- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: How to Refinance up side down?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to Refinance up side down?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Refinance up side down?

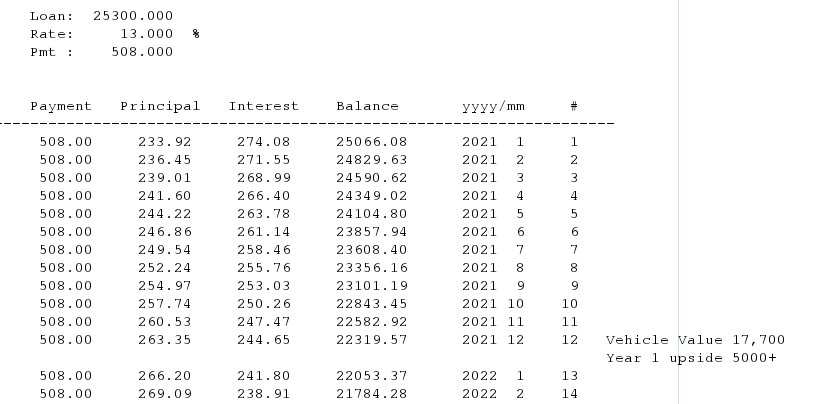

Hi there I fiance a 2019 (new at the time) Nissan sentra at 508$ a month with a 13% rate at 75mo $25,000. My cars at 25k miles and well i am starting to realize im screwed with this loan. Is there any suggestions? I think i have $22,300 i just got the car one year ago. I need to figure out either to get the monthly payments down or get rid of it helpppppp or any suggestions currently my credit is at 620, 620,630. thanks

#upsidedown

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

@Anonymous wrote:Hi there I fiance a 2019 (new at the time) Nissan sentra at 508$ a month with a 13% rate at 75mo $25,000. My cars at 25k miles and well i am starting to realize im screwed with this loan. Is there any suggestions? I think i have $22,300 i just got the car one year ago. I need to figure out either to get the monthly payments down or get rid of it helpppppp or any suggestions currently my credit is at 620, 620,630. thanks

#upsidedown

@Anonymous Are you a member of a credit union? If not, have you considered joining one, e.g. PenFed, DCU, local, etc?

CU's to join for Savings Rate now and possible Credit Products later!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

I um was one but i think i owe them 500 to one credit union.. Do lenders refiance with being upside down?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

@Anonymous wrote:I um was one but i think i owe them 500 to one credit union.. Do lenders refiance with being upside down?

It depends on the bank and the vehicle.

Some credit unions will refinance current and previous model year cars as if they were new (you'd still be upside-down, just on a path to pay it off).

A 2020 and 2021 model year vehicle could be refinanced as a new vehicle this month. Sometime between April and July it would change to 2021 & 2022 model years.

Starting Score: EQ:608, EX:617, TU:625

Current Score 3/11/2020: EQ:695, EX:703, TU:720

Goal Score: 740+

Take the myFICO Fitness Challenge

Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.

Newest Account July 8, 2020 -- Last HP October 24, 2020 -- Gardening Goal: August 2022 and reach 0/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

My credit union refinances up to 110% of NADA value.

If your scores were better you might be able to get a combo loan from a credit union.

When I re-financed with my Local Visions FCU I was $1,000 too upside down. They offered to give me an unsecured line of credit for that or increase my credit limit on my 8.5% Visa to cover the difference.

Sadly with a high interest low down payment loan it will take a very long time to get right side up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

I have 13.49% post BK, it's not that high IMHO.

People around here think anything higher than zero is too high.

You can refi out of it, most banks will go up to 120% of NADA value.

Pay down your credit cards AZEO to below 10% and try Lending Tree, Nerd Wallet, Capital One or Local Bank. You can get good rates out of Wells Fargo and Bank of America both are heavy car lenders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

@Anonymous wrote:Hi there I fiance a 2019 (new at the time) Nissan sentra at 508$ a month with a 13% rate at 75mo $25,000. My cars at 25k miles and well i am starting to realize im screwed with this loan. Is there any suggestions? I think i have $22,300 i just got the car one year ago. I need to figure out either to get the monthly payments down or get rid of it helpppppp or any suggestions currently my credit is at 620, 620,630. thanks

#upsidedown

At what payment amount would you be comfortable? Even if you can do a refi you will probably be in the $450 range with a good rate and 60 months. You should refi at a cheaper rate but I just wanted to temper your expectations in case you were expecting a much cheaper payment. I guess you could go 72 months but you will probably be negative equity all they way until you drive the wheels off it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

@Anonymous wrote:Hi there I fiance a 2019 (new at the time) Nissan sentra at 508$ a month with a 13% rate at 75mo $25,000. My cars at 25k miles and well i am starting to realize im screwed with this loan. Is there any suggestions? I think i have $22,300 i just got the car one year ago. I need to figure out either to get the monthly payments down or get rid of it helpppppp or any suggestions currently my credit is at 620, 620,630. thanks

#upsidedown

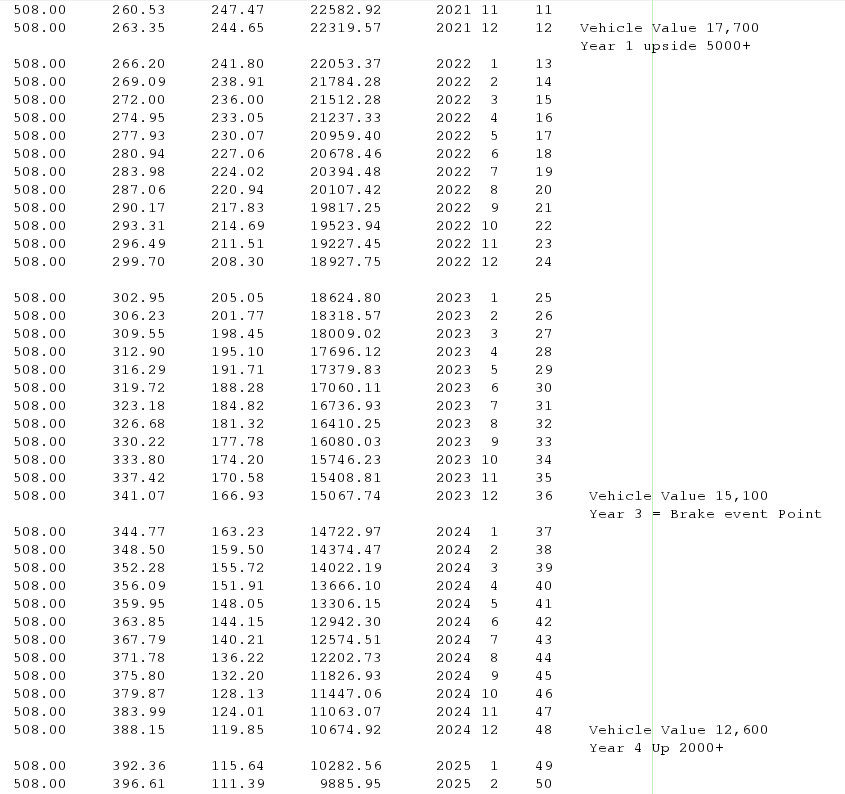

To hit the 110% loan threshold you have about another year and a half.

When you take out a 70+ month loan you are upside down for about 3 years.

You should just pay your loan and enjoy your new car for another yesr or two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Refinance up side down?

Hi OP, try Associated CU. I had a loan with Cap 1 at 9.9%. I apped to refi with ACU within 6 months of my purchase, I was approved at 4.54%.