- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: First Declined Application

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

First Declined Application

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Declined Application

@NaaryalHead wrote:

I think 3 apps within a months time might have triggered the denial condition.

Computers can be pretty cold. I got booted off of discover just for checking the prequal page every few days until last week. Now i see a permanent "oops something went wrong with prequal really request" everytime.

I would just wait for about 3 months and then try applying again perhaps!

In 3 months I may be in the same situation I'm in now. I began building credit 5 years and 8 months ago. Recently, I’m in the process of re-evaluating the current trade lines I have. There are a few reasons, being re-bucketing, better rewards, becoming more streamlined and re-organized in terms of the credit card aspect. Or simply “pruning” as another member called it. So I may or may not apply for more products in the not so distant future. I however won't halt any other products I want while waiting around for Synchrony Bank to approve me. When the time is right, I'll evaluate it with scrutiny. Though I'm not in a rush to reapply for the Lowe's Advantage Card. I'd be content with waiting another year.

@Medic981 wrote:Wow! Last September I apped for three Synchrony cards within 2 weeks and was approved for all of them. Amazon Prime, Car Care, and Conoco. Synchrony is an odd duck!

Well, let's think about this here for a moment. If Synchrony Bank declined me due to "recent credit requests" then it's becoming more possible that it's because Synchrony Bank didn't know what came out of the Citi Bank and Chase Bank "credit requests." Unlike your situation, Synchrony Bank approved those because Synchrony Bank could likely 'conntect the dots' and recognize that you were approved or declined. Furthermore, if you were approved, what the starting credit limit was. I didn't have that luxury with Synchrony Bank. Hope that makes sense for you.

@SBR249 wrote:OP:

While I agree that Sync has generally been considered a liberal lender on here and it may seem odd that you were declined with an excellent score and clean file have you checked your EX recently? I noticed that the most recent EX score you provided was the one from AmEx on 09/12/18. I'm not sure when in the monthly cycle AmEx updates their scores or how recent the data underlying that score is but it could be out of date by the time you applied for the Lowes card. Your Citi and Chase inquiries were 9/11 and 9/24 were around or after the AmEx score update. For a profile that hasn't had any inqs for several years, 2 inqs in quick succession can instantly drop your scores by a few points (I'm not sure how many but possibly 10-20pts). While 750 is still a very good score, I think the sudden buck in the trend there may have been a big factor in the denial.

Look at it this way. You are an automated UW algorithm. You get a profile. Nice and smooth for several years, no inqs, no new accounts, no derogs. Then all of a sudden, inqs 9/11, 9/24, and your app 9/24. If I was a programmer, that's just the sort of exception trigger that I would program into the system vs. someone who's added a new card or account every so often on a regular basis. I know you have no nefarious intentions, but the computer algorithm doesn't know that.

PS: if you want to check your updated EX scores, freecreditscore.com is a site that EX runs that gives you your FICO and report free along with free time alerts.

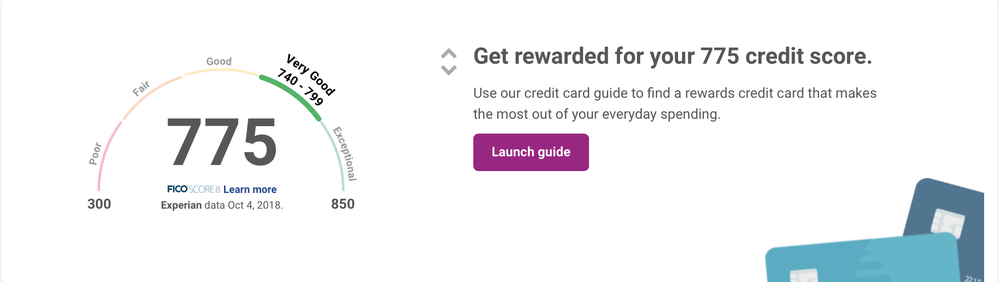

I have checked Experian recently. I'm also unsure of how often American Express updates the Experian FICO. I believe the thought that 2 inquires lower a FICO 10-20 points is a little extreme. I'd estimate 2 inquires would lower a FICO 6-10 points. I took your advice and created an account with freecreditscore.com On 10/4/2018, it provided a 775 FICO. freecreditscore.com does show 3 inquires that are reporting. Which means Experian FICO lowered 1 point since 9/12/2018. This could be due to any number of factors, like utilization. So I certainly went into the Lowe's Advantage Card with a "Very Good" (according to freecreditscore.com) Experian FICO. I will add, I appreciate the this resource. I will be using this regularly now.

I understand your logic regarding your "UW algorithm" there's no doubt about this. I still do believe that the the tool they use is a bit stringent. Though I feel as if Synchrony Bank should require a proof of the outcome of those inquiries to seek approval. This is very common for mortgages and other lending for large amounts. It's often called, "explanation of credit" or something similar. Who knows, maybe Synchrony Bank has considered this and the extra effort isn't worth it for them. Regardless, I likely should have completed research before applying. I do this with all products before I apply. Though I figured, it's a store card. Not necessary. I was wrong about that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Declined Application

FICO is a strange beast. When I go a month without any balance reporting on any of my cards (because I'm bad at the AZEO) my scores drop 16pts. It's like clockwork. Has happened multiple times. Hard to predict how things can impact scores sometimes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Declined Application

@SBR249 wrote:FICO is a strange beast. When I go a month without any balance reporting on any of my cards (because I'm bad at the AZEO) my scores drop 16pts. It's like clockwork. Has happened multiple times. Hard to predict how things can impact scores sometimes.

Yes, too many 'gears' in the FICO moving at once. By the way, here's the proof from freecreditscore.com

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First Declined Application

They were probably pulling a more indepth report than the stats shown since those are more up-to-date. On the freecreditscore experian site it somestimes gives $0 trial which pulls the latest report decision makers look at. Sometimes calling again and again could get you someone who understands or someone who gets tired of the calls and approves you like what happened for my BOA TR. I called probably 4 times a week till someone put note in system that when I call again to approve within the 30 days. All the best!