- myFICO® Forums

- Types of Credit

- Auto Loans

- Auto Refinance question - CapOne

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto Refinance question - CapOne

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Auto Refinance question - CapOne

Hi,

I haven't posted in about 5 years. That long, drawn out thread will eventually get started in the rebuilding forum.

More on the topic -

December 2021, my wife's car decided to start giving us issues. She was able to secure a loan through Carvana/Bridgecrest for a new to her family vehicle (GMC Yukon).

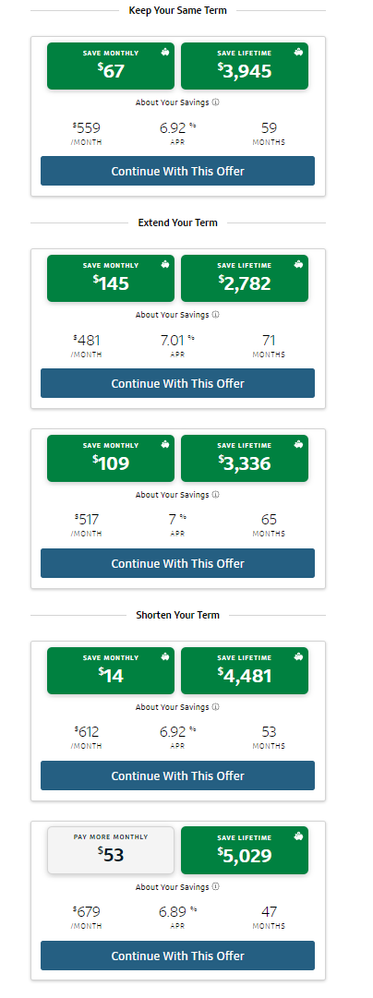

The interest rate is high, albeit (13.xx%). It is what it is. She doesn't have terrible credit just not much credit. CapOne offered the following:

I definitely don't want to extend the term and that 47 months for $53 more per month shaves about a year off the loan. Would she get a better rate at a CU? I don't know.

Thoughts?

Thanks.

Current Scores - 8/26/2025

FICO 9

EQ - 769

TU - 778

EXP - 762

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

@madmann26 wrote:Hi,

I haven't posted in about 5 years. That long, drawn out thread will eventually get started in the rebuilding forum.

More on the topic -

December 2021, my wife's car decided to start giving us issues. She was able to secure a loan through Carvana/Bridgecrest for a new to her family vehicle (GMC Yukon).

The interest rate is high, albeit (13.xx%). It is what it is. She doesn't have terrible credit just not much credit. CapOne offered the following:

I definitely don't want to extend the term and that 47 months for $53 more per month shaves about a year off the loan. Would she get a better rate at a CU? I don't know.

Thoughts?

Thanks.

without a snapshot of her profile it's hard to tell, I mean credit unions such as penfed and DCU start at like 2.6 i think for used cars so theres a potential for a lower rate. honestly if it hasn't been long since the credit pull aka if its within the window for shopping around I'd pull the trigger and try to refinance it.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

Check DCU for sure.

Recently a relative refinanced her car with DCU at 3.2%, this includes the 0.50% direct deposit discount. Her EQ5 score was in the 670s, they did require POI.

She also refinanced another vehicle with capital one at 4.9%, the only downside is that capital one doesn't offer gap insurance for refi's. So keep that in mind. Cap 1 didn't require POI

Both were seemless nontheless. Good Luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

Curious how did she get a direct deposit discount via Cap1. This is the first I'm hearing of this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

I apologize, I didn't clarify. She receives the 0.50% discount with DCU, not capital one.

I edited my initial post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto Refinance question - CapOne

I had initially financed a Lexus with Toyota financial and was paying 8.5% with my fico around 630 and a co-sign which was my brother he has a 715 in February 2021. I just refied in Oct 2021 since my score went up to 670 and was offered 5% with less month shaved off 120 dollars off my monthly payment. Cap one has terrible customer service , I sent my title to get the Lien changed and 3 months still no title I keep calling , I have to move and with no title I won't be able to register in another state . Would look into credit union might offer better rates and service , I'm going to try NFCU myself.