- myFICO® Forums

- Types of Credit

- Credit Card Applications

- NFCU - Denied 2nd card because of old checking acc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU - Denied 2nd card because of old checking account overdraft

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU - Denied 2nd card because of old checking account overdraft

Just got my denial letter from NFCU in the mail today. I have been a member since 2016 - originally opened a savings, checking and Cash Rewards MC. The checking account was a joint account with my father, who is now deceased. He was the primary user of the checking account, but I was the primary account holder. After Dad died in 2019 and stopped getting his Social Security direct deposited, I forgot to turn off autopay for some of his regular bills...and then I moved, got a little sloppy keeping track of my finances and didn't give my new address to NFCU for about a year. At some point in 2020 the NFCU checking account got overdrawn. I think the total amount overdrawn was less than $200 but by the time I set up a spreadsheet to start tracking everything, the checking account was gone from my online banking. Never got any overdraft notices in the mail, probably because I moved and didn't notify NFCU right away.

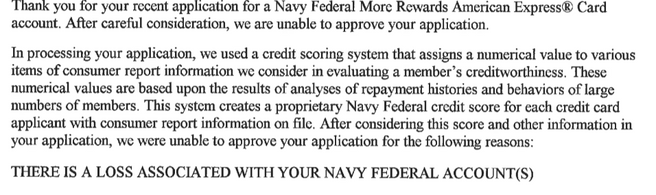

I applied for a 2nd NFCU card last week as a way to grow my total CL with them. Have had the Cash Rewards MasterCard since 2016 with no issues. Then I got the only reason for denial below: "THERE IS A LOSS ASSOCIATED WITH YOUR NAVY FEDERAL ACCOUNT(S)."

I want to pay the overdraft to make NFCU whole. They've been so good to me in building my credit, plus it's just the right thing to do. Thankfully there's never been any AA on my credit card with them. Would I qualify immediately for additional credit products after I repay the checking account loss?

Hope to hear others' experience with this!

Current Cards: PSECU $20,000 - NFCU Cash Rewards MC $21,900 - Chase Southwest $15,000 - Discover It $10,000 - Citi AAdvantage Platinum $9,500 - Apple Card $6,000 - PenFed Promise $5,000 - Truist Enjoy Cash $4,500 - Comenity Bread Cashback Amex $3,500 - BoA Customized Cash Rewards $2,800 - UVA Credit Union Visa Classic $1,600

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU - Denied 2nd card because of old checking account overdraft

@Bk2006 wrote:Just got my denial letter from NFCU in the mail today. I have been a member since 2016 - originally opened a savings, checking and Cash Rewards MC. The checking account was a joint account with my father, who is now deceased. He was the primary user of the checking account, but I was the primary account holder. After Dad died in 2019 and stopped getting his Social Security direct deposited, I forgot to turn off autopay for some of his regular bills...and then I moved, got a little sloppy keeping track of my finances and didn't give my new address to NFCU for about a year. At some point in 2020 the NFCU checking account got overdrawn. I think the total amount overdrawn was less than $200 but by the time I set up a spreadsheet to start tracking everything, the checking account was gone from my online banking. Never got any overdraft notices in the mail, probably because I moved and didn't notify NFCU right away.

I applied for a 2nd NFCU card last week as a way to grow my total CL with them. Have had the Cash Rewards MasterCard since 2016 with no issues. Then I got the only reason for denial below: "THERE IS A LOSS ASSOCIATED WITH YOUR NAVY FEDERAL ACCOUNT(S)."

I want to pay the overdraft to make NFCU whole. They've been so good to me in building my credit, plus it's just the right thing to do. Thankfully there's never been any AA on my credit card with them. Would I qualify immediately for additional credit products after I repay the checking account loss?

Hope to hear others' experience with this!

I believe so, yes, as long you allow 2-4 weeks after paying them back before applying for a card.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores: