- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Capital one

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital one

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

This thread is a good example on how someone with a BK within 6 months got a $6k CL with Cap 1 https://ficoforums.myfico.com/t5/Credit-Card-Approvals/Capital-One-Quick-Silver-6-000-Credit-Line-6-...

Thats why they are garbage, good for that person getting that CL but Cap1 is useless to others

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

I second this.

I started out with a $300 secured card in September of 2017. They gave me an auto CLI to $600 after 5 months and then after about 10 months they switched me to unsecured. I stayed at $600 for 10 months, they finally allowed me to product change to the QS card with no credit limit increase. A full year later and I'm still at a $600 credit line. My oldest credit card and it has almost my smallest limit. Keep in mind I utilize the card fully each month and pay it off in full. This is just ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

@Anonymous wrote:I second this.

I started out with a $300 secured card in September of 2017. They gave me an auto CLI to $600 after 5 months and then after about 10 months they switched me to unsecured. I stayed at $600 for 10 months, they finally allowed me to product change to the QS card with no credit limit increase. A full year later and I'm still at a $600 credit line. My oldest credit card and it has almost my smallest limit. Keep in mind I utilize the card fully each month and pay it off in full. This is just ridiculous.

Youre going to be in bucket hell for a while, I think my credit scores were around 700 for all 3 when I applied for mine and yup $300, doesnt matter though Cap1 will bucket you for the rest of your life based on the time you applied. Upgrading to better cards wont get you better terms, might help out with CLI but some of us, get it slow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

I'll probably apply for a new Cap1 card after I get over 700 and my inquiries have aged a bit.

I've wanted to close this current card for awhile specifically because they refuse to increase my limit, but I've kept it open accepting it'll never grow, but it's still my oldest credit card.

It's just a waiting game until my scores improve for now...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

@Anonymous wrote:This thread is a good example on how someone with a BK within 6 months got a $6k CL with Cap 1 https://ficoforums.myfico.com/t5/Credit-Card-Approvals/Capital-One-Quick-Silver-6-000-Credit-Line-6-months-after/m-p/5614952#M601790

Thats why they are garbage, good for that person getting that CL but Cap1 is useless to others

I think it more has to do with bankruptcy. I always felt it's b.s. that someone can default on all their credit obligations and have $10k in credit 6 months later, while someone who pays their obligations will have to deal with low scores and low limits for years. It was then brought to my attention that they're more likely to offer higher limits to someone fresh out of BK because they'll be unable to file again, and can be persued legally much easier, while the person who hasn't filed, can, in an instant if they wanted to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

@Anonymous wrote:This thread is a good example on how someone with a BK within 6 months got a $6k CL with Cap 1 https://ficoforums.myfico.com/t5/Credit-Card-Approvals/Capital-One-Quick-Silver-6-000-Credit-Line-6-months-after/m-p/5614952#M601790

Thats why they are garbage, good for that person getting that CL but Cap1 is useless to others

Strong statement that could not be more wrong. ![]()

My buddy just got a $30k venture and a $30k savor and he never had a BK and has good credit.

I am sure his $60k of limits for 2% and 4% rewards will serve him just fine. ![]()

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

@Anonymous wrote:I second this.

I started out with a $300 secured card in September of 2017. They gave me an auto CLI to $600 after 5 months and then after about 10 months they switched me to unsecured. I stayed at $600 for 10 months, they finally allowed me to product change to the QS card with no credit limit increase. A full year later and I'm still at a $600 credit line. My oldest credit card and it has almost my smallest limit. Keep in mind I utilize the card fully each month and pay it off in full. This is just ridiculous.

No offense, but your largest CL with ANY bank seems to be $1,000, right?

-----------------------------------------------------------------------------------------------------------------------

Let's set the record straight here to those who are confused...bucketting, when it happens, happens to the CARD not the person. So quite often when someone got a card with a terrible fico score when no other real bank would touch them, that card may have a glass ceiling on it. HOWEVER, when that person's credit dramatically improves, so does their opportunity to get a new much better card with a much better limit on it from Cap One. It is not uncommon for people to get their highest credit lines from Cap One especially after they applied for a new card after using and paying their old "bucket card."

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

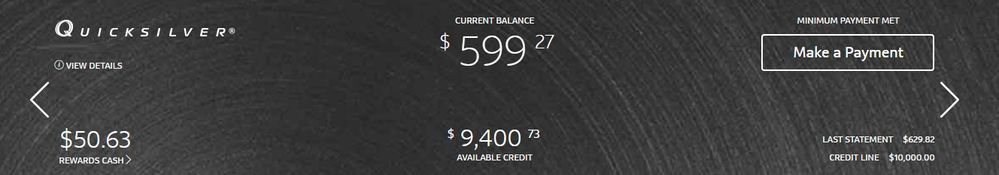

Lol I'm the person who made that thread. Mind you my average age of acocunts is 14 years. Yes 6 months after bankruptcy I applied and received a Quick Silver Signature Visa Card in the amount of $6,000 and 6 months later I received a credit limit increase of $4,000 brining my total to $10,000. Once you understand the nature of the beast all that is left is to tame it. I had 18 credit cards that i dumped into bankruptcy. Mind you as a college student I had an Amex Green Card and received an invite for a AMEX Gold Card lbvs and my Kays Card limit was $5,000 and Citi Bank Card was $5,000. I definitely know how to build my credit which is why it didn't take my long to build it back up. Having said that a year ago my credit score was 582 and now it's 731.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

Your problem in my opinion is that you pay in full every month. I spend and pay and spend and pay in which I carry a balance what is between 10% and 20% of my credit limit. My starting limit for my Capital One Quick Silver Signature Visa card was $6,000 and over a 6 month I spent $6,400 and carry a balance that utilized 10% to 20% of my limit I constantly spend and pay spend and pay instead of paying in full, and 6 month later my credit limit increase by $4,000 and credit score went from 700 to 731.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one

I have a capital one secured credit card. The card started out as $300 and was increased to $600, and from there I received an invite in the mail from credit one for $1,500 and accepted it and a month later went to the Capital One Prequal page and it stated I was aproved for all the Excellent Cards and my score was 701 and I choose the Quick Silver and received $6,000. A year later my secure credit card is stuck at $600 yet my Quick Silver is at $10,000. Having said that I'm going to apply for the Venture Card 2 to 3 weeks from now and I should receive $6,000to $10,000 and from there I'm going to close my secure credit card to get my deposit back. I'm going to wait for my balance to get to $1,000 to $1,400 before a make payment of $500 to $600. Mind you my APR is 0% for 15 months in which the intro APR ends next march and will increase to 21%.