- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Navy Federal Credit Union CC ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Credit Union CC ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

To quote the infamous CA: "I say go for it!"

Current Score: EX 753 FICO, EQ 737FICO, TU 738

Goal Score: 776 FICO

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

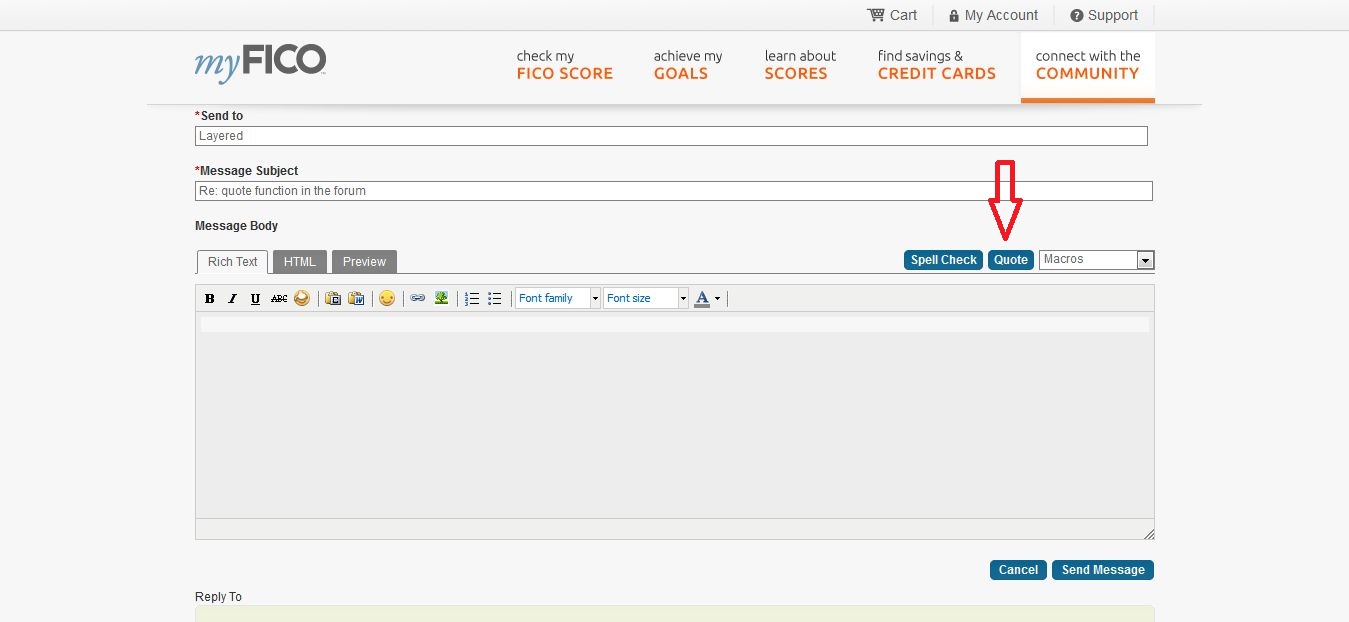

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

@mo15473 wrote:I am hearing and seeing a lot of sucess stories for NFCU. I just am a little worried about pushing it to the next level. Does anyone know if they have a pre-qual system or if i call in without them do a HP on my report ?

Even Stalin couldn't get a soft approval from Navy. They invented the HP. I just got HP'd for typing this message. But seriously, Navy is awesome. They will take care of you very very well. But expect HPs, its just how they roll.

Starting Score: 501

Starting Score: 501Current Score: 754 EQ,TU 745,EX 750

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

Thanks Lexie I was woundering how to the whole time. Kept trying to figure out why it was not quoteing. Thats sad and I work in IT. ugh

@09Lexie wrote:Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

@mo15473 wrote:Thanks Lexie I was woundering how to the whole time. Kept trying to figure out why it was not quoteing. Thats sad and I work in IT. ugh

No problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

@mo15473 I say go for it too!!! Apply for the cashRewards Visa online and see what they say....as pp stated, it is going to be a HP NO matter what. NFCU is your best chance for seeing a 4-5 digit limit at this point in your credit journey. Best of luck!!! BTW, you heard my story, low to mid 600s, a few derogs one or two unpaid and paid PR and they gave me 10k instantly.

Current Fico9/Fico8/Mortgage Score:

MyGoal Fico8/Mortgage Score:

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

@newmomnewme wrote:@mo15473 I say go for it too!!! Apply for the cashRewards Visa online and see what they say....as pp stated, it is going to be a HP NO matter what. NFCU is your best chance for seeing a 4-5 digit limit at this point in your credit journey. Best of luck!!! BTW, you heard my story, low to mid 600s, a few derogs one or two unpaid and paid PR and they gave me 10k instantly.

I Think I might after my statement cuts on the 11th. The Simulator says my TU should be between 639-669 after paying the two CC down to 0 and the new reporting of one of my account at a 0 balance as well. But as you know I have to pay to refresh transunion report. Which is no problem. As for the EQ 595-619 with new reporting. The past months is usually been in between that number or right on it. So hopefully I get lucky and all goes well. Like credaddict said guess I just have to let my accounts ages until they fall off. I also only have 5 Inquiries on my TU and only 1 on my EQ. They are all from NFCU except one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

Ignore the simulator by the way. You score is better with 1% utilization over 0%.

You will likely get HPs on EQ which just happens to be your worst report, which is why it makes sense to see if you can remove some baddies first. But for all we know, navy will be navy in the end.

Starting Score: 501

Starting Score: 501Current Score: 754 EQ,TU 745,EX 750

Goal Score: 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

@mo15473 wrote:

@newmomnewme wrote:@mo15473 I say go for it too!!! Apply for the cashRewards Visa online and see what they say....as pp stated, it is going to be a HP NO matter what. NFCU is your best chance for seeing a 4-5 digit limit at this point in your credit journey. Best of luck!!! BTW, you heard my story, low to mid 600s, a few derogs one or two unpaid and paid PR and they gave me 10k instantly.

I Think I might after my statement cuts on the 11th. The Simulator says my TU should be between 639-669 after paying the two CC down to 0 and the new reporting of one of my account at a 0 balance as well. But as you know I have to pay to refresh transunion report. Which is no problem. As for the EQ 595-619 with new reporting. The past months is usually been in between that number or right on it. So hopefully I get lucky and all goes well. Like credaddict said guess I just have to let my accounts ages until they fall off. I also only have 5 Inquiries on my TU and only 1 on my EQ. They are all from NFCU except one.

I am by no means an expert. But about a year ago I had a hard time getting any credit because of a lack of history (other than a few student loans) and I've been building history with NFCU.

I always put my base income on apps which is close to your income (98k) my bonuses range from 8% to 18% of my base. All my direct deposits go through NFCU so they see my net income. I pulled a $500 secured CC with them in Feb of last year my score was 632 at the time. The next month my score jumped to 660. In July I forgot to pay the bill but I have it setup to automatically pay the minimum amount so it wasn't late, it just reported a balance over 50%, my score dropped from 663 back down to 630. I also bought a car in June and had some (27 to be exact) inquries. NFCU preapproved me for the auto loan close to their lowest published rates but I was able to get financing through the Manufacture at 0%. In November I apped for nCashRewards after having the secured card and my auto loan and was approved for $17,500CL, my score was 654 at the time. Once the card reported my score jumped to 680. Over the next few weeks I apped for a few more cards and was approved for everything except Discover (they said there was an unpaid tax lein but a have a couple of them and they are all reporting as paid). My score went to 702 or 703. I did some spending on the cards and am now carrying a few balances. My UTIL is reporting at 20% and my score has dropped to 691.

I've been banking with NFCU for over a year and a half and when you talk to them in branch they absolutly do not give you ANY indication of your chances of approval. All I ever get at both branches I've used is "let's take your application and see what the decision says". So I don't think you will gain anything by applying in branch. The membership inquiry nearly a decade ago was TU (opened an account a long time ago, just let the accounts sit there with a few$) but all my credit apps have been hard pulls on Equifax. I wouldn't count on them pulling TU again, I think over 90% of the time they pull EQ. NFCU is deff hard pull happy.

I would pay down balances as much as possible, wait for them to report and then apply. You can probably apply on-line, I don't think there will be any difference on the decision since it all goes through their Loan Dept in VA.

I hope you have a great outcome!

AMEX Costco TrueEarnings $5,000 | AMEX Delta Gold $1,500

Chase SWA VISA $5,000 | Chase Slate $3,500 | Chase Amazon Rewards VISA $3,000

HSN Mastecard $3,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union CC ?

OP, I think it's wise to wait the one year out on the secured cards. Chances are NFCU is going to unsecure them anyhow, and why take HP on your credit reports right now anyways? I've been a recipient of the shopping cart trick too, but I don't buy into the temptation each time. I know I sound like an old mother, but resonsibly seeking credit that you need is the name of the game, not grabbing all you can get at one time. That approach tends to have a negative impact on your scores too.