- myFICO® Forums

- Types of Credit

- Credit Card Applications

- GreenState Credit Union CLI Guidelines

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

GreenState Credit Union CLI Guidelines

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

GreenState Credit Union CLI Guidelines

After making my first post about my approval for a $10K CL with GreenState Credit Union, I decided to dig further and look into their CLI’s more carefully. Especially since @dmFICO8 pointed out to me that anyone could possible join using secondary membership rules.

Full disclosure: I have yet to receive a CLI from GSCU as I have had the card less than a year and was originally informed it was a hard pull to do so. However I have heard some conflicting information and decided to leave it up to the community as to how best to advise using the data points I have learned. To be fair to them, I have only used this card in a limited fashion, and it has no balance currently.

Orignal Data

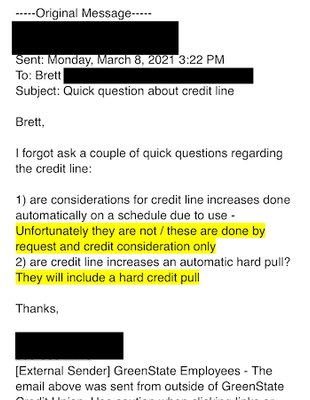

As I mentioned, I was approved after a soft-pull TU8 used when approving membership. However, I did email the person who called and approved me and I asked about CLI’s. In the email, Brent confirmed the following:

- CLI’s are not automatic

- CLI’s require a new Hard Pull.

Recent Data

I had discussions with customer service last week and today. (While I may not like the design on the card, their CS is fantastic and friendly. )

My first discussion revealed that any HP is good for 30 Days for other credit products such as Auto and Personal Loans in any combination. I was advised after the first pull online to call in to be evaluated for other products if I wanted to use it for multiple purposes.

Today’s discussion however focused on CLI’s. The agent informed me that there actually are evaluations done informally on CLI’s, based on usage and history annually. When one is offered, either a phone call or letter is sent to customer for them to accept or reject the increase. The CS agent herself has used her card as a main card, as the reward categories match her spending, and that she has received an increase through evaluation.

While this data may seem conflicting, I decided to put up the data I have collected and let the community weigh in on the best way to address it.

Details about Cards and Membership (via @dmFICO8 )

Checking their CC page, they offer 3 credit cards, they are all no-annual-fee cards.

Checking their join page for membership eligibility, it shows 4 options:

- Anyone living or working in Iowa, or nearby counties in Illinois, Wisconsin, Nebraska or South Dakota.

- University of Iowa students, staff, and alumni.

- Direct relatives of current GreenState Credit Union members.

- Members of the Iowa Consumer Council/American Consumer Council.

As mentioned by @dmFICO8 in a previous post, the American Consumer Council can be joined by anyone at no cost, making you eligible for membership.

My Credit Picture @ Time of Approval

CH7 BK August 2012 (Divorce)

Fico 8 Scores March 2021 TU - 710

Home Mortgage: M&T Bank - (09/2020) 95KPersonal income: 95K/year (2 Jobs + rental income)

Four CC's on Credit Report: Apple Card, Discover IT, Capital One Quicksilver X2