- myFICO® Forums

- Types of Credit

- Credit Card Applications

- How does this AMX Prequal Look?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How does this AMX Prequal Look?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does this AMX Prequal Look?

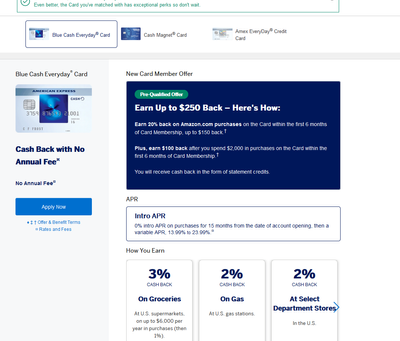

Is this promissing or just a flake prequal from american express.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

Looks pretty good. Their prequals are generally pretty solid.

When I've checked for some myself, that's what they look like.

Is that what you were asking, if it was an actual prequal?

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Mr_Mojo_Risin wrote:Looks pretty good. Their prequals are generally pretty solid.

When I've checked for some myself, that's what they look like.

Is that what you were asking, if it was an actual prequal?

Yes, that is what I am asking if it looks pretty solid. I know they can change their mind, but they pretty much ask for everything upfront. On one of the cards it says 23.99% variable, but on the others it says 13.99-23.99% variable. I am thinking about pulling the trigger after I applied for my second NFCU card. Is that rate high for prequalifications?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

+1

Looks like it has all the pre-qualify language.

@Anonymous Are you just curious to see if you are pre qualified?

Equifax FICO 8: 820/3 inq’s 1/12, 3/24

Transunion FICO 8: 821/2 inq’s 0/12, 2/24

AMEX Platinum: NPSL

AMEX Gold: NPSL

AMEX Everyday Preferred: $22,500

Capital One Quicksilver: $5750

Numerica Credit Union Platinum: $2000

Military Star: $8300

1% utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Golf-and-Credit wrote:

+1

Looks like it has all the pre-qualify language.

@Anonymous Are you just curious to see if you are pre qualified?

Soon I am going to apply for an amex card, and need to know what their lanquage looks like before I apply. Thank you for pointing that out. With what you see there, is that like a 1k SL or a bit higher? Right now I only have 1 unsecure card and three secure cards. 3k unsecure and 1,200 secure. Had secured cards for 10 months and unsecured card for 3 months. 1% utilization, only $3 dollars reporting on balances. have 1 SSL loan with nfcu paid down to $300 and that is 3 months old as well. So I am trying to get rid of the secure card in the next three months. I want two nfcu cards and 1 other card for now. Deciding if I should go cap1 or amex for my third unsecure card. All advice is helpful and thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Anonymous wrote:

@Golf-and-Credit wrote:

+1

Looks like it has all the pre-qualify language.

@Anonymous Are you just curious to see if you are pre qualified?

Soon I am going to apply for an amex card, and need to know what their lanquage looks like before I apply. Thank you for pointing that out. With what you see there, is that like a 1k SL or a bit higher? Right now I only have 1 unsecure card and three secure cards. 3k unsecure and 1,200 secure. Had secured cards for 10 months and unsecured card for 3 months. 1% utilization, only $3 dollars reporting on balances. have 1 SSL loan with nfcu paid down to $300 and that is 3 months old as well. So I am trying to get rid of the secure card in the next three months. I want two nfcu cards and 1 other card for now. Deciding if I should go cap1 or amex for my third unsecure card. All advice is helpful and thank you.

If it was me, I would take the prequal from AMEX over Cap1.

You can't really guess a SL by looking at the APR they're offering.

Your cards seem a little young, 1K or 2K is certainly a possibility.

AMEX cards typically grow quicker than Cap1 from all the DP's I've read here.

Cap1 will triple HP also if that matters to you.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Mr_Mojo_Risin wrote:

@Anonymous wrote:

@Golf-and-Credit wrote:

+1

Looks like it has all the pre-qualify language.

@Anonymous Are you just curious to see if you are pre qualified?

Soon I am going to apply for an amex card, and need to know what their lanquage looks like before I apply. Thank you for pointing that out. With what you see there, is that like a 1k SL or a bit higher? Right now I only have 1 unsecure card and three secure cards. 3k unsecure and 1,200 secure. Had secured cards for 10 months and unsecured card for 3 months. 1% utilization, only $3 dollars reporting on balances. have 1 SSL loan with nfcu paid down to $300 and that is 3 months old as well. So I am trying to get rid of the secure card in the next three months. I want two nfcu cards and 1 other card for now. Deciding if I should go cap1 or amex for my third unsecure card. All advice is helpful and thank you.

If it was me, I would take the prequal from AMEX over Cap1.

You can't really guess a SL by looking at the APR they're offering.

Your cards seem a little young, 1K or 2K is certainly a possibility.

AMEX cards typically grow quicker than Cap1 from all the DP's I've read here.

Cap1 will triple HP also if that matters to you.

That sounds good, I am always worried about the triple HP from cap1. I have only had two hp's in like 9 years. I tried to be very careful an avoiding hard pulls as much as possible for when my profile can afford the hp's. I am not there yet, and do not want denials due to seeking too much credit too fast. Thanks for sharing those DP's. I am hoping I can get the nfcu 2nd card prior to the amex, hoping that is the right choice. I will wait on the cap 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Anonymous

I agree with @Mr_Mojo_Risin again. If you are looking at avoiding multiple hard pulls then I would say no to the Cap 1. Most of the time, again MOST of the time, AMEX will pull EXP 8. But they have been known to pull others so YMMV. EX looks like its your highest score. It could be a borderline approval with a $1K starting line. You could maybe research the approvals section for the card you want to get some data points from others. Or you could wait until you are closer or over the 700 mark.

Equifax FICO 8: 820/3 inq’s 1/12, 3/24

Transunion FICO 8: 821/2 inq’s 0/12, 2/24

AMEX Platinum: NPSL

AMEX Gold: NPSL

AMEX Everyday Preferred: $22,500

Capital One Quicksilver: $5750

Numerica Credit Union Platinum: $2000

Military Star: $8300

1% utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Golf-and-Credit wrote:@Anonymous

I agree with @Mr_Mojo_Risin again. If you are looking at avoiding multiple hard pulls then I would say no to the Cap 1. Most of the time, again MOST of the time, AMEX will pull EXP 8. But they have been known to pull others so YMMV. EX looks like its your highest score. It could be a borderline approval with a $1K starting line. You could maybe research the approvals section for the card you want to get some data points from others. Or you could wait until you are closer or over the 700 mark.

Very well said!

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does this AMX Prequal Look?

@Golf-and-Credit wrote:@Anonymous

I agree with @Mr_Mojo_Risin again. If you are looking at avoiding multiple hard pulls then I would say no to the Cap 1. Most of the time, again MOST of the time, AMEX will pull EXP 8. But they have been known to pull others so YMMV. EX looks like its your highest score. It could be a borderline approval with a $1K starting line. You could maybe research the approvals section for the card you want to get some data points from others. Or you could wait until you are closer or over the 700 mark.

I think you are correct. I am hoping to soon be over 675 for all three scores, but not there yet. 700 would be great still have a lot of work to do. 1k could work to get in the door, but I wonder when you get approved for that low amount that you stay there. I will look for more dp's thanks for the info.