- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

SCORECARDS?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SCORECARDS?

Hi, I've been trying to figure out the scorecards and the FICO credit score ranges for each scorecard and got few answers.I have three 60 days late on one closed account from two years ago. Also I have one Collection on Experian and Equifax cr's.

The only things that I could come up with are:

1-Their are possibility 15 scorecards [about 10 ''non-derog'' and about 5 ''derog'' scorecards]

2-Each scorecard that you fall in you you are compared to people with similar credit reports.

3-''Derog'' scorecard are 90 days late or worse.

4-Each scorecard has a minimum and maximum FICO score range.

5-Credit score may decrease when jump from one scorecard to another.[rebucketed]

The only things I could come up are something like;

''Non derog Scorecards''

-Thickness of File

-Thin File

-Age of File

-Mortgage

-Recency of new openings

-Late payments [30 and 60 Days]

-Car Loan

-Student/Personal Loan

-Credit Cards

''Derog Scorecards''

-Bankruptcy

-90 Days Late

-Collections

-Public Records

-Indebtedness

Does anyone have a detailed description of FICO Scorecards and Scorecard credit score ranges?

If their is anything anyone wanted to add or correct please do.I posted this so I can share my experiences and learn from the real Credit Experts.

Thanks,

DIYcredit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

Hello DIYcredit! Interesting question.

There may be two reasons you are asking it. First you may be interested in something purely practical, rooted very specifically in your own situation. Your question in this sense might be this. Hey guys, I have the following derogs on my file: X, Y, Z. As long as they are on there what is the upper range for how high my score can go? Here you are interested in practical knowledge so you can make choices and plans.

Second, you might be interested in something purely theoretical. In that sense, you might just be curious about how FICO 8 works, just for the pleasure of learning about it.

And you might have both interests operating. But it may be useful to clarify which is your primary driver. If you reframe the practical question as above, you may get a bottom line answer that doesn't involve going down a theoretical rabbit hole.

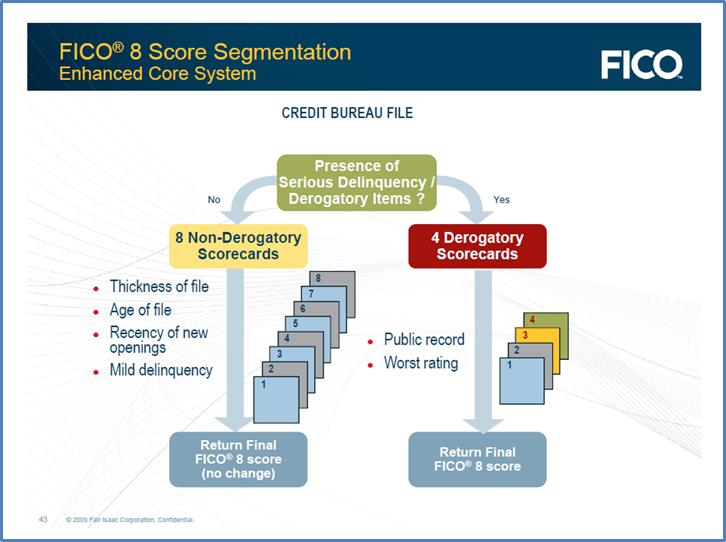

That said, I hope that Thom Thumb chimes in on your question. He has a great interest in theoretical questions (as do others) and goes out of his way to do a lot of research and thoughtful speculation. The last time I spoke with him about this (maybe a few weeks ago) I think he reminded me that there are 12 scorecards for FICO 8, eight of which are for clean profiles and that the remaining four are probably 2 dirty and 2 very thin.

He also found a resource a while back (LW's book) that enabled him to make an interesting guess as to how the 8 clean score cards are determined. TT wrote:

Liz Weston's book: Your Credit Score (4th ed.) states the following for Fico scorecards:

1) Fico 4 scorecards - total 10, 8 for clean files and two for non clean files.

2) Fico 8 scorecards - total 12, 8 for clean profiles, 4 for non clean profiles

Three factors are identified for scorecard assigmet on profiles with only positive information :

a) # of accounts, b) AAoA and c) age of youngest account.

My guestimate on breakpoints ... for scorecard assignment is 8 accounts (possibly 10), 8 years and 2 years. If each of these three factors is assigned a + or - then there are a total of 8 combinations; which matches the stated number of scorecards for "only positive information".

If history shows "a serious delinquency", the model also looks for: presence of any public record ( such as bankruptcy or tax lien) and the worst delinquency, if there is more than one on file, to assign a profile to one of the remaining scorecards.

Again, to return to the practical question about what you might need to do, it's basically the boring unsexy stuff you probably have heard. I.e. your score is going to be sharply punished until you (or Father Time) can get your derogs off your profile (especially the collection). While you are working on that, you want to allow your accounts to age, pay off your credit cards (and then keep your utilization very low when you need the best score), etc.

Also, again from a practicial perspective, I wouldn't worry about your score going down due to moving to a clean score card. First off that is rare. And second, it doesn't change what you have to do, which is get your damn derogs off.

Here is a link to another discussion that you may find interesting:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

HI

Thanks for your very informative information My primary interest is in learning about how FICO 8 works just for the pleasure of learning about it.It.I made a continuous effort to learn the most about how the whole FICO Credit System works in detail.I am very THANKFUL to the CONTRIBUTES and EXPERTS of this forum who give me a GREAT CREDIT EDUCATION.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

Yep, I continue to learn a lot from folks here, Glad you are here.

Truth is, however, the exact details of the scorecards are things that FICO keeps pretty secret. Nocofy knows for sure what factors are used to place people in one scorecard over another and what the ranges are for each card, So may find it difficult to find out too much.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

Indeed Fico 8 has 12 scorecards and Fico 4, 98 have 10 scorecards. In all cases 8 scorecards are for clean files. There are a number of published papers, such as the TransUnion Scores document, in addition to Liz Weston's book that speak to Fico and other model scorecards.

It is well known that certain factors, such as the # of cards reporting a balance, influence score differently depending on the credit profile. It is generally believed this relates, in part anyway, to what scorecard your profile is assigned. There are no published "score ceilings" for scorecards but there are strong indications ceilings exist.

Liz does state that scorecard assignment (for the 8 clean cards) takes number of accounts, age of accounts and age of youngest account into consideration.

Everything from here down is speculation on my part - so consider it accordingly [and I reserve the right to revise my hypothesis at any time based on new data]. Let's start with the premise that each of the three factors are given either a high (H) or low (L) rating. The 3 factors at two levels yields 8 combinations - same as # of clean scorecards.

Data suggests you can reach a score of 850 with an account less than 2 years old and no loans on file. It is unclear what the minimum # of accounts (open + closed) might be for still achieving a top score. Evidence continues to suggest 8 years AAoA may be required for a top score - perhaps 10 years for oldest account. At any rate, ability to achieve a top score as presented by many posters indicates multiple scorecards have an 850 potential. However, level of execution may need to be more rigorouis on lower scorecard assignments - Like a gymnastics routine that has all the manditory elements but a lesser degree of difficulty.

Anyway here is a hypothetical table for Fico 8.

The ceilings and High/Low criteria values are a personal best guess based on reviewing posted data "snapshots" over time.

(edit - increased ceiling guestimate on clean 8 scorecard to 759 from 719 based a reported 730 score from a co-worker with two credit card with 9 months total reporting history. (Score came from Discover card statement - Cap One card 9 months old, Discover card 2 monts old). A few searches on MyFico forums showed 2 posters new to credit with scores in the 710 to 720 range. A 3rd poster new to credit reported a score in the "upper 700s" but did not explicitly state score was Fico 8. 1-2016

| Card Type | Card # | Scorecard | Oldest | Youngest | Total accts (revised 5/2016) | Score ceiling (revised 5/2016) |

| clean | 1 | H-H-H | 10 | 1 | 6 | 850 |

| clean | 2 | H-L-H | 10 | x | 6 | 850 |

| clean | 3 | H-H-L | 10 | 1 | x | 850 |

| clean | 4 | L-H-H | x | 1 | 6 | 820 |

| clean | 5 | H-L-L | 10 | x | x | 799 |

| clean | 6 | L-H-L | x | 1 | x | 799 |

| clean | 7 | L-L-H | x | x | 6 | 799 |

| clean | 8 | L-L-L | x | x | x | 759 |

| minor dirt | 9 | H | n/a | n/a | n/a | 759 |

| minor dirt | 10 | L | n/a | n/a | n/a | 719 |

| major dirt | 11 | H | n/a | n/a | n/a | 719 |

| major dirt | 12 | L | n/a | n/a | n/a | 649 |

Edit add 2/2016:

Note: Minimum score for any clean scorecard is guestimated as low as 580 if file is young & thin, multiple recently added cards are near 100% utilization and there are a bunch of relatively new hard inquiries.

Clean profiles (all combined) appear to span a score range of around 270 points (say 580 to 850) - estimate 200 point range for a specific clean scorecard

Dirty profiles (all combined) appear to span a much greater score range of around 440 points (say 320 to 760) - estimate 300 point range for a specific dirty scorecard

Refer to link below for a clean but thin and young profile (no lates/no badies) reporting a score drop from 705 to 609 due to high utilization with new cards.

Here is a 2nd link listing a score drop from 732 to 590 due to maxing out cards. Again, no missed payments or lates.

http://ficoforums.myfico.com/t5/Credit-Cards/I-maxed-out-all-my-credit-cards/m-p/3490565#M964636

Edit - Add Fico 8 scorecard screen shot (4/2016)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

Thanks, This is great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

Here are a couple links to scorecard info fro Equifax and TransUnion.

http://www.equifax.com/assets/USCIS/efx-00190_efx_fico.pdf

https://www.transunion.com/docs/financialServices/FS_ScoresOverview.pdf

Here is a slide share from Fico on scorecards and a paste of some illustrative info from that presentation.

http://www.slideshare.net/FICO/building-powerful-predictive-scorecards

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

@Thomas_Thumb wrote:Indeed Fico 8 has 12 scorecards and Fico 4, 98 have 10 scorecards. In all cases 8 scorecards are for clean files. There are a number of published papers, such as the TransUnion Scores document, in addition to Liz Weston's book that speak to Fico and other model scorecards.

It is well known that certain factors, such as the # of cards reporting a balance, influence score differently depending on the credit profile. It is generally believed this relates, in part anyway, to what scorecard your profile is assigned. There are no published "score ceilings" for scorecards but there are strong indications ceilings exist.

Liz does state that scorecard assignment (for the 8 clean cards) takes number of accounts, age of accounts and age of youngest account into consideration.

Everything from here down is speculation on my part - so consider it accordingly [and I reserve the right to revise my hypothesis at any time based on new data]. Let's start with the premise that each of the three factors are given either a high (H) or low (L) rating. The 3 factors at two levels yields 8 combinations - same as # of clean scorecards.

Data suggests you can reach a score of 850 with an account less than 2 years old and no loans on file. It is unclear what the minimum # of accounts (open + closed) might be for still achieving a top score. Evidence continues to suggest 8 years AAoA may be required for a top score - perhaps 12 years for oldest account. At any rate, ability to achieve a top score as presented by many posters indicates multiple scorecards have an 850 potential. However, level of execution may need to be more rigorouis on lower scorecard assignments - Like a gymnastics routine that has all the manditory elements but a lesser degree of difficulty.

Anyway here is a hypothetical table for Fico 8. The ceilings and High/Low criteria are a guess on my part so don't assume they are based in fact.

Card Type Card # Scorecard AAoA Youngest Total accts Score ceiling clean 1 H-H-H 8 1 10 850 clean 2 H-L-H 8 x 10 850 clean 3 H-H-L 8 1 x 850 clean 4 L-H-H x 1 10 820 clean 5 H-L-L 8 x 10 799 clean 6 L-H-L x 1 x 759 clean 7 L-L-H x x 10 759 clean 8 L-L-L x x x 719 minor dirt 9 H n/a n/a n/a 759 minor dirt 10 L n/a n/a n/a 679 major dirt 11 H n/a n/a n/a 719 major dirt 12 L n/a n/a n/a 619

I'm curious what category I'd fall under. I want to know my ceiling. Also curious if I can change categories before my BK drops away. I sure hope so!

I have a BK7 about to have it's 4th birthday of being DCed, and 4 IIBed cards(date of last activity about 5.5 yrs ago, average( that compise my derogs.

Non-derogs: A bunch of old student loans paid off. 1 open student loan. 1 closed overdraft account, satisfasctory, opn 2 of 3 bureaus. 1 10+ yr old AU card.

# 2 month aold bank cards, and a slew of store cards, 2 months old or less. I'm really curious what score card I'm on. That reminds me of a vegas fight! ![]() Any help would be appreciated, and I can answer more questions if needed. Thank you

Any help would be appreciated, and I can answer more questions if needed. Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

CaptainJ - Wish I could answer that for you but, my table is speculative - I put it together mainly as an illustration.

I have no inside info from Fico on score card ceilings. Perhps I need to revise the column heading to better reflect the values ar "guestimates"

P.S. As things age up it is likely you can go from an L to an H scorecard. Once the bankruptcy drops off, you theoretically could also go from a Major to a Minor (assuming lesser derogs would still be on file) - If not, you would then jump to one of the clean score cards..

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SCORECARDS?

I think the above slide share was excerpted from the following PDF:

http://www.fico.com/en/node/8140?file=7900

I skimmed through it several months ago. IIRC, it looked like it was an introduction for someone learning how to use a tool that helped create scorecards. I assumed it was used by some banks to help create internal scores based off a FICO score. One important takeaway was multiple scorecards were applied to reach a final score. As in, you are in multiple buckets at the same time. In addition to Bank internal scores, the process may be how FICO creates the enhanced scores. For example, they may take your FICO score, apply additional scorecards to get your auto enhanced FICO score.

However, I didn't read the document very closely. My summary may be way off.