- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Citi cli denied

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi cli denied

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi cli denied

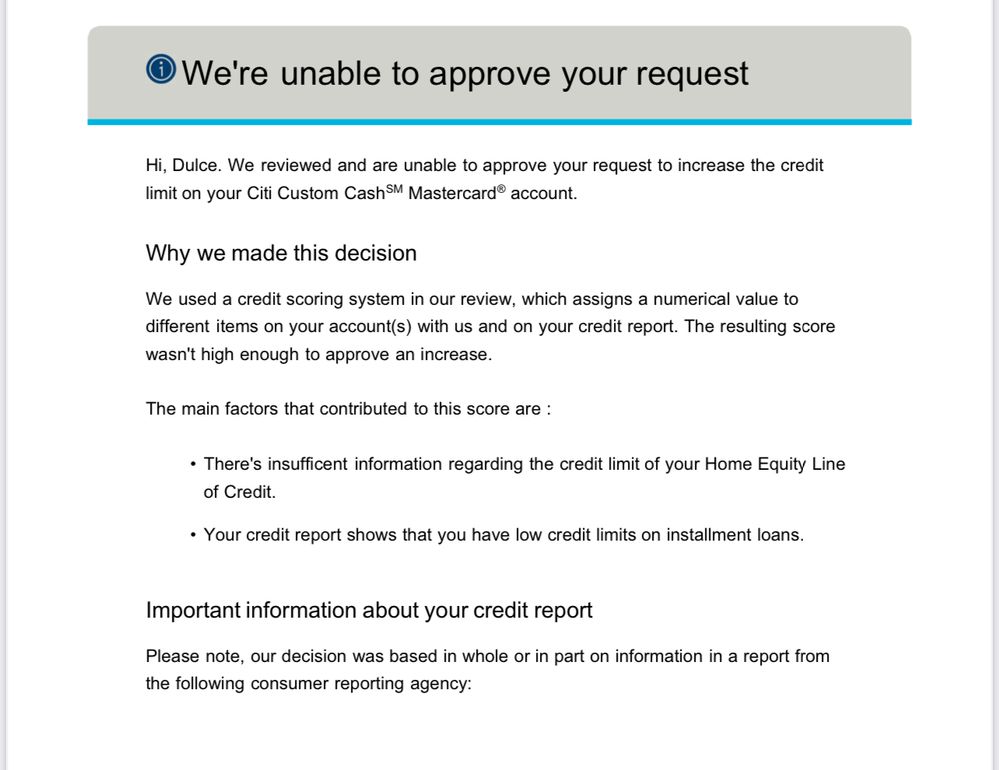

I tried getting a cli in my citi custom cash card and got this letter. I don't really understand the reason. Has anyone gotten these reasons before? Is there a minimum credit score i should have?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

I wouldn't take it to badly Citi isn't known for giving out CLI's and no one is legaly required to give a real answer on exactly why they turn people down.

I would say it's probably more to do with the economic downturn than anything else there watching the books more than they used to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

@Bradac56 wrote:I wouldn't take it to badly Citi isn't known for giving out CLI's and no one is legaly required to give a real answer on exactly why they turn people down.

I would say it's probably more to do with the economic downturn than anything else there watching the books more than they used to.

Oh ok i understand. Its very strange because i had the cli button in the app for the longest time but i was carrying a limit close to limit. Then i paid it down to $0 and started using it in a responsable manner and leaving a balance under 10%, the button went away. I actually asked via citi bot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

@Veronik2019 wrote:I tried getting a cli in my citi custom cash card and got this letter. I don't really understand the reason. Has anyone gotten these reasons before? Is there a minimum credit score i should have?

It sounds like they are talking about some internal score. But given the reasons, do you have installments loans with "low" credit limits?

And how is the HELOC showing on your credit report? As others say, these may not be the actual reasons for decline, but worth looking at.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

@Anonymous wrote:

@Veronik2019 wrote:I tried getting a cli in my citi custom cash card and got this letter. I don't really understand the reason. Has anyone gotten these reasons before? Is there a minimum credit score i should have?

It sounds like they are talking about some internal score. But given the reasons, do you have installments loans with "low" credit limits?

And how is the HELOC showing on your credit report? As others say, these may not be the actual reasons for decline, but worth looking at.

I dont know what low credit on installment loans mean. I dont have a HELOC. I have a personal loan $10k 2 months old and a car loan $8k 2 months old as well. I have 3 other installment loans on my credit. They are car loans. Paid off 100%. $4.5k from 2013, $8k from 2017. $44.5k from 2020.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

@Veronik2019 wrote:

I dont know what low credit on installment loans mean.

I agree with @Bradac56 that part of the reasoning for the additional scrutiny is because of the economic downturn.

Based on their internal scoring system, by stating "low credit" I think Citi means the 2 new installment loans (the 10K personal loan and the 8K car loan) are only 2 months old and so not a lot of payments ("credit") have been applied towards the 10K and 8K balances. I think they will stop saying that once those 2 accounts age to 6 months old. Also, you said you don't have a HELOC so that's clearly a Citi mistake, and they didn't remove it from the template letter before sending it to you. Try requesting another CLI in about 4 months.

"If you don't stand for something, you might fall for anything."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

@Stealth-1 wrote:

@Veronik2019 wrote:

I dont know what low credit on installment loans mean.I agree with @Bradac56 that part of the reasoning for the additional scrutiny is because of the economic downturn.

Based on their internal scoring system, by stating "low credit" I think Citi means the 2 new installment loans (the 10K personal loan and the 8K car loan) are only 2 months old and so not a lot of payments ("credit") have been applied towards the 10K and 8K balances. I think they will stop saying that once those 2 accounts age to 6 months old. Also, you said you don't have a HELOC so that's clearly a Citi mistake, and they didn't remove it from the template letter before sending it to you. Try requesting another CLI in about 4 months.

Thank you so much I will try that!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi cli denied

I haven't experienced any scrutinization by Citi due to that *economic downturn*

You have been too active, and the reason loans are referenced is because they are new and fully utilized. Limit in this case isn't amount of the loan, they are talking about how much is paid off, which in your case is one to two payments at best.

Also, once you get PL, unless you have a super magnificent profile, you need to chill for a bit. For the most part, PL screams of "there are things I couldn't pay for and/or pay off", so wait till it's paid down a bit.