locked thread. The rewards are nothing to brag about the only reason I have it is for the 8% interest.

Sam's Mastercard $15k / Walmart Mastercard $10k / Blispay $7.5k PayPal Ex MC $10.8k

CareCredit 5k / Husq $5k / Cap1 QS $4.5k / Barclay Ring $5.35k / Citi DC (WMC) $12k

Gardening Date 7/01/16 / MyFico 08: EQ 801 / TU 777 / EX 771 / 06/08/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@Anonymous wrote:you should stop comparing your credit score with your cousin's, because credit score and go up an down by a lot of different reason, just focus your own and don't try to rush it. hell... my younger brother's got credit score of 770 while i'm struggling at 655, and he doesn't even do anything special for that score, he just pay off his bills and not maxing out his cards.

+1000. Its the file that matters. My 19 year old daughter had a score of 757. The only thing in her file was being an AU on 4 of my cards. She appd and got a cap one card, but She was shot down for several car loans for no history and low income. It's the file that weighs heavier than the score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@woodyman100 wrote:

@Anonymous wrote:you should stop comparing your credit score with your cousin's, because credit score and go up an down by a lot of different reason, just focus your own and don't try to rush it. hell... my younger brother's got credit score of 770 while i'm struggling at 655, and he doesn't even do anything special for that score, he just pay off his bills and not maxing out his cards.

+1000. Its the file that matters. My 19 year old daughter had a score of 757. The only thing in her file was being an AU on 4 of my cards. She appd and got a cap one card, but She was shot down for several car loans for no history and low income. It's the file that weighs heavier than the score.

Proud of that kid by the way. About to make me a proud Grampa!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@coldnmn wrote:To respond to your question about the Barclay Ring from your locked thread. The rewards are nothing to brag about the only reason I have it is for the 8% interest.

Thanks! That was what I was afraid of. The 8% is nice to have in case of emergency but carrying balances is, as we all know, undesireable. I don't know if you were involved in my post about the Sears CITI card but you should check out the card I mentioned in that thread. The Huntington Voice card, it comes in two different types. One is a 3% category card and the other is a low interest card. It might be a rate comparable to or better than the RIng.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I NEED INPUT

@woodyman100 wrote:

@woodyman100 wrote:

@Anonymous wrote:you should stop comparing your credit score with your cousin's, because credit score and go up an down by a lot of different reason, just focus your own and don't try to rush it. hell... my younger brother's got credit score of 770 while i'm struggling at 655, and he doesn't even do anything special for that score, he just pay off his bills and not maxing out his cards.

+1000. Its the file that matters. My 19 year old daughter had a score of 757. The only thing in her file was being an AU on 4 of my cards. She appd and got a cap one card, but She was shot down for several car loans for no history and low income. It's the file that weighs heavier than the score.

Proud of that kid by the way. About to make me a proud Grampa!

Congratulations!