- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Discover CLI Declined

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover CLI Declined

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover CLI Declined

AAoA 2y1m. Applied for CLI with Discover and was declined (SP). I received a letter stating:

Unfortunately, at this time we are not able to approve your request for a credit line increase due to the following:

RATIO OF MONTHLY PAYMENTS TO INCOME (DEBT BURDEN).

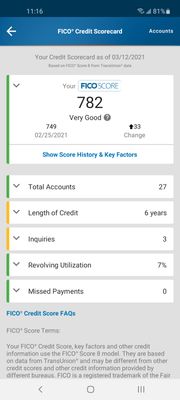

TUC: 742

Length of time revolving accounts have been established

Time since most recent account opening is too short

% of balance to credit limit too high on revolving accounts

Too many accounts with balances

Number of inquiries on credit bureau.

Here's the question:

I own a business, which I purchased in January 2021. I don't know how much the business grosses in a year, but I got about $12k last month and about $13k this month (less deductions). I pay myself $4,000 a month, and that is the income I declared for the CLI. I purchased the business with two loans, one of which has a payment of $587 a month and the other has a payment of $1,733 a month. These payments are automatically deducted from my business income before it gets deposited into my credit union (Lender's requirements).

Presumably, Discover's computer looked at $4,000 a month, those two loans, the rest of my payments and the numbers were out of guidelines.

Possible solutions:

1. Wait until next year when, armed with a tax return showing my income, I can state a higher amount with a clear conscience.

2. Just start stating $150k based on my most recent two months' gross income from the business. But then, what to state for rent? Do I include the business rent? How would that work?

3. Just state $90k a year, a number that Experian's website has indicated would put me compliant with most lenders DTI requirements.

4. Actually try to pay myself $90k a year (difficult).

5. Try to demonstrate to a human that the loans are business related.

6. Something else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI Declined

What does your revolving utilization look like? My take is that is more of an issue than your income. I've known plenty of part time college students making $10k-$15k per year that have received Discover CLIs just fine. 2 of your negative reason statements point to your balances, so I would look at those. Keep in mind that for CLI denials you must be provided with a reason, which doesn't have to be all of the reasons. I'd focus less on your income and more on improving your credit report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI Declined

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI Declined

Credit Karma summary pages aren't accurate and often don't tell the whole story. For example, if you missed a payment 3 years ago, that summary page would still say "100%" for payment history since their front end only looks at the last 2 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI Declined

Even if that's true, wouldn't one of the reasons I didn't score higher be something like late payments? I just assume that if Discover says the problem is debt-to-income then it's probably debt-to-income.