- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Getting that last point is the hardest

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Getting that last point is the hardest

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting that last point is the hardest

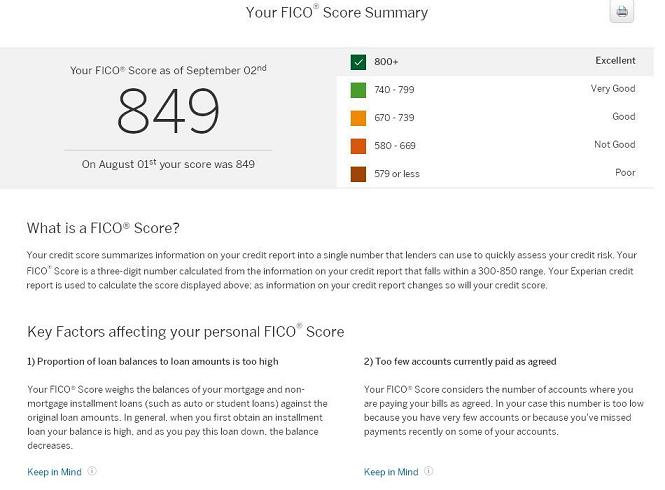

Okay, I've been on a long term experiment to see if / when I could post an 850 fico8 score.

Sort of pointless I know, but it is what I have for credit entertainment while gardening. There

isn't really anything I should be apping for right now anyway.

My EX score has been stuck at 849 for a few months. Minor changes in utilization haven't

effected it, I report small ~1% balances on all 5 cards that report now, but I had the same 849

with my utilization optimized with one reporting a ~1% balance last month.

My particulars -

I have a refinanced mortgage that is 20 months old. The balance is 82% of the beginning

balance.

I have 2 newish credit cards that are 18 and 23 months old.

I have 2 inquiries on EX that are 20 and 23 months old. AAoA is listed as 10 years, but it

no longer increases. Is 10 years maxed out ? My real AAoA is about 11 years.

I'm assuming that the factor of "loan balances to loan amounts too high" is my mortgage ?

Will it cease to be a factor when it falls below 80% in a couple months ? Or at what percentage ?

I don't understand the "Too few accounts paid as agreed". I have no derogs on my reports. Is

this because I only have 5 cards, 1 current mortgage and one paid off mortgage reporting? I

thought anything past 3 accounts was no effect.

Is there anything I can tweak for the last point, or do I just wait for my newest card account to age

past two years in march?

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting that last point is the hardest

Hello bada_bing,

Its hard to say what the road block is for sure but there are some things it is not such as:

1) Number of open credit cards. "iv" had 5 cards and a 850 score and I have 6 cards and an 850 score. Your 5 cards is sufficient

2) Aggregate UT% - I reported values of 1%, 2%, 3%, 4%, 5% and 6% while at 850. (monthly reporting thru Discover). A balance of 1% should be fine per your example.

- Note: Too low a balance may be interpreted as "0" by the model so report enough $$ to protect against 0% aggregate utilization

3) Individual card UT% - Been as high as 80% on a BB card while maintaining Fico 8 at 850 (always PIF).

4) Number of cards reporting a balance - that is profile dependent. "iv" reported a drop from 850 when 5 of 5 cards reported a balance. I held 850 with 6 of 6 reporting small balances.

5) Maintained 850 going from 0 - 1 - 0 inquiries under 1 year old (CLI request generated HP). No new cards.

- Your inquiries that are over 12 months but less than 24 months are not holding back your score.

Note: Although your data shows your score was not hurt by multiple cards reporting small balances and 850 can be maintained with multiple cards reporting; there is less upward resistance with fewer cards reporting balances. For best odds based on your background data, recommend you only report a balance on one or two cards in a given month.

- However, feel free to splurge. IMO you could report 20% or even 30% on a lower CL card no problem if you maintain aggregate UT to 6% or less.

Side notes

AAoA dropped from 15 years to 13 years due to a couple (30 year and 20 year history) aging off. No impact on score.

Balance remaining on mortgage: currently 43%, was 54% when Discover card.first reported 850

Likely score limiting suspects are as follows

1) Age of youngest account - may need to be 2 years (24 months)

2) Possibly mortgage balance %. Recent CAPTOOL data indicates a possible bump dropping below 70% on an installmet loan. Not sure about mortgage 80%.

3) AAoA under 11 years.

Looks like allowing accounts to age up is the ticket for you. Can't say specifically about mortgage remaining %.You may want to try reporting a balance of 6% to 10% on one card only all others at zero - do this on a higher CL card so AG UT falls out at between 2% and 4%..

Its all a matter of time.

P.S. The Fico 8 standard model has a large buffer which can accommodate varying degrees of "sub optimal" behavior without dinging score at the top end. Typically iincreasing # open cards reporting a balance will negatively impact Fico scores - I see the effect on my EQ Fico 8 Bankcard score (monthly reporting thru Citi). Also, Fico 04 mortgage and industry enhanced models are [from my experience] more sensitive to # open accounts reporting a balance.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950