- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: I am so confused by my FICO Auto Score 8 Score...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I am so confused by my FICO Auto Score 8 Scores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am so confused by my FICO Auto Score 8 Scores

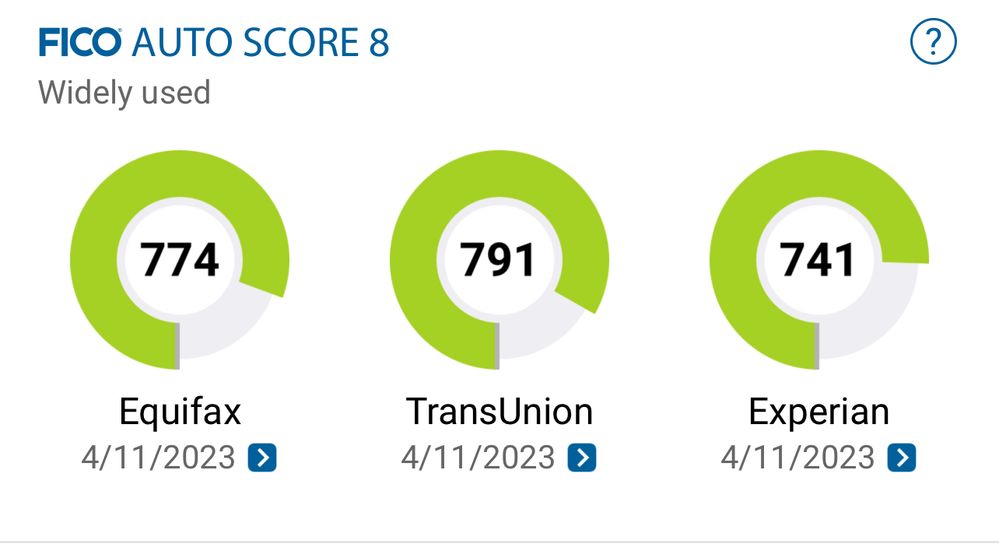

I had a serious rebuild a few years ago and luckily I have been maintaining. I have had some peaks and valleys but for the most part have been doing well. With that said I am super confused about my FICO Auto Score 8 Scores. I don't understand why my Experian score is so low. I also don't understand why Capital One is quoting me 14-15% interest rates. Can anyone help me to understand?

Salary 155K

DTI - sub 35%

No derogs across all reports

FICO Score 8

EQ - 744

EX - 741

TU - 724

FICO Auto Score 8

EQ - 700

EX - 667

TU - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

Previous history or lack thereof with auto loans/installment loans?

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

You are missing all the important stats.

lates, collection, inquiries 6 and 12 months, new accounts, utilization, accounts with balances, previous loan history(a major factor on auto scores).

also what is your actual DTI? Sub 35% doesn't say much 30% is a major threshold.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

i thought the no derogs covered the lates and collections.

absolutely no lates

absolutely no collections

2 inquiries in past 12 months

2 new installment loan accounts in the past 12 months (1 paid off, 1 with a balance)

no new cards since 2018

29% utilization

6 cards with a balance, 6 at zero

no auto loans since 2008

the dti issue is tricky. i am at 29% utilization on my cards but I have 1 installment loan. I am not sure how to calculate that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

@precision wrote:i thought the no derogs covered the lates and collections.

absolutely no lates

absolutely no collections

2 inquiries in past 12 months

2 new installment loan accounts in the past 12 months (1 paid off, 1 with a balance)

no new cards since 2018

29% utilization

6 cards with a balance, 6 at zero

no auto loans since 2008

the dti issue is tricky. i am at 29% utilization on my cards but I have 1 installment loan. I am not sure how to calculate that.

Calculate the current balance divided by opening loan amount.

It's a sperate calculation catagory from revolving / open ended credit.

Where are you pulling your AUTO FICO8 Scores from?

If there are negative factors, you should compare them to what your Tranunion and Equifax factors state.

If you can copy them to your post, please do.

August 28, 2023 FICO BankCard 8

August 28, 2023 FICO Auto 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

13% DTI according to Lending Club.

Ficos both FICO 8 and Auto are coming from myFICO. Last update is 4/7/2023.

There are no negative factors listed.

The only thing listed under the scores is the following:

Loan terms:

| Original Loan Amount: | $32,000 |

| Loan term: | 36 months |

| Interest rate: | 5.09% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

@precision The no derogs did my brain just skipped over it.

DTI is housing cost + credit debt obligation divided by gross monthly income.

so 1,000 rent/mortgage + 300 dollar car payment + 700 in reported credit card debt= 2,000 say you make 5,000 pre-tax that would be 2,000/5,000= 40% DTI.

As for why the cap1 offer was so high... Cap1 is a subprime lender with a few prime cards and massive name recognition. They are rarely a good deal, if I am reading your last post correctly you have a brand new 32k loan that has 89% of it's balance remaining... remember I said loans (auto) are a significant factor for auto loans? That would be a rather large factor right there in those higher rates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

@Beefy1212 wrote:@precision The no derogs did my brain just skipped over it.

DTI is housing cost + credit debt obligation divided by gross monthly income.

so 1,000 rent/mortgage + 300 dollar car payment + 700 in reported credit card debt= 2,000 say you make 5,000 pre-tax that would be 2,000/5,000= 40% DTI.

As for why the cap1 offer was so high... Cap1 is a subprime lender with a few prime cards and massive name recognition. They are rarely a good deal, if I am reading your last post correctly you have a brand new 32k loan that has 89% of it's balance remaining... remember I said loans (auto) are a significant factor for auto loans? That would be a rather large factor right there in those higher rates.

This gives me some persepective on the Cap1 issue. But it still boggles my mind that I see other people with way worse FICO's getting far better terms. I would be interested in SP'ing another app at another lender. However, the only other one that I am aware of is PenFed and I am not a member there. I heard that NFCU (which I do have) offers SP auto loans to compare rates. But I can't confirm that.

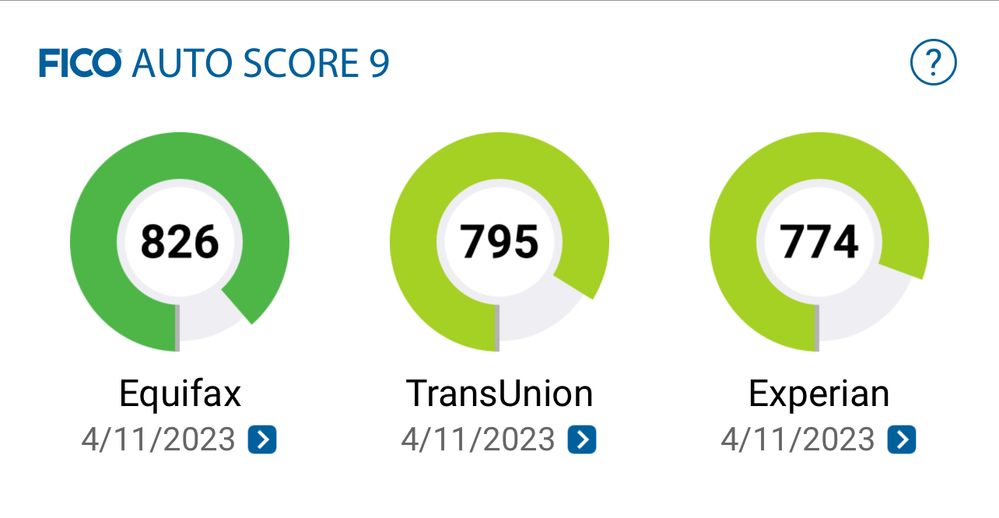

I am still confused on the variance of my auto scores. It makes no sense to me that there is nearly a 60 point swing between scores when there are no derogs on my reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

@precision 50-60 point changes are fairly common on the industry enhanced scores... They all have a slightly different algorithm.

Just a hunch those 2 inquiries you spoke of are on ex right? The important thing is you know your best scores now look for a lender that uses that score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am so confused by my FICO Auto Score 8 Scores

@precision wrote:

no auto loans since 2008

This is why your auto scores are lower! Auto scores rely more heavily on information from auto loans and you haven't had one in so long that it probably isn't even listed on your credit reports anymore. My auto scores are higher than my normal FICO scores but I have two paid off auto loans and 2 ongoing auto loans reporting. The industry scores rely more heavily on industry specific metrics, if you have no/fewer of those metrics in your report to draw from then that will hurt you.

8/8/25

8/8/25