- myFICO® Forums

- Types of Credit

- Credit Cards

- Preparing for BCE App *UPDATED*

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Preparing for BCE App *UPDATED*

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Preparing for BCE App *UPDATED*

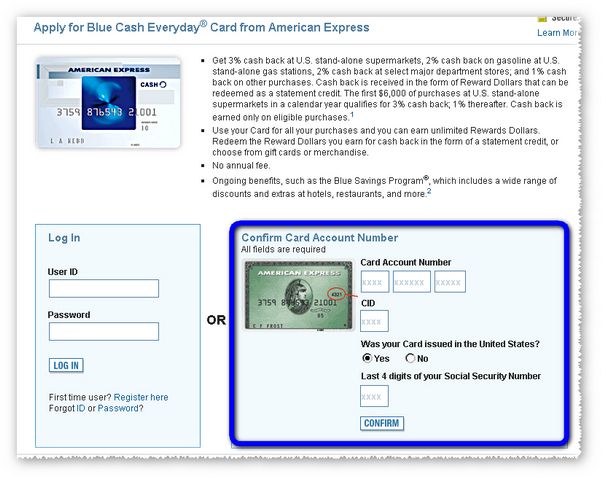

I logged into my AMEX account and clicked the APPLY NOW link for BCE. I'm assuming since I already have an AMEX affiliation and I'm logged in I got this page because when I logged out and tried I was asked for way more info.

So those of you that have continued beyond this page completing the box I put in blue, does this indicate the app would be a SP? Is it accurate to say it dies at a SP if declined and then goes HP if approved? (Dont want to tick off Barclays for no gain)

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

@jake619 wrote:I logged into my AMEX account and clicked the APPLY NOW link for BCE. I'm assuming since I already have an AMEX affiliation and I'm logged in I got this page because when I logged out and tried I was asked for way more info.

So those of you that have continued beyond this page completing the box I put in blue, does this indicate the app would be a SP? Is it accurate to say it dies at a SP if declined and then goes HP if approved? (Dont want to tick off Barclays for no gain)

Thanks.

If you are denied, it will be a SP. If you are approved, it will be HP.

Are you planning to app now? Wait next month for max backdating.

12/19/2013, $100k+ Available Credit. Total Util: 0-1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

Actually, I was planning to pull the trigger this month seeing that it would only be a SP if I stink it up. I have accounts all the way back to 1995 with AMEX (which I discussed in a separate thread) so I don't know if waiting will make much difference.

So they approve off the SP then do what with the HP? Set the CL? If the SP get's me in the door what is the HP for?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

@jake619 wrote:Actually, I was planning to pull the trigger this month seeing that it would only be a SP if I stink it up. I have accounts all the way back to 1995 with AMEX (which I discussed in a separate thread) so I don't know if waiting will make much difference.

So they approve off the SP then do what with the HP? Set the CL? If the SP get's me in the door what is the HP for?

Yes, if they have your SP on file, they will go off that. If their SP is too old, you can request a new one (recon), in this case it will be a HP even if you denied.

If you are approved based on the SP that they have, they will go ahead and HP you.

Let me know if you pull the trigger, I am planning to next month.

12/19/2013, $100k+ Available Credit. Total Util: 0-1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

I've never quite understood Amex's method, but I presume they tentatively approve from the soft pull and then do a hard pull to make sure nothing crazy has happened between the soft and the application. It makes Amex cards a bit easier to apply for on a whim. ![]()

On a different note, for those not already backdated to 1995, it definitely makes sense to wait until next month. I just snagged the HHonors Amex last month, but only because they chopped 25k points off the bonus offer starting on 12/1. Otherwise, I would have waited until January for maximum backdating juice.

Chase: CSP - $10k | Freedom UL - $3k

Citi: Costco - $11.2k | Penfed: PCR - $20k | Apple: $13.5k

TU (Vantage): 802 | EX (FICO 8): 833 | EQ (FICO 8): 854

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

It may not make a big difference or any difference at all, but it's tough to argue with waiting 2 weeks for 11 months of extra AAoA

| Chase Freedom $9500 DCU Visa $10000 Capital One QS $2000 AMEX BCE $3000 | Lowe's CC $8500 WalMart CC $3100 BOA Platinum $600 AMEX Gold NPSL |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

Impact on AAoA is really file dependent. With each year of backdating, the 11 months has less impact and other factors may outweigh the benefit of waiting. For example, if he thinks (as it sounds like he does) that he will be denied, the additional time to work on the reason for denial may outweigh the value of the increased AAoA. Or his AAoA may be over 11 years, at which point there is little impact on changes. Personally, I calculated mine from yesterday (when I apped) vs Jan 1 and the total impact on AAoA was 1 week.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

@Cdnewmanpac wrote:Impact on AAoA is really file dependent. With each year of backdating, the 11 months has less impact and other factors may outweigh the benefit of waiting. For example, if he thinks (as it sounds like he does) that he will be denied, the additional time to work on the reason for denial may outweigh the value of the increased AAoA. Or his AAoA may be over 11 years, at which point there is little impact on changes. Personally, I calculated mine from yesterday (when I apped) vs Jan 1 and the total impact on AAoA was 1 week.

Oh I totally agree, I just think 18 days to gain 11 months is a pretty good decision no matter to end result. I guess that's just my rebuilding mode self trying to squeeze every last point out of my score ![]()

| Chase Freedom $9500 DCU Visa $10000 Capital One QS $2000 AMEX BCE $3000 | Lowe's CC $8500 WalMart CC $3100 BOA Platinum $600 AMEX Gold NPSL |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

I'm definitely not tracking this backdating topic properly. If a card is backdated then what value is the year of acquisition when calculating AAoA?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for BCE App

If you are backdating to 2011, for example, then the difference between January 2011 (if you wait 2 weeks) and December 2011 would be a 50 percent increase in card age. So the impact on AAoA (especially if initial AAoA is a year or two) would be large. On the other hand, the difference between December 1988 and January 1988 represents only a 4 percent change in card age, thus less impact in an AAoA calculation.