- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Getting Approved for Chase Slate with High DTI...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Getting Approved for Chase Slate with High DTI?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Approved for Chase Slate with High DTI?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Approved for Chase Slate with High DTI?

@Anonymous wrote:Good morning. I hope this is the correct place to post this question.

My wife has about $7K on her Discover card which we would like to balance transfer to a new card. The Slate card seems perfect for our needs since it has 0 fees. Her TU FICO is 770, no baddies, no inquires, 20 year history, 11 years at her job, but about 40% utilization due to the Discover balance. We will pay this down to below 30% before applying. She would be applying alone because I just got a new card for my BT last month and I will most likely need a new car loan within the next 6-12 months.

The problem is that her income is $31K a year and our joint mortgage is $1250 month. This gives her a DTI of 48% if she applies without my income (17% of total household income).

Will they even give her a card with this kind of DTI? And if they do will it have a limit that will be usable for BT?

Thanks in advance for any advice you can give.

At the last page of your application it will ask you to enter the balance transfer account and amount that you wish to transfer, this may help getting approved for the full amount she is looking for. Also, please go onto discover and request a CLI, they have been very generous lately with large soft pull CLI's. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Approved for Chase Slate with High DTI?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Approved for Chase Slate with High DTI?

In case you haven't pulled the trigger yet with Chase. A couple alternative thoughts.

1) Some people have had luck getting Discover to lower their APR and/or offer 0% offers mid stream. I don't know if either of those has happened with a current balance on the card, but I figure it's worth mentioning. Also, I think some that have gotten 0% it's been on new purchases only. I'm not sure of your monthly spend on a card, but if you could use new cash to pay down old spend that's at x% and put new purchases on at 0% it might take a month or two but maybe you could 'move' the balance to 0% on the same card.

2) Alternatively, if you spend enough on a card which gives you a grace period (if you've got 'empty' cards) then direct more money towards paying down discover, if you can get Discover paid down a sizeable amount, perhaps you could use a Discover BT offer. (I've always got them on my account, YMMV).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting Approved for Chase Slate with High DTI?

Update:

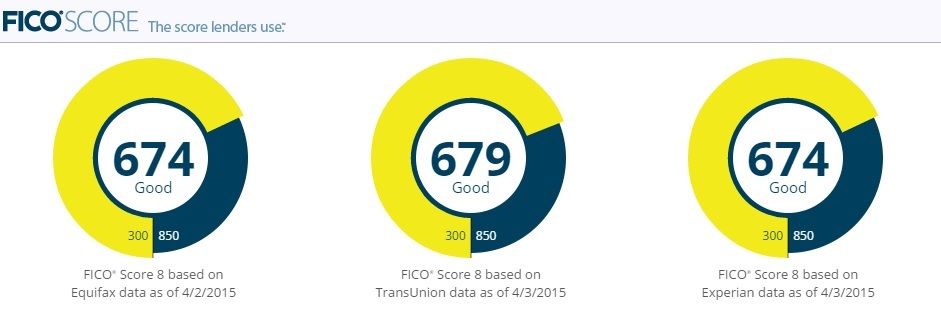

I paid down the Discover by $1000 and waited for TU and EQ to update (which was like 10 days after Experian). Used that time to look at all my options and pulled the trigger on Sallie Mae MC. I used our joint income from 2014 as gross income.

Approved for $12,500 0% for 15 months then 13.99% after. We're very happy wih the results as this card has more rewards than the Slate and the CL is high enough to get some use.

Thanks for all the advice!