- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Amex CLI

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex CLI

Very Happily in the garden

Goal Cards:

None for Now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

What is your current limit?

801 EQ FICO 06/2022

797 TU FICO 04/2022

793 EX FICO 04/2022

$30k NFCU Platinum | $30.7k NFCU cashRewards Sig | $15k NavChek | $7.1k Cap1 Quicksilver | $10k Amazon Store | $19k Cap1 VentureOne | $16k Barclay Aviator | $5k Chase Freedom | $5k Chase Sapphire Preferred | $9k Costco Visa | $20k AMEX BCE | AMEX Gold | NFCU Platinum #2 $19.3k | Apple $8.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

If it's the $1500 BCE in your mobile signature, by all means go for $4500! Yes, it has to be at least 180 days between credit line increases, so you can ask at any time after midnight Central Time tonight. Note: Your signature is only showing on mobile. My Settings/Personal/Personal Information is where you can copy the same thing as your mobile signature to a desktop signature so everyone can see it. Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

Very Happily in the garden

Goal Cards:

None for Now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

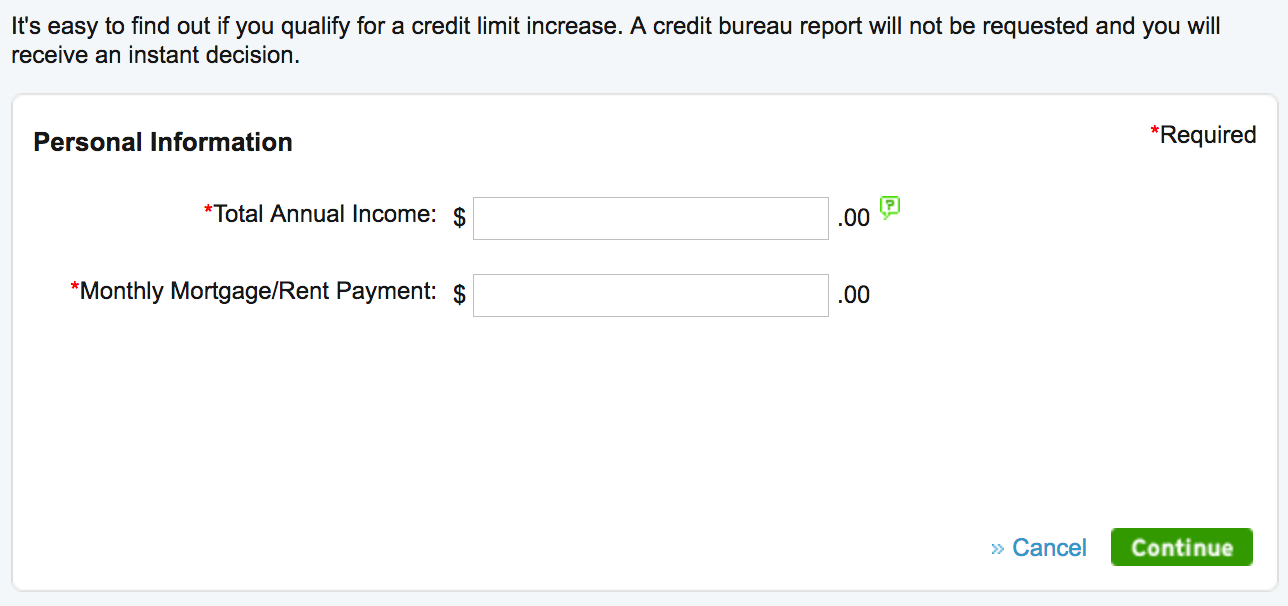

So need some more advice. I was just on my citi account after making a payment and decided to creep around and saw this under my increase tab. Does this mean soft pull increase? I feel like I just got my increase recently on this card so not sure if I should try or not

Very Happily in the garden

Goal Cards:

None for Now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

That is indeed the Soft Pull language for Citi, and it will give you the option for a Hard Pull if you are unhappy with the increase amount. Citi only allows a CLI every 6 months, so if it has been less than that, just mark your calendar. For me the wording has just stayed there. Best of luck with Amex tomorrow; let us know how it goes!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

Very Happily in the garden

Goal Cards:

None for Now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI

@Bmn5940 wrote:

It seems my last increase was back in may on the 11th but what I find super odd is that I do remember checking not too long ago and it saying it would be a hard pull. Obviously it's not been roughly 4 months since last increase so not at the 6 month mark yet but just curious why they'd give soft pull. Also to add to this My Citi card was opened early February, I got my first soft pull increase(luv button) on May 11th only 3 months after having card, instant increase from 500 to 1600 now about 3-4 months later from last increase I'm getting soft pull option again. I will say I put a lot of use through this card like my balance rn is 900/1600 Because I bought all my books and supplies with it while awaiting my financial aid disbursement. Maybe they like me? Tempted to hit the button

Yes, it changed to the SP language for me at about 4 months also and I got a $1300 SP CLI. It seems to come up when the computer thinks your profile is eligible for it, even if your account may not be yet. It has not gone back to the HP language since it first changed for me in March. I've tried since (on both my account and wife's) and got the "There must be 6 months between credit line increases" letter. It doesn't reset the clock; my wife just got a $4k SP CLI a few weeks ago. Waiting until September to try again on mine. You should be good to go in mid-November!