- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: I'm getting that itchy feeling to app help! 😣

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I'm getting that itchy feeling to app help! 😣

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm getting that itchy feeling to app help! 😣

So I promised myself that I would wait until at least August before I thought about apping for new credit but the itch is getting harder to ignore. Currently I'm in good shape to app for the US Cash+ & the Penfed Cash Rewards. I have few inquiries: EX: 1/12 EQ: 0, TU 2/12 & no baddies, mortgage, car or student loans

AOOA: 3 yrs

AoYA: 11 months

AAOA: 22 months

4 accounts: Discover (11/17) 394/7200,(now @ 0 but not reported until next month) Cap 1 QS( 4/17) 0/1811, PPMC (6/19) 444/10,000 & CFU (6/19) 0/4400

UT 4%

Scores in my siggy current

Income 36k

The only thing holding me back is I'm mildly curious to see how much a score bump I'm get once my 2 youngest cards reaches a yr. I'm wondering if I apply for Penfed membership that would @ least make the itch go away assuming its a SP. At this point is it even worth it to wait?

Cap One QS: $4811

CFU: $8,000

PPMC: $12,000

US Bank Cash+: $13,000

Penfed Powercash Rewards: $7,500

AAOA: 3.5 yrs

Experian (Fico 8) 756

Transunion (Fico 8) 757

Equifax (Fico 8) 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@Fated4Credit wrote:So I promised myself that I would wait until at least August before I thought about apping for new credit but the itch is getting harder to ignore. Currently I'm in good shape to app for the US Cash+ & the Penfed Cash Rewards. I have few inquiries: EX: 1/12 EQ: 0, TU 2/12 & no baddies, mortgage, car or student loans

AOOA: 3 yrs

AoYA: 11 months

AAOA: 22 months

4 accounts: Discover (11/17) 394/7200,(now @ 0 but not reported until next month) Cap 1 QS( 4/17) 0/1811, PPMC (6/19) 444/10,000 & CFU (6/19) 0/4400

UT 4%

Scores in my siggy current

Income 36k

The only thing holding me back is I'm mildly curious to see how much a score bump I'm get once my 2 youngest cards reaches a yr. I'm wondering if I apply for Penfed membership that would @ least make the itch go away assuming its a SP. At this point is it even worth it to wait?

your credit scores are high and your history is clean. only thing that would keep you from approval is the age of your tradelines... so why apply now when the only thing that could hurt you is age instead of just waiting until those lines get to 1 year and its not longe ran issue.

step away from the apply button

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@Fated4Credit wrote:I'm wondering if I apply for Penfed membership that would @ least make the itch go away assuming its a SP.

I recently applied for membership at PenFed, partially for this reason. I got a HP though. The primary reason I wanted membership was to be ready for the forthcoming relaunch of their Pathfinder credit card. This is of course assuming that it is actually relaunched.

I'm in the middle of getting the PenFed membership. I thought SDFCU was a hassle, but wow! PenFed provides zero feedback via messaging or email. I basically wait a few days, and then call to see why nothing is happening. It's like pushing a logchain. Right now we're working on address verification. I am glad that I'm getting the membership out of the way now so when (if) the Pathfinder comes, I don't have to go through this first!

Yet I press on. I know that there is a sweet reward waiting at the other end: PenFed membership, and eventually the Pathfinder credit card!

Business Cards

Debit Cards

FICO 8 Scores (as of Dec 14, 2022)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@MrT_521 wrote:

@Fated4Credit wrote:I'm wondering if I apply for Penfed membership that would @ least make the itch go away assuming its a SP.

I recently applied for membership at PenFed, partially for this reason. I got a HP though. The primary reason I wanted membership was to be ready for the forthcoming relaunch of their Pathfinder credit card. This is of course assuming that it is actually relaunched.

I'm in the middle of getting the PenFed membership. I thought SDFCU was a hassle, but wow! PenFed provides zero feedback via messaging or email. I basically wait a few days, and then call to see why nothing is happening. It's like pushing a logchain. Right now we're working on address verification. I am glad that I'm getting the membership out of the way now so when (if) the Pathfinder comes, I don't have to go through this first!

Yet I press on. I know that there is a sweet reward waiting at the other end: PenFed membership, and eventually the Pathfinder credit card!

I don't know why everyone's experience with PenFed is so different. I joined and was apparently only approved for a savings account, no hp though. A few weeks later they sent an email and said I was approved for the checking account, I didn't even app for it. Again no hp. I'm just waiting for my scores to go up and hoping they send me some preapproved offers for a card.

Starting Fico Scores:November 2019

Current Fico Scores: January 6, 2021

Goal Scores: 700 across all three

Goal Scores: 700 across all three

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

Op, you are almost there , just wait. Better to improve your USBank odds.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@Anonymous Usually I'm not really app happy, it was 18 months between my second & third cards, I guess its the temptation of reading all these SP approvals from Penfed membership makes it mighty tempting to not wanna jump on the bandwagon. Which in hindsight isn't a guarantee that it wouldn't be a SP. I hate seeing inquires on my report even though I know its a few points at best its almost always unaviodable

I could wait on the PCR card but I wanted to at least get my front in the door with a membership & the as far US bank goes I know they're more concerned about too many new accounts in a 12 month period. I've read enough times about denials right at the 12 month mark with 2-3 new accounts which is why I was waiting until August when accounts were at 14 months, but I appreciate the sentiment of the longer the wait the better.

Cap One QS: $4811

CFU: $8,000

PPMC: $12,000

US Bank Cash+: $13,000

Penfed Powercash Rewards: $7,500

AAOA: 3.5 yrs

Experian (Fico 8) 756

Transunion (Fico 8) 757

Equifax (Fico 8) 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@Anonymous

>>so why apply now when the only thing that could hurt you is age instead of just waiting until those lines get to 1 year and its not longe ran issue.

So is that the standard to go by - if you wait until your youngest accounts are aged 1-year it helps that much?

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'm getting that itchy feeling to app help! 😣

@BmoreBull wrote:I don't know why everyone's experience with PenFed is so different. I joined and was apparently only approved for a savings account, no hp though. A few weeks later they sent an email and said I was approved for the checking account, I didn't even app for it. Again no hp. I'm just waiting for my scores to go up and hoping they send me some preapproved offers for a card.

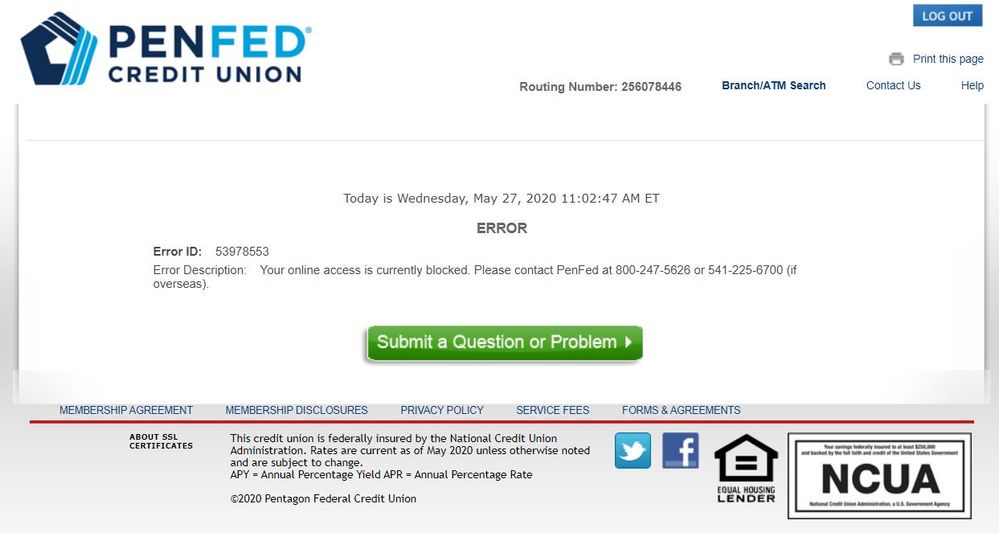

Here are a few more details on my experience: I applied for membership through the online portal, probably like everyone else here does. The approval was very quick, like within minutes. I was able to log in and view my savings account.

However, a few hours later I could no longer log in. I would get a message saying that online access was blocked. I called, and I was told that they need identity verification. The agent told me to send a copy of my driver's license (front and back) SS card, and a utility bill or something for address verification. I was told that I would be able to log in when the documents were processed. The document upload portal didn't work because I couldn't log in, so I used an efax service to fax them. I waited a day or two, and I still could not log in. I called again. I was told that they need color copies, but I sent black and white. I hadn't thought about it, but this was due to sending them via fax. He told me that I can use the upload portal by selecting the "Not yet a member?" option.

So, I resent the documents. It was actually one document, because I had put all of the photos in a PDF and sent that. Again I waited a few days, and I still could not log in. So I called again yesterday. (It is important to note that calling usually involved being on hold for 30 minutes or so until I reach a live agent.) The agent told me that the document I sent for address verification was too old. So, I found a more recent one and sent it. That was just yesterday. So now I still wait to be able to log in...

One big issue I have is that I get no feedback; no messages, no emails, nothing. Nothing happens until I call and ask what's up. To be fair, it was like this with SDFCU too. I find when working with the big credit card companies that I will get a message and/or email letting me know what is going on, or what they need from me, or anything else.

Here is the screen I get when I try to log in:

Business Cards

Debit Cards

FICO 8 Scores (as of Dec 14, 2022)