- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Another Cap1 thread of an adventure of getting a C...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Another Cap1 thread of an adventure of getting a CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Another Cap1 thread of an adventure of getting a CLI

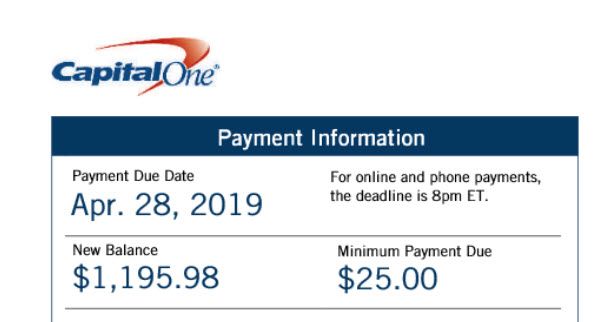

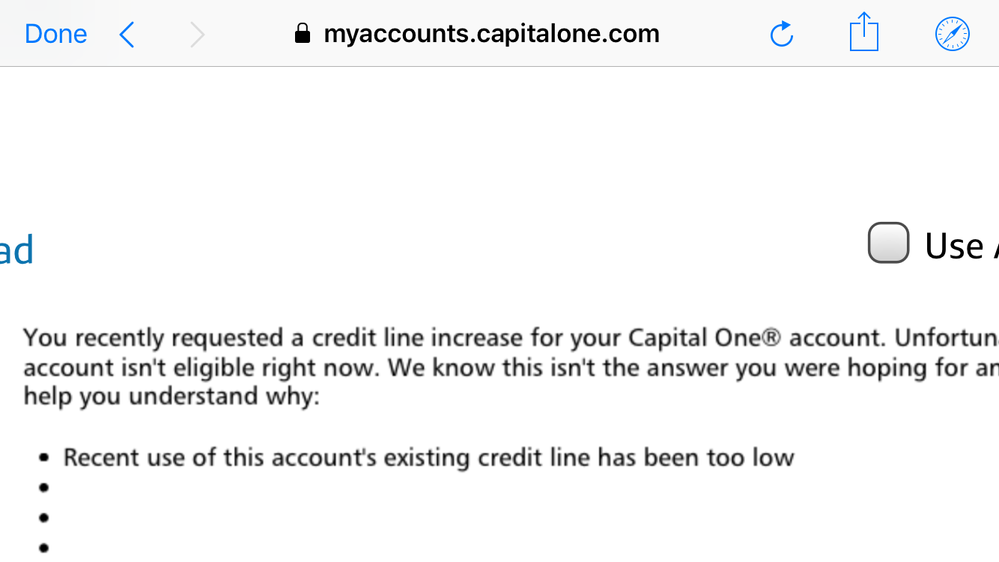

So my last denial of an CLI was due to credit usage too high, had a balance and was paying it off with larger than minimums, which was about 9 months ago and I paid off my balance and received an increase, I updated to the Venture One Card and after the 6 month period I applied for another CLI, and was denied for credit usage too low, well last month I took out a balance transfer out for around $1111, charged my cellphone bill $87 and utility bill of$92. So my balance was around $1,290 and a ratio of 28%. I made 3 payments one for $87, one for $501.50 and $780.50 all spread out to show multiple payments being made. After the statement date closed, I applied again for a CLI and was told the same thing, credit usage too low. Which makes me think it’s an automated process when you request a CLI with Cap1. I just did another balance transfer for $2500 and will be doing the same thing as I did last month and see what the automated process thinks next month

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

At the start of your post you stated that your denial reason was credit usage too high, then later in the post say you received the "same" denial reason of credit usage too low. Which is it?

These are very different things. Credit usage too high suggests high utilization where you're at an elevated risk (in their eyes) and they don't want to extend more credit to you as a result. Credit usage too low means in their view you're not spending enough on their card or using enough of your current limit to justify a CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

@Anonymous wrote:At the start of your post you stated that your denial reason was credit usage too high, then later in the post say you received the "same" denial reason of credit usage too low. Which is it?

These are very different things. Credit usage too high suggests high utilization where you're at an elevated risk (in their eyes) and they don't want to extend more credit to you as a result. Credit usage too low means in their view you're not spending enough on their card or using enough of your current limit to justify a CLI.

Your guess is as good as mine because my credit usage was high last month but paid off and Cap1 gives me another denial based on credit usage too low???... Just shows how Cap1 is and why I hate this card, but whatever I have a thin file and I have to deal with them in order to get what I want in the end

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

I'm not sure of these reason codes, but if you are doing balance transfers then those are not swipes. I would think that is what they mean with the credit usage too low.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

Which card are you talking about?

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

@Anonymous wrote:

@Anonymous wrote:At the start of your post you stated that your denial reason was credit usage too high, then later in the post say you received the "same" denial reason of credit usage too low. Which is it?

These are very different things. Credit usage too high suggests high utilization where you're at an elevated risk (in their eyes) and they don't want to extend more credit to you as a result. Credit usage too low means in their view you're not spending enough on their card or using enough of your current limit to justify a CLI.

Your guess is as good as mine because my credit usage was high last month but paid off and Cap1 gives me another denial based on credit usage too low???... Just shows how Cap1 is and why I hate this card, but whatever I have a thin file and I have to deal with them in order to get what I want in the end

Cap1 is no different than most of the lenders today. CLI's used to fly in. But times have changed. Just because we use a card for whatever amount doesn't entitle us to a CLI whenever we want. Its their money we borrow. Not ours. Dont hate. Just play the game.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

I've found Capital One to be quite conservative with CLIs and I think that's a good thing. If I'm only putting (say) 25% of my limit through their card per cycle and paying it off in full, that doesn't show them that I "need" a greater limit. On a $10k credit line, that's $2500 which may seem like a good spend in terms of dollars, but percentage wise there's still plenty of breathing room there and absolutely no reason a CLI should be given.

Contrast that to Amex or Discover that will give someone a CLI when they are using 0%-1% of their credit limit during a cycle. It's lenders like Amex and Discover that cause us to get pissed about those like Capital One in this example... but Capital One is really the "smart" one here and Amex and Discover are the idiots from a business perspective in terms of risk/reward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Cap1 thread of an adventure of getting a CLI

@Anonymous wrote:I've found Capital One to be quite conservative with CLIs and I think that's a good thing. If I'm only putting (say) 25% of my limit through their card per cycle and paying it off in full, that doesn't show them that I "need" a greater limit. On a $10k credit line, that's $2500 which may seem like a good spend in terms of dollars, but percentage wise there's still plenty of breathing room there and absolutely no reason a CLI should be given.

Contrast that to Amex or Discover that will give someone a CLI when they are using 0%-1% of their credit limit during a cycle. It's lenders like Amex and Discover that cause us to get pissed about those like Capital One in this example... but Capital One is really the "smart" one here and Amex and Discover are the idiots from a business perspective in terms of risk/reward.

This post is a example of how wrong you are, when people with BKs get CLI from $5k to $8k with Cap1, who’s really the idiots? Who’s running the risk vs giving someone a CLI with no BK? I only have a $4500 CL and that’s been over the long run of 4 years, so that $1290 I used last month is using the credit line I was given, which I made a mistake and stated I was denied for usage. It seems I am being denied for recent use of credit line too low, will they say the same thing next month, when I have used $2500 of the credit line? I will be at a 55% debt ratio instead of the 28%, of last month, which I expect my score to drop farther. I do expect to get a CLI, but since this automated process is delayed, it may take 1 more balance transfer to show them credit line is being used