- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: DCU: EXPERT LEVEL NEEDED STAT

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU: EXPERT LEVEL NEEDED STAT

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

I applied online with a thin file but high score ( have lived abroad for several years so the old TLs were contributing to the score).

I was told that I was approved, but that I would need to verify my identity. On the phone, the CSR to me that my CL was 10K.

Figuring to myself "I have nothing to lose", I asked her if I could get the other cc, the Rewards, with the same pull. She put me on hold for a few minutes and came back with " approved, also for 10k".

So my advice is to call and speak with them and try to raise the limits on the card.

In the last 6 months they have been very easy to work with, imo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

@AverageJoesCredit wrote:

I cant help but keep seeing your " i got 66k from x lender so why dont they do the same" . You've been 8n the game long enough to know every lender is different and just because one lender gives you x amount that it doesnt mean another lender has to or will match. Sorry, imo, if someone was putting that in my face then coming at my lending institution as if we are wack for not doing the same id be put off. Please remember when sm'ing them or corresponding with them, i would keep your statement respectful and conscise. Some people csn actually read sarcasm or anger and a csr or uw are human after all. Just my 2 cents , worthless though it may be

I hear what you are saying. its not if this lender gave me this than so should you, but what lacks for me is the parity between them. if I have been with nfcu your years, I have a card and checking and nothing pos or neg has happened, I pop up on the grid and I get a wrist slam vs here you go, come on aboard, that is what i have difficulty with vs doing a checking accounting online with dcu and midway through a dialoge comes up saying, hey, we dont know you but here is $5K if you want it. even though 5k is low in my orbit I feel more positive about them and the experience. honestly even if nfcu offered me 5 or 10 at this point I would pass just because I dont think they get it or me and I have a more positive impression of dcu. I want to be around people that get me even if I am just a #. dont even attempt logic in any of this, just woke up and 0 coffee lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

@bellrock190 wrote:

My experience with DCU in January of this year:

I applied online with a thin file but high score ( have lived abroad for several years so the old TLs were contributing to the score).

I was told that I was approved, but that I would need to verify my identity. On the phone, the CSR to me that my CL was 10K.

Figuring to myself "I have nothing to lose", I asked her if I could get the other cc, the Rewards, with the same pull. She put me on hold for a few minutes and came back with " approved, also for 10k".

So my advice is to call and speak with them and try to raise the limits on the card.

In the last 6 months they have been very easy to work with, imo.

good advice, thank you. I will do this vary thing after I finish up the app. will prob wait for monday at this point

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

@AverageJoesCredit wrote:

I cant help but keep seeing your " i got 66k from x lender so why dont they do the same" . You've been 8n the game long enough to know every lender is different and just because one lender gives you x amount that it doesnt mean another lender has to or will match. Sorry, imo, if someone was putting that in my face then coming at my lending institution as if we are wack for not doing the same id be put off. Please remember when sm'ing them or corresponding with them, i would keep your statement respectful and conscise. Some people csn actually read sarcasm or anger and a csr or uw are human after all. Just my 2 cents , worthless though it may be

+1. Exactly my thoughts.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

DCU has been great. When I was looking for an Auto Loan last year, they were one of the few to approve me. My scores were fine (767), but my credit history was thin and young. In one day, I got approved for checking, savings, an auto loan for up to $25k, and a $5k credit card (when I only had 2 other cards with $300 & $500 limits). That was in October. On July 1st, I logged into my account and was preapproved for a SP CLI to $10k on my card, among 7 other various preapprovals up to $50k in my loan suite. I'll be taking them up on the refinance offer, which will save me over $1k.

I also want to add that I recently overdrafted because a bill that I thought had been changed over to my Visa, was still withdrawing from my checking. DCU automatically drafted from my savings and the fee was only $5. Wells Fargo probably would have charged me at least $30. Needless to say, I'll be changing my accounts over full-time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU: EXPERT LEVEL NEEDED STAT

Looking forward to seeing how they respond. Keep us posted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

totally serious, is dcu just winging it?

no intention of beating a dead horse here or flaming the cu as I like what I see, i am just curious for my own edification. I got membership that I am sure is being cancelled as I type this. during the membership process there was an inline lookup done and based on this query I was pre-approved or offered in my lingo a $5K card, no strings attached in writing that I took to mean an unconditional offer. somehow in my mind, misguided as it might be, this offer based on it being within another app process carried more weight than a chase or amex pre-approval app one might get via a browser.

long story short I completed the app via phone, was told about a hard pull but at no time was the requirement of returns mentioned. I now firmly believe that is one is self-employed with dcu they want 2 years of returns. I know there are exceptions to the rule but in general this is what I believe, the cu is return happy. they should put this in bold faced neon imo, we are not in Europe where credit is done by in large based on employment and banking, we still base much of our credit on scores and returns are for mortgages. imo.

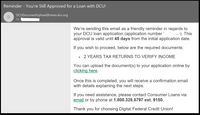

I sent them a well crafted document both uploaded via their portal on 7/15 before I was a member and via email on 7/15 directly to dcu-loan@dcu.org post-membership covering the topic and requesting the $5K they offered me. never heard back except for an email 6 hours after my email to them which is below.

my question is simple; how can one be approved for something based on a condition such as returns? nfcu was crystal clear that same day with me via sm, `conditional' - I knew exactly where I stood. I know I am being obtuse and this is a semantics deal but really, how can one be approved based on a condition, it makes zero sense to me. what make perfect sense, however, is for them to cancel my membership and turn the hp into a sp and unring the bell like it never happened. on many levels it seems like they are a neat little outfit and I just hit a snag with the returns and my interpretation of their dialogue with me. guess I just take offers at face value, this feels like some sort of bait and switch which i know its not. again, big picture this is no big deal but big enough that I feel better writing about it so thank you

mods, move this where it should go, I never get this right lol

EDIT, not that it matters but the approval is for $20k with returns. I want the $5K unconditional offer that popped up during the app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: totally serious, is dcu just winging it?

so, they countered with $500 down from $5000?

Most CU's are DTI sensitive and require docs for approvals. In most cases if you're W2 then it's a paystub but, SE means you cough up your 1040's.

If it's an issue then just don't reply and they'll cancel the app. The HP sticks because you hit submit though.

If you submit the 1040's though as you said you get a $20K CC from them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: totally serious, is dcu just winging it?

Using your credit reports and stated income, they can make a decision as to the CL and APR. The returns are simply to verify the information before the credit becomes available.

Many CUs require some sort of proof of income.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select