- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Paying off credit cards and score is going down

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paying off credit cards and score is going down

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying off credit cards and score is going down

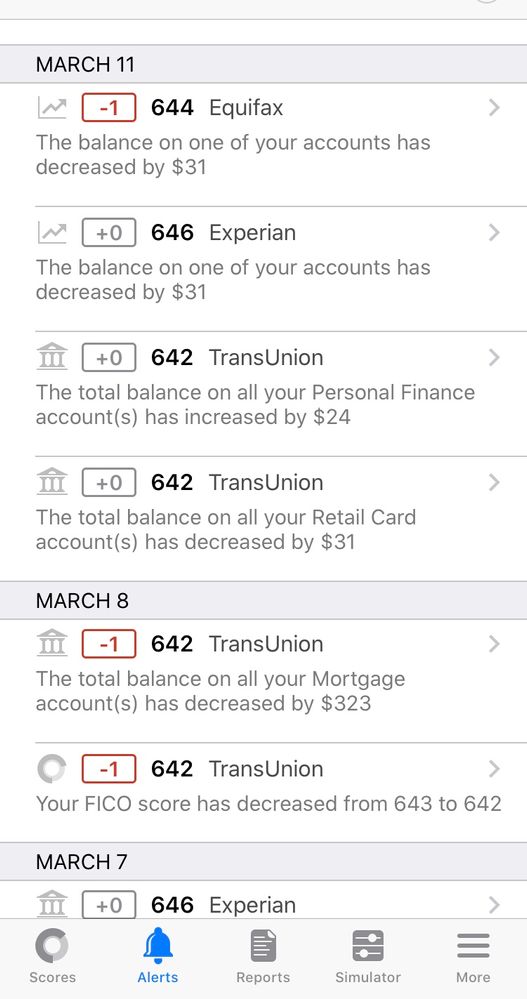

This is so confusing/frustrating for me. I had declared bankruptcy in 2014. Have done great rebuilding. Purchased a home last May for 219k with USDA loan. Have purchased and paid off furniture and used credit cards - also only about 6000 still owed on cc(Lowe's, disc, BofA, and cap 1) in the last couple months I have paid off over 10k but with each pay off my T

equifax score drops. Others have continued to go up a few points here and there. I am sitting at about 645 avg across all 3 according to myFICO. I am trying to figure out why I just seem stuck.

I need to buy a vehicle. Trying to keep it under 15,000. Even that amount makes me anxious. I vowed to never have a car payment again so even the thought of purchasing is nerve wracking for me. Other debts are student loans(56k) current income $95k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

If all of your cards are sitting at zero, you lose a pretty decent amount of points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

Without knowing what your original debt was for each account and what you paid it down to relative to its limits, it would be a little difficult to answer. I can only guess and say it has something to do with utilization thresholds, and perhaps you haven't paid it below one? The following thresholds are: 8.9% 28.9% 48.9% 68.9% 88.9%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

Can you fill these out with Credit Line/ Balance:

Lowe's

Disco

BofA

Cap 1

Theres something hiding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

Okay so here goes the list lol

ill start with what I have paid off. Then list what still has balances

victoria secret - had $189 high and now 0 limit $250

meijer- high $429 now 0 limit $500

walmart store - was $490 now 0 limit $500

capital 1 Walmart rewards- $150 high limit 300 now $18 (got gas today)

bp 490 limit $500 now 0

quicksilver $480 limit 500 now 0

Synchrony- Ashley high 6300 (opened in June 19) now 0

tdbank (also Ashley) opened June 2300 high and now 0

still with balances

house of course - recent payment actually caused a score drop lol balance is 218,445.

payment is 1540 month and I pay 1600 usually.

bofa - 900 limit - stay high utilization but down now to $509.

discover- limit 1000 current 757

capital one plat limit 850 currently owe $370

Kohls -$340 bal limit is $2000

lastly is my highest balance - Lowe's limit 5000 and I have $4500 on it. Purchase washer and dryer, grill, and riding mower when I bought the house.

i know my utilization was insanely high. Although I've never had a missed or late payment on any of my accounts. Nor have I since my bankruptcy in 2014. But I thought if I started paying everything off/down that my score would increase. It seems to be the opposite though. Also, I seem to be stuck with these low limits. I've considered contacting capital one to see if I could roll into just one product with a higher limit. Kind of afraid to do much of anything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

@Anonymous wrote:Okay so here goes the list lol

ill start with what I have paid off. Then list what still has balances

victoria secret - had $189 high and now 0 limit $250

meijer- high $429 now 0 limit $500

walmart store - was $490 now 0 limit $500

capital 1 Walmart rewards- $150 high limit 300 now $18 (got gas today)

bp 490 limit $500 now 0

quicksilver $480 limit 500 now 0

Synchrony- Ashley high 6300 (opened in June 19) now 0

tdbank (also Ashley) opened June 2300 high and now 0

still with balances

house of course - recent payment actually caused a score drop lol balance is 218,445.

payment is 1540 month and I pay 1600 usually.

bofa - 900 limit - stay high utilization but down now to $509.

discover- limit 1000 current 757

capital one plat limit 850 currently owe $370

Kohls -$340 bal limit is $2000

lastly is my highest balance - Lowe's limit 5000 and I have $4500 on it. Purchase washer and dryer, grill, and riding mower when I bought the house.

i know my utilization was insanely high. Although I've never had a missed or late payment on any of my accounts. Nor have I since my bankruptcy in 2014. But I thought if I started paying everything off/down that my score would increase. It seems to be the opposite though. Also, I seem to be stuck with these low limits. I've considered contacting capital one to see if I could roll into just one product with a higher limit. Kind of afraid to do much of anything.

Theres why your stuck. Especially Loews as maxed out. Once individual and aggregate util goes down. Your scores will go back up. And it depends when these accounts were opened. Congrats on getting so much paid down. Now its time to finish off the rest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

@Anonymous wrote:This is so confusing/frustrating for me. I had declared bankruptcy in 2014. Have done great rebuilding. Purchased a home last May for 219k with USDA loan. Have purchased and paid off furniture and used credit cards - also only about 6000 still owed on cc(Lowe's, disc, BofA, and cap 1) in the last couple months I have paid off over 10k but with each pay off my T

equifax score drops. Others have continued to go up a few points here and there. I am sitting at about 645 avg across all 3 according to myFICO. I am trying to figure out why I just seem stuck.

I need to buy a vehicle. Trying to keep it under 15,000. Even that amount makes me anxious. I vowed to never have a car payment again so even the thought of purchasing is nerve wracking for me. Other debts are student loans(56k) current income $95k

1. Paying off credit cards has NOT decreased your score. It's something else.

2. Since you've given us virtually no information, it's impossible to hazard a guess as to what is causing your Equifax score to drop.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

@Anonymous wrote:Okay so here goes the list lol

ill start with what I have paid off. Then list what still has balances

victoria secret - had $189 high and now 0 limit $250

meijer- high $429 now 0 limit $500

walmart store - was $490 now 0 limit $500

capital 1 Walmart rewards- $150 high limit 300 now $18 (got gas today)

bp 490 limit $500 now 0

quicksilver $480 limit 500 now 0

Synchrony- Ashley high 6300 (opened in June 19) now 0

tdbank (also Ashley) opened June 2300 high and now 0

still with balances

house of course - recent payment actually caused a score drop lol balance is 218,445.

payment is 1540 month and I pay 1600 usually.

bofa - 900 limit - stay high utilization but down now to $509.

discover- limit 1000 current 757

capital one plat limit 850 currently owe $370

Kohls -$340 bal limit is $2000

lastly is my highest balance - Lowe's limit 5000 and I have $4500 on it. Purchase washer and dryer, grill, and riding mower when I bought the house.

i know my utilization was insanely high. Although I've never had a missed or late payment on any of my accounts. Nor have I since my bankruptcy in 2014. But I thought if I started paying everything off/down that my score would increase. It seems to be the opposite though. Also, I seem to be stuck with these low limits. I've considered contacting capital one to see if I could roll into just one product with a higher limit. Kind of afraid to do much of anything.

1. Your house payment did not cause a score drop. It's something else.

2. You have too much individual utilization on Lowes, BOA, Discover, and Cap One. You need to get each down to 28% or less of the limit.

If you already knew your utilization is "insanely high" why on earth are you asking us why your scores aren't better?

You need to pay things down. That will improve your scores, not worsen them.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paying off credit cards and score is going down

What additional information would you like?