- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Help with new credit card applications and the pos...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help with new credit card applications and the possibility of getting approved

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with new credit card applications and the possibility of getting approved

- Columbia Collectors, Inc. $1,200 remain on credit 7/2023 PAID 1-29-2021 NO DELETE THEY WILL UPDATE AS PAID IN FULL

- Credit Collection Services $247 remain on credit 12/2026 (PAID 1-26-2021) Phone PFD They said they will honor it.

- Enhanced Recovery $90 remain on credit 2/2023 (PAID 1-22-2021) Phone PFD They said they will honor it.

- EOS CCA $1,900 remain on credit 7/2021 WILL AGE OFf AUGUST 2021

- Columbia Collectors, Inc. $2,400 remain on credit 9/2024 PFD 1-30-2021

- USAA Charge Off $17,000 remain on credit 7/2023 WILL LET AGE OFF

- Bonneville Collections $314 remain on credit 9/202 (PAID 1-25-2021) Phone PFD They do not honor them.

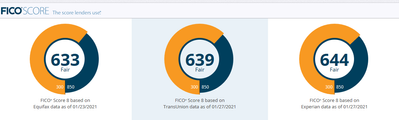

- my 639 just updated from a 634 whn one of the collections reported paid. I gained 5 points for a paid collection

Currently I have 3 secured credit cards:

1. OpenSky $300 CL : Current Balance $10.00

2. AssentCard $400 CL: Current Balance $0

3. First Progress Card $500 CL: Current Balance $0

Each card is entering the 8th statement month. Never late on any of the cards.

I do not have any bk's on cr. No late payments per credit reports in 9 months, but I have not had anything to pay on in over three years. I do not know why they report it that way, unless its the co, and that was charged off more than 3 years ago. I had 120e day late on childsuport and that was over three years ago. Then I paid it to zero, and then they closed the account.

With this credit file can I be pre-approved and approved for any unsecure credit cards. Hoping someone has had a similar experience and could share it with me. I am only looking for non-retail cards and what cc will I have a better chance of getting approved for.

Thank you in advance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

You'll likely be able to find unsecured cards with your profile, just be careful with predatory lenders.

Charge offs even if 3 year's old look new in the eye's of most lender's and Fico scoring if the account is unpaid and reporting monthly.

If I was in your situation, I would check the Discover pre-approval monthly while working on cleaning up my credit reports. Discover and American Express tend to offer credit to some people with less than perfect credit.

While you can get unsecured credit cards with a 620-640 score, the offers and lender choices improve as your score increases.

Starting Score: EQ:608, EX:617, TU:625

Current Score 3/11/2020: EQ:695, EX:703, TU:720

Goal Score: 740+

Take the myFICO Fitness Challenge

Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.

Newest Account July 8, 2020 -- Last HP October 24, 2020 -- Gardening Goal: August 2022 and reach 0/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

Let the PFDs update on your reports first. Once everything has updated, PFD or paid to $0, then hit the Disco and CapOne prequals and see what they say. Don't do it until the updates are done though - often those prequal SPs are held for a period of time before a new one would be pulled. You don't want them doing it based off of older reports that don't show your improvements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

@chiefone4u wrote:You'll likely be able to find unsecured cards with your profile, just be careful with predatory lenders.

Charge offs even if 3 year's old look new in the eye's of most lender's and Fico scoring if the account is unpaid and reporting monthly.

If I was in your situation, I would check the Discover pre-approval monthly while working on cleaning up my credit reports. Discover and American Express tend to offer credit to some people with less than perfect credit.

While you can get unsecured credit cards with a 620-640 score, the offers and lender choices improve as your score increases.

Thank you for your response, yes I want to app but only for the right purpose. I do not want any subprime cards if i can avoid that starting out. I am interested in both discover and amex. I tried their pre-qual sites respectively. Discover preapproved for a secured card so i did not follow through with it. The amex showed me three prequalified offers but no preapprovals. Does amex approve off the prequalified offers?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

@Anonymous wrote:Let the PFDs update on your reports first. Once everything has updated, PFD or paid to $0, then hit the Disco and CapOne prequals and see what they say. Don't do it until the updates are done though - often those prequal SPs are held for a period of time before a new one would be pulled. You don't want them doing it based off of older reports that don't show your improvements.

Ok perfect, I will wait, ca said it can take up to 45 days to update. No rush i am patient. Do you know how long discover and cap1 take to release the first sp?

I did discover based on their free credit score site, then did the prequal. They first came back with no offers. I wating 8 days and tried again and then they gave me a preapproval for a secured card. But dealing with the PFD's and Paid collections will be a bit longer. Thanks for info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

Yes, I've seen references to Disco that eight day intervals allow for a fresh SP. I don't know on CapOne, but I do know they do account reviews quarterly when you're a cardholder so often they quote an out-of-date score when you request account modification. As for prequals though, I just don't know. Hopefully someone else will know though.

Agreed also with the above that Amex would be good to try on prequal but that big charged off balance will probably put a bullet in that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

@Anonymous wrote:Yes, I've seen references to Disco that eight day intervals allow for a fresh SP. I don't know on CapOne, but I do know they do account reviews quarterly when you're a cardholder so often they quote an out-of-date score when you request account modification. As for prequals though, I just don't know. Hopefully someone else will know though.

Agreed also with the above that Amex would be good to try on prequal but that big charged off balance will probably put a bullet in that.

Them big charge offs shame on them. I wish I could do something about it, but USAA is not budging and very hard to work with even though they started the problem. As usual big companies get the last laugh and hold you up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

@chiefone4u wrote:You'll likely be able to find unsecured cards with your profile, just be careful with predatory lenders.

Ok, how do you know what lenders arre predatory?

Charge offs even if 3 year's old look new in the eye's of most lender's and Fico scoring if the account is unpaid and reporting monthly.

When do charge offs stop looking new in the eye's of the lender?

If I was in your situation, I would check the Discover pre-approval monthly while working on cleaning up my credit reports. Discover and American Express tend to offer credit to some people with less than perfect credit.

That is great advice. Does American Express offfers show up at preapprovals? Do you know of any thresholds that these two lenders have as far as collection accounts and charge offs that might render a decline?

While you can get unsecured credit cards with a 620-640 score, the offers and lender choices improve as your score increases.

Ok, I am hoping to get up to at least a 650 fico, is that a good place to start?

Thank you again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with new credit card applications and the possibility of getting approved

@Anonymous wrote:Let the PFDs update on your reports first. Once everything has updated, PFD or paid to $0, then hit the Disco and CapOne prequals and see what they say. Don't do it until the updates are done though - often those prequal SPs are held for a period of time before a new one would be pulled. You don't want them doing it based off of older reports that don't show your improvements.

Ok, I will wait to see what happens, I am hoping for the best since I will still have one collection and one charge off remaining. I contacted the cra's in attempt to have the one soon to be aged off collection to be included in EE program. I will update when results and response are in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content