- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: AMEX BCP vs. Sallie Mae

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX BCP vs. Sallie Mae

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMEX BCP vs. Sallie Mae

Brief backround:

- 25 yo, grad student, current income $65k. Traveled abroad for undergrad and masters => came back in Aug. 2013, credit file was “fresh” => app’d for few CC => kept getting denials => ultimately approved for BoA secured (CL 500) and Discover (CL 500) in Oct. 2013. Scores were 580-600 range for all 3CB.

- In Jun 2014, I moved to a new apartment => needed bunch of credit checks (new rent, electricity, internet), INQ were on TU. In July, I was added as AU on Amex Hilton which has CL30k. I wish I paid the statements myself through my account (to build history with Amex), instead of sending the payments to my primary account holder to make the payments. I didn’t know it was important till now. I also applied for the Amazon Store Card, since I did a lot of shopping on Amazon and approved for CL 1500. In Oct. 2014 graduated my BoA to CL 3000 and also applied for BoA Asiana - approved with CL 2000. I tried for CLI on Discover and Amazon, but denied - both stating that my file was thin + too many INQ on TU.

- For January 2015, I zeroed the balances on all but one account with 3% overall utilization. Current scores EQ 700 (8 INQ) , TU 700 (12 INQ), and EX 740 (5 INQ). Most of my spending is on gas (1.30hr commute daily), online shopping on Amazon, and grocery stores. So I planned to apply this month for Chase Freedom, AMEX BCP, and Sallie Mae. Tried with Chase, but denied because of thin file (now 1.2 yrs) and 3 overdrafts that happened on my checking account. Going to recon again, even for a low CL, just need a foot in the door.

I need some help/advice with my apps for AMEX BCP (pulls EX) and Sallie Mae (pulls TU, but the analyst said they can pull other CB). I am a bit anxious, do I have a chance and risk the 2 INQ? Or should I wait a bit longer? Is there something that I can do to help my chances? What y'all think ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

@Anonymous wrote:Brief backround:

- 25 yo, grad student, current income $65k. Traveled abroad for undergrad and masters => came back in Aug. 2013, credit file was “fresh” => app’d for few CC => kept getting denials => ultimately approved for BoA secured (CL 500) and Discover (CL 500) in Oct. 2013. Scores were 580-600 range for all 3CB.

- In Jun 2014, I moved to a new apartment => needed bunch of credit checks (new rent, electricity, internet), INQ were on TU. In July, I was added as AU on Amex Hilton which has CL30k. I wish I paid the statements myself through my account (to build history with Amex), instead of sending the payments to my primary account holder to make the payments. I didn’t know it was important till now. I also applied for the Amazon Store Card, since I did a lot of shopping on Amazon and approved for CL 1500. In Oct. 2014 graduated my BoA to CL 3000 and also applied for BoA Asiana - approved with CL 2000. I tried for CLI on Discover and Amazon, but denied - both stating that my file was thin + too many INQ on TU.

- For January 2015, I zeroed the balances on all but one account with 3% overall utilization. Current scores EQ 700 (8 INQ) , TU 700 (12 INQ), and EX 740 (5 INQ). Most of my spending is on gas (1.30hr commute daily), online shopping on Amazon, and grocery stores. So I planned to apply this month for Chase Freedom, AMEX BCP, and Sallie Mae. Tried with Chase, but denied because of thin file (now 1.2 yrs) and 3 overdrafts that happened on my checking account. Going to recon again, even for a low CL, just need a foot in the door.

I need some help/advice with my apps for AMEX BCP (pulls EX) and Sallie Mae (pulls TU, but the analyst said they can pull other CB). I am a bit anxious, do I have a chance and risk the 2 INQ? Or should I wait a bit longer? Is there something that I can do to help my chances? What y'all think

Actually, AMEX doesn't care whether the AU or the Basic cardmember makes the payment, at least not for a "risk assessment" standpoint.

I suggest a healthy combo of a Sallie Mae AND a Sam's Club MC with your spending on gas.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

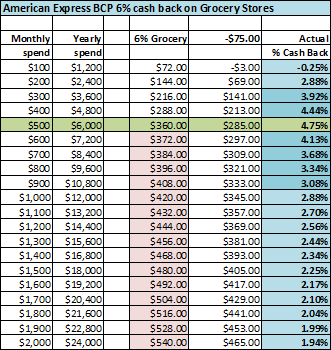

BCP doesn't give you anything that SM doesn't other than drugstores and a higher annual threshold. If you're living alone, there is a decent chance that you won't break the $250 per month cap on groceries. Additionally, once you factor in the annual fee, BCP only gives 4.8% cash back on groceries, assuming that you spend the entire $6k per year ($500 per month).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

@Anonymous wrote:BCP doesn't give you anything that SM doesn't other than drugstores and a higher annual threshold. If you're living alone, there is a decent chance that you won't break the $250 per month cap on groceries. Additionally, once you factor in the annual fee, BCP only gives 4.8% cash back on groceries, assuming that you spend the entire $6k per year ($500 per month).

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

Both cards are great for groceries - you can't really make a "bad" choice here. One factor that I never really see discussed in this BCP v. SM debate is the value of Amex Offers. As you can see in my signature, I have the BCP and in addition to the 4.75% net CB on groceries I get (we spend $6k per year), I have also redeemed over $250 in Amex Offers in the past 9 months. Most recently, I got $25 for spending $100 at Staples. For the last 2 months I got $25 off my FiOS bill. On Small Business Saturday I used my card and my BF's AU card to get $60 of gift certificates to a local restaurant. Once upon a time I had an offer for $20 back for spending $20 at Amazon - so a totally free gift card! All these opportunities for additional cash far outstrip that $75 annual fee, at least for my pattern of spending.

| EX08: 841 | TU08: 841 EQ08 (Bankcard Enhanced) 844 (out of 900) | ||||||

| FAKO TU: 803 Vantage 3.0 - TU: 817 - EQ: 818 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

They both have merit, but as you are a student, I don't know if you can justify the BCP's fee. Sallie Mae is a great choice for groceries and gas. You probably would not exceed the caps anyway, being a student.

You could get a BCE as backup instead of BCP. At least BCE is no AF so if you don't use it much it's not a big deal. As someone else said, Amex is a good card to have, in general. You could see if there's a different offering from Amex that suits you better, though.

Also since when does BCP include drugstores unless I missed something?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

@matthew2115 wrote:Both cards are great for groceries - you can't really make a "bad" choice here. One factor that I never really see discussed in this BCP v. SM debate is the value of Amex Offers. As you can see in my signature, I have the BCP and in addition to the 4.75% net CB on groceries I get (we spend $6k per year), I have also redeemed over $250 in Amex Offers in the past 9 months. Most recently, I got $25 for spending $100 at Staples. For the last 2 months I got $25 off my FiOS bill. On Small Business Saturday I used my card and my BF's AU card to get $60 of gift certificates to a local restaurant. Once upon a time I had an offer for $20 back for spending $20 at Amazon - so a totally free gift card! All these opportunities for additional cash far outstrip that $75 annual fee, at least for my pattern of spending.

These are excellent reasons to get an AMEX card in general, but not to get BCP. You get the same benefits for the $0 AF BCE.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

If you're in their footprint, you might like to look into the Huntington Voice for 3x points (for one chosen category), no AF. I got it and use it primarily for gas since my BCP doesn't offer as many points for gas.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX BCP vs. Sallie Mae

Thank you for all the great suggestions ![]()

Thus far, SM looks solid for gas and Amazon. I guess BCP may be worth it with the Amazon Prime + $100 cash back, those two will cover the annual fee for two years. I guess I wanted a card with AMEX to have for the longterm. Also, what do you think of Gold's 50k signup bonus? Too much for now? I think I read that it's for new AMEX only, if I am not mistaken.