- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Re: To File or Not to File...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

To File or Not to File...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To File or Not to File...

Looking for some advice from the community on path forward. I'll spare you all the sob story, but short version is I've found myself massively in debit as a high earner to the point where I need to decide, given the amount I owe, whether I should be considering Chapter 13 (making an assumption 7 is out of the question).

Pertinent Details:

- 1 Mortgage | 347K Remaining Balance | $2100 /month

- ~10 Credit Cards | 110K Balance | ~2K month

- 2 Car Payments | $810 & $610 / month

- Base Income $145K w/ annual bonus ~40K

- No late payments or derogs

- Utilities ~600 month

- 1 kid in college (community college, super cheap)

So I could struggle and make it through to my next bonus, payoff ~25K and keep chipping away at it but am currently at risk should a major life event happen.

Some questions/thoughts/guidance needed:

- With over 100K in unsecured debt, I'd take a negative credit report to pay a fraction of that back considering what I could have left over and save each paycheck...

- I'd look to keep both of my vehicles (unless there was a compelling reason not to, I suspect if I let one go it would just add more money to pay back to creditors)

- Any perspective on how the means test impacts someone at my wage level?

- Would future bonus payouts be subject to inclusion in the bankruptcy plan? They are not "guaranteed" and must be approved by board of directors each year (though they've never NOT been approved)

It's completely embarrassing that I'm in this mess so any guidance or perspective anyone has would be helpful. I also plan on locating a competent bankruptcy attorney for a consultation soon as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: To File or Not to File...

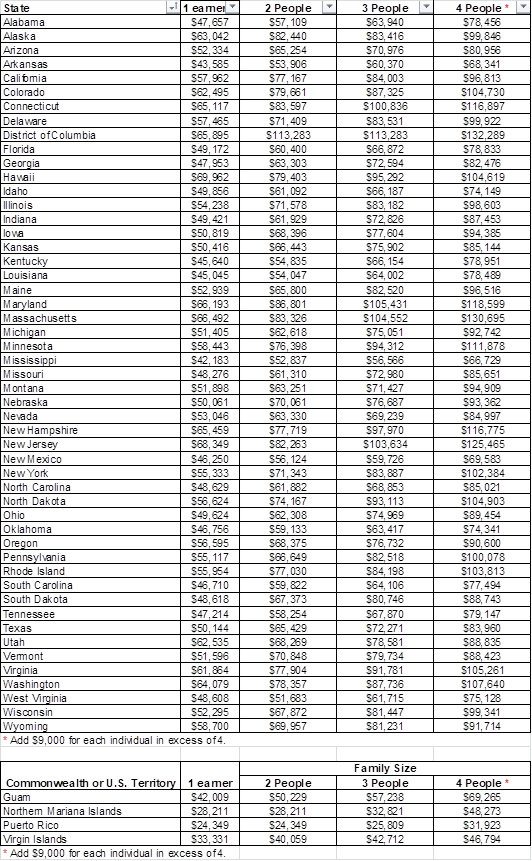

You need to qualify based on where you file..

https://www.justice.gov/ust/means-testing

Based on # of people in household and TOTAL income for the household (household is a financial unit)

Does your house have equity?

If so check exemptions for your filing area and or federal.

All Negatives History Removed as of October 2025 - Only BK CH7 Showing as Public Record

Lines of Credit:

Personal Loan:

Total Reported Revolving CL: $162,450 + 26K PLOC = $188,450

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Ch7 Means Test Income as of 4/1/19

All Negatives History Removed as of October 2025 - Only BK CH7 Showing as Public Record

Lines of Credit:

Personal Loan:

Total Reported Revolving CL: $162,450 + 26K PLOC = $188,450

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: To File or Not to File...

If you can get a Ch7, I would absolutely do it. Your amount of debt and situation certainly warrants it.

Either way, I wish you well, keep us updated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: To File or Not to File...

@Anonymous wrote:Looking for some advice from the community on path forward. I'll spare you all the sob story, but short version is I've found myself massively in debit as a high earner to the point where I need to decide, given the amount I owe, whether I should be considering Chapter 13 (making an assumption 7 is out of the question).

Pertinent Details:

- 1 Mortgage | 347K Remaining Balance | $2100 /month

- ~10 Credit Cards | 110K Balance | ~2K month

- 2 Car Payments | $810 & $610 / month

- Base Income $145K w/ annual bonus ~40K

- No late payments or derogs

- Utilities ~600 month

- 1 kid in college (community college, super cheap)

So I could struggle and make it through to my next bonus, payoff ~25K and keep chipping away at it but am currently at risk should a major life event happen.

Some questions/thoughts/guidance needed:

- With over 100K in unsecured debt, I'd take a negative credit report to pay a fraction of that back considering what I could have left over and save each paycheck...

- I'd look to keep both of my vehicles (unless there was a compelling reason not to, I suspect if I let one go it would just add more money to pay back to creditors)

- Any perspective on how the means test impacts someone at my wage level?

- Would future bonus payouts be subject to inclusion in the bankruptcy plan? They are not "guaranteed" and must be approved by board of directors each year (though they've never NOT been approved)

It's completely embarrassing that I'm in this mess so any guidance or perspective anyone has would be helpful. I also plan on locating a competent bankruptcy attorney for a consultation soon as well.

There's your answer right there. If you could come up with tighter budget and trim some things for a couple years would be a good plan. There hasnt been an emergency yet, and hopefully one doesnt come your way. You've admitted to your mistakes and time to learn from them cause you know what to do. Stop all CC use. Pay down what you owe until its down to nothing. We really dont say yes file BK on the forum. No one wants to be responsible for such a important decision that will affect your life for 7 or 10 yrs. Suggestions only to better options is what we give you. Its up to you. BK should be the nuclear option. I'm not seeing anything posted that your behind with all kinds of charge offs, judgements, collections or being behind on anything. Just a emergency savings padding is not really a reason to file. I wish you the best with your decision. Good Luck!

BK Free Aug25