- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Locking accounts and credit apps

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Locking accounts and credit apps

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Locking accounts and credit apps

Well, here's one for the books...

I recently locked my Experian account (with Experian monitoring app) and forgot I locked it. I applied for Chase Freedom today. I was approved but for lower starting line than my other cards. Naturally, I wondered why.

Then I received notification from Experian that they blocked an attempt to view my Experian credit report. I also got an email from Cap One letting me know a big change occured on my TU account.... Well it did, my score was lowered -4 points because of a HP inquiry from Chase.

My TU score was 712. My Experian score is 728. Not much of a difference but I may have had a better SL if I hadn't forgot I locked the dag gone Experian report. LOL!

Now I don't want the card -- I hear getting a SLI is rare with Chase.

The things we learn as we grow!!!~

Think I will be gardening now for a while ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

Kind of funny!!!

So, you didn't mention what your approval was for so, there's not much to offer here for advice.

20 points isn't going to bring you from a $2500 limit to a $15K limit though. SL is just what it is... Starting.... so, as long as you're "coded" in the right bucket you'll be able to grow it over time. If it's coded in the right bucket you might even get some auto cli's from them as well.

Just use the card each month and make payments to make things grow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

Just put netflix or something on it and autopay each month. Seems like you're about to hit a new bracket soon from your other CL's but, in the meantime gotta just wait out the timer on the extra points before being moved up. Time is the biggest hurdle when we're used to instant gratification these days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

Would you please explain the brackets?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

Well, it's a bit of a secret from the bigger lenders as to who falls where but, here's a breakdown:

https://www.nerdwallet.com/blog/finance/credit-score-ranges-and-how-to-improve/

FICO score ranges Range % Range % Source: FICO Score 8 data as of April 2015, courtesy of Fair Isaac Corp.

| 300 - 499 | 4.9% | 650 - 699 | 13% |

| 500 - 549 | 7.6% | 700 - 749 | 16.6% |

| 550 - 599 | 9.4% | 750 - 799 | 18.2% |

| 600 - 649 | 10.3% | 800 to 850 | 19.9% |

So, say you pick up a card when you're at 650 and using the table you see you're in the upper 50% of the pool of people. So, your account gets a code / bucket assigned when you open it. Unfortunately with most of the big banks you don't get credit for improving things while maintaining the account with a rate reduction or CLI as someone in the 700 tier.

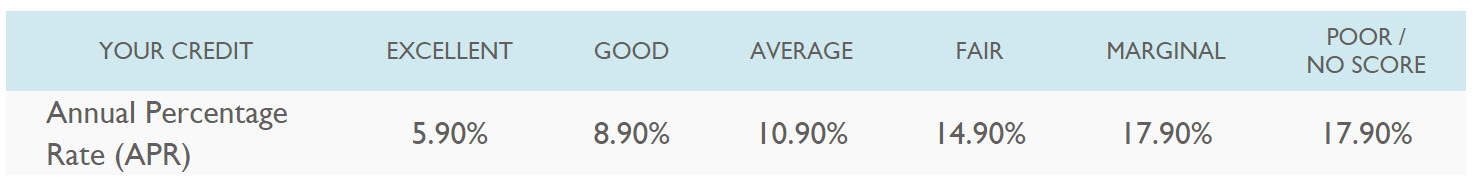

So, if you look at one of my CU's they also have a table where APR's are assigned based on score. The difference with them though is that as your scores go up your rates go down if you ask them for a reduction / CLI.

So, IIRC a 650 would get you a Fair rating on this table @ 14.9%. As you move up to 680 you can drop to the 10.9 and over 720 you would be good for the 8.9 rate. Over 760.... 5.9% is your ideal rate if you were to carry a balance.

So, depending on where your profile is now is probably where your bracket/bucket/code would be for the life of the CC. This is why you see people apping for additional Cap1 / Chase / BOA / etc. and then folding them into the existing line or moving the old account limit into the new one. You not only grow the CL but, you get better terms if you keep the newer account.

For instance I have a Chase Slate that was a carry over from WAMU back in the day and my scores were probably mid 6's at that point. So, they have kept the rate high and the limit low $5,500 / 21.x% and in the last year they dropped the rate to an enticing 17.x%. So, I tried everything with the account for several years but didn't get anywhere and just SD'd it to keep the age since it's been open since 2007. So, I started seeing the "offers' when logged in and laughed at the rates all 3 offers being over 20%.

Testing the coding/bucket theory I decided to pull a cold app on the FU and see how they acted now that my reports are spotless and scores in the 830-840 range. Filled things out and hit submit. Instant approval for $25.9K / 15.74% / 0% for 15 months. Meanwhile that trusty old Slate is sitting there in the background collecting dust and a free Fico each month.

Of course each bank is going to be different where those cut off points are for each bracket they assign. In general though they tend to be sub 600, 600-650, 650-680, 680-720, 720-750/760, up to 850 from there. Once you hit 750 though there's not much to be gained from credit products unless you're going for a mortgage. Once you get above 740 you start getting discount points off your mortgage rate up to 1% less than the advertised rate in some cases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Locking accounts and credit apps

@Anonymous wrote:

Yup, you are correct. I was approved for 3k. My three other account are all 5.5 k. Not much but still enough to make me notice. Thanks 😊

When you first mentioned you got a SL lower than your other cards, I thouhgt itll be something like 15k limits on your other cards, and 3k on this new card. But being your other cards are 5.5k, I think 3k isnt too far off, its still a similar range. Let it grow......chase is known to be a bit more stingy with CLI and requires a HP when requesting but auto CLI are still very possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content