- myFICO® Forums

- Types of Credit

- Student Loans

- Re: federal private defaulted loan

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

private defaulted loan

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

private defaulted loan

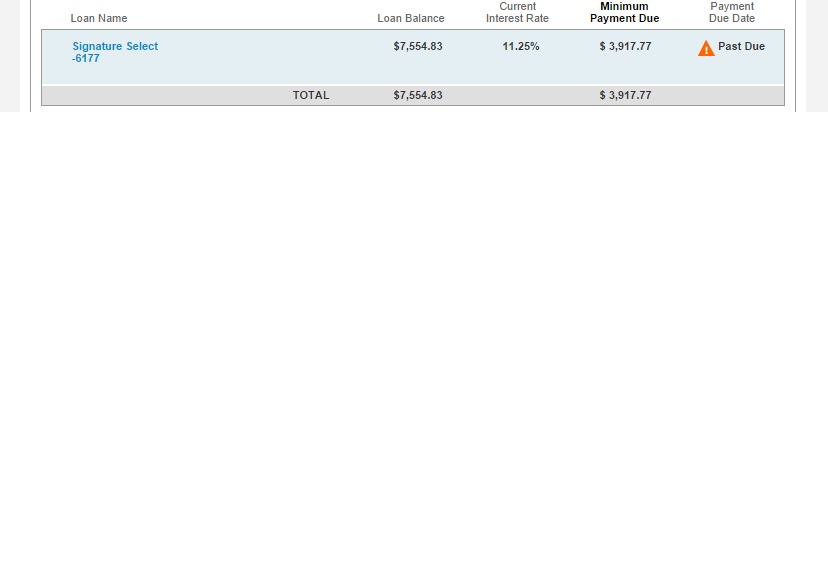

I have tried GF letters. This is the LAST negative thing i have on my reports. its a defaulted private loan. I need some angles to get the intrest rate lower. currently i am paying 460-690$ a month solely on this loan. I have previously tried GF letters. this loan show is the last thing i have to pay off before im 100% green lights accross the board. any tactics can help ? please advise

*EDIT*

thanks for pointing that out yea i made a small mistake in naming this thread. its a PRIVATE loan, that is managed on my sallie mae account. You mentioned a few things i will attempt. I am trying to get right and pay these off. if they could help me with the intrest It would be awesome. At this rate I estimate 7-8 months before its caught up to just principal and no longer have that huge minimum payment due. I just dont have that much to allocate. the other options are limited I just bought a house and have other debts to allocate 2 or 3 x the normal payments to. I am attempting to pay off a truck and car note early also if possible.

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: federal private defaulted loan

Your post title is confusing. Is this a federal or a private student loan?

From the limited information you give, I think it is probably a private loan. Have you looked into refinancing? Websites like Credible and SoFi may help, or you could look into local banks and credit unions.

It looks like the original lender may still have this loan, rather than being with a collection agency. Have you asked them if you can make a more managable payment to get the loan current? Sometimes lenders will agree to add extra payments to the end of the loan term or similar to take care of that past due balance.

If the lender has not agreed to change the past reporting, you should focus on what you need to do moving forward. How can you bring this loan current and keep it current? That may mean cutting expenses, increasing income, and focusing your money on taking care of this debt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: federal private defaulted loan

Call this # 1-877-499-5406

That is the department that handles temporary interest rate reductions for private loans. They reduced my interest rate to 1% for a year which reduced my payment. I'll warn you that they do get all in your business and make you have an hour long phone session with a credit counselor (HP on Experian too). You have to reapply each year.

When you tell them your expenses don't include any frills such as gym or cable. They want to see that you've literally cut everything out. It seems like this loan is more of an inconvenience than a financial hardship, so it's a tough call as to if you'll get approved.

You're very behind in payments, so they may not want to work with you, but at least try

IMO, you shouldn't be paying extra on a car or house while you have this looming over your head. Throw everything you can at this loan until it is gone.

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: federal private defaulted loan

be that as it may , when i am off of work , i enjoy having a place to LIVE and not be HOMELESS. sorry but i wont live at my moms any more , four cats and two dogs, i take shots for allergies and its not getting any better when im home. when im at her place im miserable i hide in one room in her house and some times i come home to random animal **bleep**s on my bed , **bleep** that i bought a house.

right now im earing way more than enough , in fact i almost have enough cash in the bank to wipe the loan out but i need an emergency fund so im not doing that. this loan is so old from 2004. but i AM trying to pay it off. if you see above i said i pay 600-690 on it every month , the monthly payment on this loan was originally 55$ a month.

THANK YOU very much for the information posted above. I will consider and weight this option. I have one other thing to do on my experian report next month 10/22/14. asking my CU to CLI my CC with them. afterwards I wont mind them trying to get up in my buiz. really i just want the intrest rate cut back to make it easier to pay this loan OFF in 7-9 months. I am balancing trying to pay off my truck note 6,8xxk and this loan , before this time next year.

btw , my average scores while mortage were 720 and my total house note is 926$ monthly to include EVERYTHING no pmi. tax escrow and insurnace included. my average income monthly is about 7k cash in hand. before uncle sam molests my hard work its 12k

5/14/14 Equifax – 673 Experian – 744 Transunion – 722

already bought the house! closed with a great deal all thanks to information i learned here!