- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Capital one prequalify tool

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital one prequalify tool

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital one prequalify tool

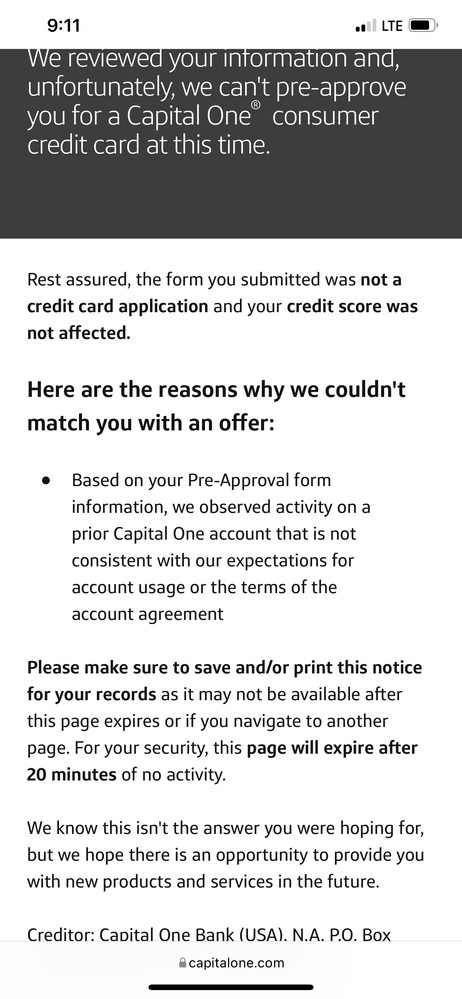

I defaulted maybe 4 years a on 300.00 limit don't remember why n I'm sure they reacted on some charges. Went to the prequalify page n get thi

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

This is very strange considering i burned cap 1 in my bk7 for 5k two years ago and now i have 3 cards from cap 1 with a combined limit of 6300 and i make a fraction of what i did when i was working.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

Anybody else have any idea

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@SUPERSQUID wrote:This is very strange considering i burned cap 1 in my bk7 for 5k two years ago and now i have 3 cards from cap 1 with a combined limit of 6300 and i make a fraction of what i did when i was working.

Not strange at all. You had a BK and your debt to Capital One was discharged. The OP has an open default that is not discharged. So as per the AA it is still on record.

As far as the OP, if your scores and income are doing ok now I think you should just apply to a bank that is open to a CO but one that you have not done business with in the past. Depending on all this you may be good to go with Pen Fed, they pull EQ for CC's so I would suggest that you check your scores and be sure you are rated at least as "fair" before going to Pen Fed.

Thanks

Mark

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

Weird. I burned Cap 1 and 5 years later I got a card and now have 3 cards from them. I still get letters from the collection agency. But it's been 7 years so they just go right in the shredder. Maybe they recently started cracking down on giving cards to people that burned them? Maybe you should just go ahead and pay them? It's 300 or less right? Did you do something against their rules with the card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@BenTramer1978 wrote:Weird. I burned Cap 1 and 5 years later I got a card and now have 3 cards from them. I still get letters from the collection agency. But it's been 7 years so they just go right in the shredder. Maybe they recently started cracking down on giving cards to people that burned them? Maybe you should just go ahead and pay them? It's 300 or less right? Did you do something against their rules with the card?

You can't pay a debt that's vern discharged in BK. Or well to word it better, Cap One can't ask you to pay them back since it was discharged in BK. The only bank I know of that will still allow you to pay after burning them is Amex.

OP, that is strange. Cap One is normally one of the more forgiving lenders, even if you burned them in the past with a CO/BK. Perhaps they just need more time.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@OmarGB9 wrote:

@BenTramer1978 wrote:Weird. I burned Cap 1 and 5 years later I got a card and now have 3 cards from them. I still get letters from the collection agency. But it's been 7 years so they just go right in the shredder. Maybe they recently started cracking down on giving cards to people that burned them? Maybe you should just go ahead and pay them? It's 300 or less right? Did you do something against their rules with the card?

You can't pay a debt that's vern discharged in BK. Or well to word it better, Cap One can't ask you to pay them back since it was discharged in BK. The only bank I know of that will still allow you to pay after burning them is Amex.

Ooops I missed the BK. I thought he just didn't pay, my mistake.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@BenTramer1978 wrote:Ooops I missed the BK. I thought he just didn't pay, my mistake.

OP didn't say they had a BK. They only said they had a CO.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@EAJuggalo wrote:

@BenTramer1978 wrote:Ooops I missed the BK. I thought he just didn't pay, my mistake.

OP didn't say they had a BK. They only said they had a CO.

Right. My response was directed @BenTramer1978. OP only defaulted.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one prequalify tool

@OmarGB9 wrote:

@EAJuggalo wrote:

@BenTramer1978 wrote:Ooops I missed the BK. I thought he just didn't pay, my mistake.

OP didn't say they had a BK. They only said they had a CO.

Right. My response was directed @BenTramer1978. OP only defaulted.

Then why did you bring up BK?