- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: AAoA Question?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AAoA Question?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AAoA Question?

Can someone tell me how the AAoA is calcuated? I have several closed accounts in good standing that date back to 2004 and my current account age with all current accounts opened since that time is 3 years, 9 months.

I am trying to understand the calculation method. Any help would be appreciated.

Thanks,

Bobby

Fico 9 Scores: EX: 799 (11/9/20) EQ: 794 (10/13/20)

Ch7 BK Filed on 10/13/2013 - Discharged 1/14/14

Amex Blue Cash Preferred $15K | Amex Gold Card | Citi Costco Visa $7700 | USBank Altitude Go Visa Sig $10K | USBank Cash+ Visa $8K | C1 Savor MC Elite $15K | C1 Venture One $10K | C1 Quicksilver Visa Sig $10K | C1 Quicksilver WMC $10K | Penfed Plat Rewards Visa $9,500 | Penfed Power Cash Rewards Visa $11K | Discover IT $7500 | USAA Pref Rewards Visa $5K | Penfed Path Visa $10K | Logix FCU Plat MC $12K | SDCCU Plat Visa $2,500 | Best Buy Visa $2K | Chase Amazon Prime Visa Sig $500 | Consumers CU Visa Cash Rebate $5K | PNC Points Visa $2500 | JCPenney $1,800 | Abound CU Plat Visa $5K | Lowes $7K | HSN Card $3K | Walmart MasterCard $2K | Walmart Store Card $2K | Kohls $1K | Target Red Card $800 | QVC Card $800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

@BobbyJ wrote:Can someone tell me how the AAoA is calcuated? I have several closed accounts in good standing that date back to 2004 and my current account age with all current accounts opened since that time is 3 years, 9 months.

I am trying to understand the calculation method. Any help would be appreciated.

Thanks,

Bobby

Your AAoA is the sum of the ages of every account (except CA collections and public records) on your report, whether open or closed, calculated in months, divided by the number of accounts and then divided by 12. I use the division by 12 to make it easier to convert into years. This is measured from the time each account was opened until present.

You’ll need to figure the age of each account, open or closed, on each report. If all three reports are identical (very unlikely), you're in luck; otherwise, you'll need to run this for each report.

Edited to add: AAoA is always rounded down.

From a BK years ago to:

EX - 3/11 pulled by lender- 835, EQ - 2/11-816, TU - 2/11-782

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ulateRe: AAoA Question?

As to how long accounts remain in your CR, that is totally unregulated by the FCRA. It is arbitrary on the part of the CRA.

The general experience is that the CRA tends to begin deleting old accounts after they have been closed for ten years.

That somewhat arbitrary number seems to make some sense based on the CR falloff periods set forth in FCRA 605(a), such as 7 years for regular delinquencies and judgments, 7 1/2 years from DOFD for charge-offs and collections, and 10 years for BKs. Thus, each of those normal periods will normally have expired after 10 years from account closure. It then becomes relatively safe from a credit reporting point of view for the CRA to discontinue maintining information in your credit file that it is normally prevented from including in any credit report they issue.

However, deletion of accounts after, for example, ten years, can still lead to distortions of the system. Unpaid tax liens never expire. And artibtrary deletion of accounts, as the subject of this thread covers, leads to distortions in a consumer's AAoA. And it may also affect creditors. Since the exemptions in credit reporting set forth in FCRA 605(a) are not absolute, due to the exemption provision of section 605(b), a creditor entitled to pull your entire credit file in the case of, for example, a credit transaction invollving a principal amount of $150,000 or more wont have access to that information after it is deleted.

In my opinion, the integrity of the credit reporting and scoring system would suggest that old accounts never be deleted by a CRA. But the CRAs do it, apparently to make data storage space available and to reduce CR computer processing times. Just one of those things......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

Marinevietvet wrote:

Your AAoA is the sum of the ages of every account (except CA collections and public records) on your report, whether open or closed, calculated in months, divided by the number of accounts and then divided by 12. I use the division by 12 to make it easier to convert into years. This is measured from the time each account was opened until present.

You’ll need to figure the age of each account, open or closed, on each report. If all three reports are identical (very unlikely), you're in luck; otherwise, you'll need to run this for each report.

Edited to add: AAoA is always rounded down.

Yep.

MVV was one of the first to help me understand AAofA. His post makes it easy to understand and to calculate AAofA.

I found it easiest to just pop the info into my Excel (but that's only because I put just about everything in Excel) and then do a quick update every month or so. So I figured my AAofA on EXperian, on TU, and on EQuifax just once; update it; and I always know my AAofA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

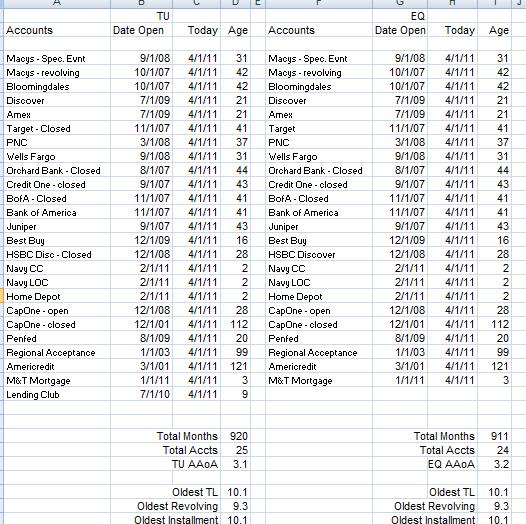

What I find helpful is to create a spreadsheet and then I'll updated it every first of the month. Gives me a visual of when my AAoA turns next.

EX is also in there but cut it off to save on space in this post. We all know that FICO rounds AAoA down, but I put an extra digit on there to give me a visual as to when I'd hit the next-year AAoA. In my 3.1 EQ example, I probably have 10 months to go. ![]()

Here's the formula I used to calculate the age:

=(YEAR(C5)-YEAR(B5))*12+MONTH(C5)-MONTH(B5) ...... of course B5 represents the date open and C5 represents the "today" date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

Dude - now I feel normal! ![]()

It's great to see the spreadsheet, llecs! It's just so much easier to do it this way - and you only do it once, then the updates are fast.

And, like you, it helps me (enormously) to readily see my AAofA and how close I am to breaking through to a new age.

But, man, you've got a lot of accounts!!!!

I've got - like - half as many. And even with my small number (less than 20) accounts, the spreadsheet thing makes it much easier than doing it by hand.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

llecs, you are truly priceless!! This is awesome!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

I absolutely LOVE the spreadsheet idea! Thank you for sharing! I just created mine and it is great to actually see your AAoA on paper. ONLY tweak I made to the spreadsheet was after I entered all my accounts and opening dates, I sorted the data to have the oldest accounts on top. Just a littler easier when searching for a specific date. Thanks again for sharing this!!!

CH 7 Filed 7/27/15 Discharged 11/16/15

Starting Score: EQ 620 TU 568 EX 593

Current Score (07/13/16): EQ 674 TU 649 EX 674 (FICO's 08)

Cap1 QS ($5350) (Combined QS and QS1) Discover It ($4100) MilStar ($8,600) Fingerhut ($800)

Off to the garden 05/01/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question?

The speardsheet is awesome! I'm going to create one like it. I'm going to add when inquiries are schedule to fall on mines. That'll save me time from having to check my reports.