- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: DCU Auto Refinance Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU Auto Refinance Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DCU Auto Refinance Approval

I applied to DCU yesterday via a phone call for the refinance of the 2015 Toyota Highlander that I had earlier financed last year through Penfed at 7.02% APR with a 48month tenure. Not the most comfortable conversation as the CSR wanted to know even my blood group and genotype ![]() After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up.

After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up.

I called later in the evening and got a more pleasant fellow who immediately looked up the app and within 5 minutes of being on-hold, approved for 2.74% with the 0.5% DD discount applied. He said the EQ4 they pulled was 719 and their 2.49% goes with a 730 score. Oh well. Accepted the offer. Received a link via email for the loan docs (One paystub and refinance form). Sent them over immediately but since it was already 9.05 pm, I decided to call back this morning to finalize the loan process.

Called today and they sent in the DocuSign agreement. I promptly signed it and now the account has shown up online along with the free checking account. (For some odd reason, 2 free checking accounts popped up, must be an error).

As DP, they valued the car at $22.5k and I financed only my outstanding which is $16.3k. i.e 71% LTV. I chose a 65month tenure because I wanted to drastically reduce my DTI on paper. So monthly payment is now $276 down from $522(FYI: I still expect to pay off the loan in 2years). Also added their $295 GAP to it even though I don't really need it, for $5 a month. Could take it off for a full refund if cancelled within 60 days from today. Hope to give it more thought.

One point of contention with the initial CSR who took the app, was my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

I was also offered a credit card this morning, which I roundly declined to the CSR's surprise(i have made a decision not to accept any card if I am given the option if it has less than a $10k SL). Funny enough, she insisted on leaving the approval on my account till Monday after which she will cancel it if I don't call back. I found that really curious. I insisted she cancels it immediately to be safe, as I will not change my mind as a $5k card does not fit in with my overall credit strategy at this time. It was a very pleasant exchange, though. where she cited my income $25k as the barrier and I insisted it was a barrier they erected given my overall profile and my 1-year history with them.

I joined DCU a year ago and I have used their 6.17%-APY savings account for a while but only had a pre-approval for that 22% 1k loan. Hope I covered all the bases to help others looking to go the DCU way. Pls, feel free to inquire further if anymore DP is needed.

DP in my signature is up to date. Cheers folks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

@Credit_Flavours wrote:I applied to DCU yesterday via a phone call for the refinance of the 2015 Toyota Highlander that I had earlier financed last year through Penfed at 7.02% APR with a 48month tenure. Not the most comfortable conversation as the CSR wanted to know even my blood group and genotype

After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up.

I called later in the evening and got a more pleasant fellow who immediately looked up the app and within 5 minutes of being on-hold, approved for 2.74% with the 0.5% DD discount applied. He said the EQ4 they pulled was 719 and their 2.49% goes with a 730 score. Oh well. Accepted the offer. Received a link via email for the loan docs (One paystub and refinance form). Sent them over immediately but since it was already 9.05 pm, I decided to call back this morning to finalize the loan process.

Called today and they sent in the DocuSign agreement. I promptly signed it and now the account has shown up online along with the free checking account. (For some odd reason, 2 free checking accounts popped up, must be an error).

As DP, they valued the car at $22.5k and I financed only my outstanding which is $16.3k. i.e 71% LTV. I chose a 65month tenure because I wanted to drastically reduce my DTI on paper. So monthly payment is now $276 down from $522(FYI: I still expect to pay off the loan in 2years). Also added their $295 GAP to it even though I don't really need it, for $5 a month. Could take it off for a full refund if cancelled within 60 days from today. Hope to give it more thought.

One point of contention with the initial CSR who took the app, was my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

I was also offered a credit card this morning, which I roundly declined to the CSR's surprise(i have made a decision not to accept any card if I am given the option if it has less than a $10k SL). Funny enough, she insisted on leaving the approval on my account till Monday after which she will cancel it if I don't call back. I found that really curious. I insisted she cancels it immediately to be safe, as I will not change my mind as a $5k card does not fit in with my overall credit strategy at this time. It was a very pleasant exchange, though. where she cited my income $25k as the barrier and I insisted it was a barrier they erected given my overall profile and my 1-year history with them.

I joined DCU a year ago and I have used their 6.17%-APY savings account for a while but only had a pre-approval for that 22% 1k loan. Hope I covered all the bases to help others looking to go the DCU way. Pls, feel free to inquire further if anymore DP is needed.

DP in my signature is up to date. Cheers folks!

Thank you for that UW datapoint, one thing I've always liked about DCU is they've always told me, and apparently you, their tiers.

I'm really considering just refinancing my own vehicle with DCU, hard for me to get over their 3 month pay ahead rule but at any 2.X rate I'm going to be well below my mortgages and as such I'd just let it ride to full term naturally autopay style. Their relationship discount and in my case EV discount all stacks for a totally winning rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

wrote:I applied to DCU yesterday via a phone call for the refinance of the 2015 Toyota Highlander that I had earlier financed last year through Penfed at 7.02% APR with a 48month tenure. Not the most comfortable conversation as the CSR wanted to know even my blood group and genotype

After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up.

I called later in the evening and got a more pleasant fellow who immediately looked up the app and within 5 minutes of being on-hold, approved for 2.74% with the 0.5% DD discount applied. He said the EQ4 they pulled was 719 and their 2.49% goes with a 730 score. Oh well. Accepted the offer. Received a link via email for the loan docs (One paystub and refinance form). Sent them over immediately but since it was already 9.05 pm, I decided to call back this morning to finalize the loan process.

Called today and they sent in the DocuSign agreement. I promptly signed it and now the account has shown up online along with the free checking account. (For some odd reason, 2 free checking accounts popped up, must be an error).

As DP, they valued the car at $22.5k and I financed only my outstanding which is $16.3k. i.e 71% LTV. I chose a 65month tenure because I wanted to drastically reduce my DTI on paper. So monthly payment is now $276 down from $522(FYI: I still expect to pay off the loan in 2years). Also added their $295 GAP to it even though I don't really need it, for $5 a month. Could take it off for a full refund if cancelled within 60 days from today. Hope to give it more thought.

One point of contention with the initial CSR who took the app, was

my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

I was also offered a credit card this morning, which I roundly declined to the CSR's surprise(i have made a decision not to accept any card if I am given the option if it has less than a $10k SL). Funny enough, she insisted on leaving the approval on my account till Monday after which she will cancel it if I don't call back. I found that really curious. I insisted she cancels it immediately to be safe, as I will not change my mind as a $5k card does not fit in with my overall credit strategy at this time. It was a very pleasant exchange, though. where she cited my income $25k as the barrier and I insisted it was a barrier they erected given my overall profile and my 1-year history with them.

I joined DCU a year ago and I have used their 6.17%-APY savings account for a while but only had a pre-approval for that 22% 1k loan. Hope I covered all the bases to help others looking to go the DCU way. Pls, feel free to inquire further if anymore DP is needed.

DP in my signature is up to date. Cheers folks!

Congrats.

Question

They valued the car at $22.5k and financed only my outstanding which is $16.3k. i.e 71% LTV.

Did they use NADA/KBB values; was this on a 2015 highlander with how many miles? Did you ask for LTV or they gave you the $22.5k value.

CSR wanted to know even my blood group and genotype ![]() After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up. my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up. my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

My question is

a) Did you have to provide for a paystub? did you have self employment income; any bank statements; tax returns?

b) CSR>>>>> what questions including blood group was CSR so curious for?

c) Are you sure it was an EQ4. Mostly they use EQ5 EQUIFAX scores ? has it changed recently or being used specifically for Auto loans? was there chexsystems or EQ pull for opening account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

@Anonymous wrote:

wrote:I applied to DCU yesterday via a phone call for the refinance of the 2015 Toyota Highlander that I had earlier financed last year through Penfed at 7.02% APR with a 48month tenure. Not the most comfortable conversation as the CSR wanted to know even my blood group and genotype

After what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up.

I called later in the evening and got a more pleasant fellow who immediately looked up the app and within 5 minutes of being on-hold, approved for 2.74% with the 0.5% DD discount applied. He said the EQ4 they pulled was 719 and their 2.49% goes with a 730 score. Oh well. Accepted the offer. Received a link via email for the loan docs (One paystub and refinance form). Sent them over immediately but since it was already 9.05 pm, I decided to call back this morning to finalize the loan process.

Called today and they sent in the DocuSign agreement. I promptly signed it and now the account has shown up online along with the free checking account. (For some odd reason, 2 free checking accounts popped up, must be an error).

As DP, they valued the car at $22.5k and I financed only my outstanding which is $16.3k. i.e 71% LTV. I chose a 65month tenure because I wanted to drastically reduce my DTI on paper. So monthly payment is now $276 down from $522(FYI: I still expect to pay off the loan in 2years). Also added their $295 GAP to it even though I don't really need it, for $5 a month. Could take it off for a full refund if cancelled within 60 days from today. Hope to give it more thought.

One point of contention with the initial CSR who took the app, was

my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

I was also offered a credit card this morning, which I roundly declined to the CSR's surprise(i have made a decision not to accept any card if I am given the option if it has less than a $10k SL). Funny enough, she insisted on leaving the approval on my account till Monday after which she will cancel it if I don't call back. I found that really curious. I insisted she cancels it immediately to be safe, as I will not change my mind as a $5k card does not fit in with my overall credit strategy at this time. It was a very pleasant exchange, though. where she cited my income $25k as the barrier and I insisted it was a barrier they erected given my overall profile and my 1-year history with them.

I joined DCU a year ago and I have used their 6.17%-APY savings account for a while but only had a pre-approval for that 22% 1k loan. Hope I covered all the bases to help others looking to go the DCU way. Pls, feel free to inquire further if anymore DP is needed.

DP in my signature is up to date. Cheers folks!

Congrats.

Question

They valued the car at $22.5k and financed only my outstanding which is $16.3k. i.e 71% LTV.

Did they use NADA/KBB values; was this on a 2015 highlander with how many miles? Did you ask for LTV or they gave you the $22.5k value.

CSR wanted to know even my blood group and genotypeAfter what seemed like forever, she said an underwriter would get in touch within 24hrs as they were a bit backed up. my income as she insisted on using only my part-time gig that had a more traditional paystub, so income used was $25k but it didn't really matter in the words of the UW that finally approved the loan since I had substantial equity in the car already.

My question isa) Did you have to provide for a paystub? did you have self employment income; any bank statements; tax returns?

Yes they required the most recent paystub from the side gig which i sent in after approval. I work fulltime for an organisation outside the US and also own 2 new businesses, so my income situation is not cut and dry. They didnt ask for bank statemnts or tax returns as the lady just seemed fixated on paystubs. I didn't see the need to push further for the use of those as evidence of income as the loan had already been approved at a rate that could only be reduced if my credit score was higher.

b) CSR>>>>> what questions including blood group was CSR so curious for?

The blood group comment was a joke. LOL. But she was getting there, honestly. As she was asking about my marital status, number of kids(if any), Immigration/travel history and things that had no bearing whatsoever to a decision on auto refinance. I quickly shut her down and she offered a half-hearted apology and proceeded to tell me that i will get a reply in 24hours. Honestly i feel its best to just apply online and only call them if there is a need for a recon. Some of these CSRs just go overboard. She ended up by telling me she wasn't a loan officer, then why were you grilling me like you were one????

c) Are you sure it was an EQ4. Mostly they use EQ5 EQUIFAX scores ? has it changed recently or being used specifically for Auto loans? was there chexsystems or EQ pull for opening account.

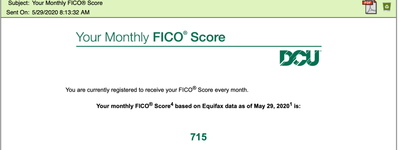

Honestly i get confused about these EQ versions but i am referring to the one provided on the account. It says score4 on there but i know its the mortgage score they use which is EQ5. So i dont really know.

There is no EQ pull for account opening anymore, i can confirm because i just helped DW with her membership which was approved yesterday but there should be a chexsystems pull. I cant say definitively but i know almost all CUs use Chex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

@Revelate wrote:Thank you for that UW datapoint, one thing I've always liked about DCU is they've always told me, and apparently you, their tiers.

I'm really considering just refinancing my own vehicle with DCU, hard for me to get over their 3 month pay ahead rule but at any 2.X rate I'm going to be well below my mortgages and as such I'd just let it ride to full term naturally autopay style. Their relationship discount and in my case EV discount all stacks for a totally winning rate.

@Revelate I'm planning to refinance my car with DCU in August or September -- I'm curious what this 3-month pay ahead rule is?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

@beutiful5678 wrote:

@Revelate wrote:Thank you for that UW datapoint, one thing I've always liked about DCU is they've always told me, and apparently you, their tiers.

I'm really considering just refinancing my own vehicle with DCU, hard for me to get over their 3 month pay ahead rule but at any 2.X rate I'm going to be well below my mortgages and as such I'd just let it ride to full term naturally autopay style. Their relationship discount and in my case EV discount all stacks for a totally winning rate.

@Revelate I'm planning to refinance my car with DCU in August or September -- I'm curious what this 3-month pay ahead rule is?

DCU like other lenders if you pay aggressively will advance your payment due date out, which is handy when you're short cash for a given month for whatever reason. In DCU's case though, they will reset the due date back to 3 months out... so for example if you pay a year ahead in a chunk, you will move your due date out a year, but then DCU will manually reset it to 3 months out from your next due date.

Defeats the purpose of reindeer games or being able to take time off if you get short on cash from a financial defensibility play.

They have great auto loans, and if you just intend to pay it off month by month by month they're hard to beat, but in my case my income can swing wildly depending whether I happen to be employed or not, and I prefer to be able to pay things ahead when I'm cash flush and I can't do that with much effectiveness with DCU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

@Revelate wrote:

@beutiful5678 wrote:

@Revelate wrote:Thank you for that UW datapoint, one thing I've always liked about DCU is they've always told me, and apparently you, their tiers.

I'm really considering just refinancing my own vehicle with DCU, hard for me to get over their 3 month pay ahead rule but at any 2.X rate I'm going to be well below my mortgages and as such I'd just let it ride to full term naturally autopay style. Their relationship discount and in my case EV discount all stacks for a totally winning rate.

@Revelate I'm planning to refinance my car with DCU in August or September -- I'm curious what this 3-month pay ahead rule is?

DCU like other lenders if you pay aggressively will advance your payment due date out, which is handy when you're short cash for a given month for whatever reason. In DCU's case though, they will reset the due date back to 3 months out... so for example if you pay a year ahead in a chunk, you will move your due date out a year, but then DCU will manually reset it to 3 months out from your next due date.

Defeats the purpose of reindeer games or being able to take time off if you get short on cash from a financial defensibility play.

They have great auto loans, and if you just intend to pay it off month by month by month they're hard to beat, but in my case my income can swing wildly depending whether I happen to be employed or not, and I prefer to be able to pay things ahead when I'm cash flush and I can't do that with much effectiveness with DCU.

Oh yes, I can see how that would be annoying for your use case.

I'm trying to lower DTI and build up cash reserves so DCU is probably still my best bet, especially with my current interest rate from Cap One.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

i m working on getting my score up with EQ5. Now that i understand what 3 pay looks like i find it very very interesting.

right now my eq5 is just 590 as of june 15,2020. I have better EX fico score Fico2 of 657 as of june 15, 2020.

lets see where it takes me.

hopefully, we can keep this message post alive until end of 2020.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Auto Refinance Approval

so let me be sure i understand this DCU Refinance

a) DCU is NO GOOD if making extra payments or paying in advance upto a YEAR. They will only advance the payment due date by 3 months manually. eg. due date is June 30, 2020; scheduled payment is $300; You have $300 debited from your DCU checking account on june 30 2020 & before next statement you make a payment of $3600. (1 year payment).

if i understand it correctly, $3600 went towards principal but next payment is still scheduled for Sept 30, 2020 for $300. (3 months ahead). You do not have a payment due in July/August;

do all banks you refinance have this provision or is this exclusive to DCU?

How would it be different or better/worse with lets say PenFed or RBFCU

6/18/15

TU: 678

EQ: 640

EX: 639