- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: NFCU application for Flagship rewards just bef...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

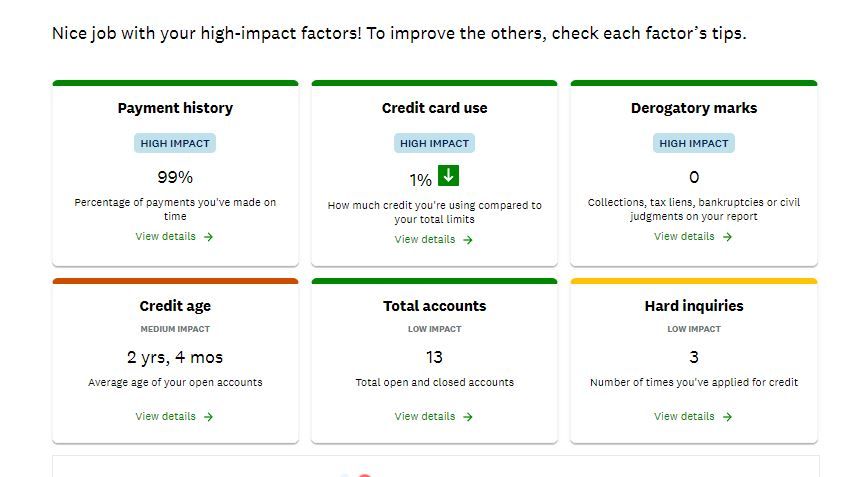

So I'm a dumb ape, crypto investor so I'm not all there, so I just applied for a Flagship Rewards card, just before applying for a mortgage which will be in a month of 2. Every body says don't do it, so I did it anyway and your benifit from my pain is you get some hard data and what is true, because a lot of what is said is theoretical to my ape brain. Theory being:

You want the highest score and best looking credit profile to maximiz chances and lower interest rate

New account might increase risk profile when considering possibly reasons why it was done (maybe having money issues)

Lowering your credit age which hurts your over all credit

Adding a new inquiry from hard pull hurting score

Some even say keep it clean for a YEAR before application. So why did I do such a stupid thing especially with a marginal profile:

651 FICO

6 years ago charge off, paid in full but not yet removed from report

2.5 years average account age.

Well, because I'm taking a chance on my logical assesment of full spectrum aproach to lending. I'm sure they are looking at EVERYTHING and I think the full picture puts me in the clear for the mortgage, not so much for the card. I'm skeptical that even with me showing I paid the charge off in full, that they would give me top card when BankOfAmerica won't even unsecure my card after 3 awesome years of on time payments and TD Bank after 3 years won't give me a single CLI. Stuck at $1k.

Here why I think I'll be OK:

I just got $2k to $4k CLI on Amazon

I have $9k total credit but 1% used.

I have enough income to pay a $3000-$5000 credit card balance in a month.

Vantage is 717/697

I have 5 cards so adding one more won't crush my credit age

NFCU pre approved me

NFCU is known to be more generous than for example PENFED who I'd not try this with.

Score hit will be small and I might recover most or all before closing (3-4 months)

I was approved for $1M mortgage by NFCU a year ago and my credit is MUCH better now, plus even more income

Between deposit and closing costs, it's going to be a TOUGH load to save the money I need, so if this fails and delays me, that's a bigger downpayment and therefore mortgage, so delays are good...unless interest rates go up too soon. ![]()

anyway, I sent them a bunch of docs preemptively. Paystub, account statement and charge off payment letter. Told them I plan to use their card for most of my transactions because the higher limit is a better match for my spending and also the cards I have now are a challenge to keep up with because even a small purchase on wrong card can hurt my score if done the wrong time.

So, join me on this 2-3 day rollercoaster of anxiety. lol

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

If you are going through NFCU for the mortgage it probably won't be an issue. If you aren't then good luck. When I did my mortgage with NFCU they ask about the HPs they found in my file for the Capital One QS card I had apped for just like an hour before putting in my mortgage prequal information...

It was a non-issue, the UW just wanted to know if the HPs led to an account opening and I put down that it did and that was that. I didn't have to write a letter or "explain" anything, I got a form that had all the information pre-filled and I had to indicate what the HPs were for. No big deal at all.

8/22/24

8/22/24

3/09/25

3/09/25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

NFCU preapprovals for credit cards are not reliable. They may approve but they can also reject. Credit card lending is not the same as house lending and results can suprise some, even those with the right income for a home. Just be cognizant of this .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

Starting Score: 469

Starting Score: 469Current Score: 819

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@Junejer wrote:

Mine wasn’t a home purchase but a refinance a few years ago. I opened my Southwest Priority Card and my Amex within a day of one another and refinanced about a month later. Scores were upper 600s at the time. Refinance was with Chase. I’ll be interested to read your findings.

Look at you, OVER 800!! What is your secret? Tell me the password!

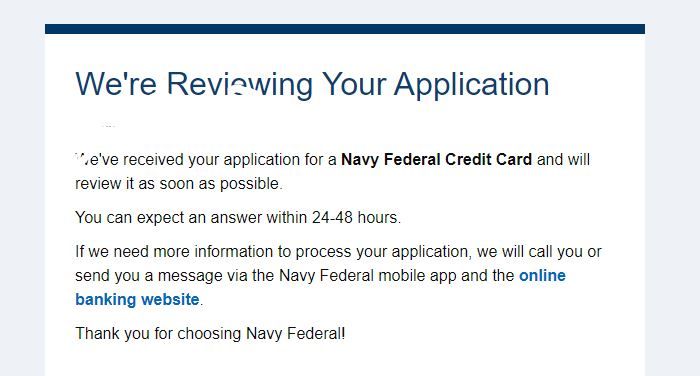

So I lost a total of 3 points on my vantage score from the NFCU inquiry. Application is "under review" so that means I'm going to get declined of course. lol. They said maybe by Sunday. Claimed to be backed up.

If I get declined, should I apply for another card? I really need a $5000 limit card so I can relax with building credit. I have to watch these tiny limit cards like a hawk. What card would you try to get?

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@visualfxpro wrote:

@Junejer wrote:

Mine wasn’t a home purchase but a refinance a few years ago. I opened my Southwest Priority Card and my Amex within a day of one another and refinanced about a month later. Scores were upper 600s at the time. Refinance was with Chase. I’ll be interested to read your findings.Look at you, OVER 800!! What is your secret? Tell me the password!

So I lost a total of 3 points on my vantage score from the NFCU inquiry. Application is "under review" so that means I'm going to get declined of course. lol. They said maybe by Sunday. Claimed to be backed up.

If I get declined, should I apply for another card? I really need a $5000 limit card so I can relax with building credit. I have to watch these tiny limit cards like a hawk. What card would you try to get?

Double secret password is to stay clean and keep utilization low. Aging of accounts does wonders.

I am by no means a credit card expert, so take my suggestion with a grain of salt. Have you checked for pre-qualified offers on FNBO? I'm not sure what their FICO cutoffs are, but I haven't read a post that suggests people don't get the CL that they are shown on the pre-qualification site.

Starting Score: 469

Starting Score: 469Current Score: 819

Goal Score: 850

Highest Scores: EQ 850 EX 849 TU 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@Junejer wrote:

@visualfxpro wrote:

@Junejer wrote:

Mine wasn’t a home purchase but a refinance a few years ago. I opened my Southwest Priority Card and my Amex within a day of one another and refinanced about a month later. Scores were upper 600s at the time. Refinance was with Chase. I’ll be interested to read your findings.Look at you, OVER 800!! What is your secret? Tell me the password!

So I lost a total of 3 points on my vantage score from the NFCU inquiry. Application is "under review" so that means I'm going to get declined of course. lol. They said maybe by Sunday. Claimed to be backed up.

If I get declined, should I apply for another card? I really need a $5000 limit card so I can relax with building credit. I have to watch these tiny limit cards like a hawk. What card would you try to get?Double secret password is to stay clean and keep utilization low. Aging of accounts does wonders.

I am by no means a credit card expert, so take my suggestion with a grain of salt. Have you checked for pre-qualified offers on FNBO? I'm not sure what their FICO cutoffs are, but I haven't read a post that suggests people don't get the CL that they are shown on the pre-qualification site.

FNBO just prequalified me for a secured card. LOL

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

DECLINE! ![]()

Prequalified my butt! So what should I do now? Should I apply for a lower card at NFCU? What is my best chance at getting a $5000 limit now?

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@visualfxpro wrote:DECLINE!

Prequalified my butt! So what should I do now? Should I apply for a lower card at NFCU? What is my best chance at getting a $5000 limit now?

You really need to do careful research before applying. There's DPs around the forum that document how NFCU's prequal is pretty much useless...

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU application for Flagship rewards just before mortgage like an IDIOT! lol

@OmarGB9 wrote:

@visualfxpro wrote:DECLINE!

Prequalified my butt! So what should I do now? Should I apply for a lower card at NFCU? What is my best chance at getting a $5000 limit now?

You really need to do careful research before applying. There's DPs around the forum that document how NFCU's prequal is pretty much useless...

How do I find that? I was searching around and it looks like there is no corrent DP for that.

BTW, NFCU told me today that it's POSSIBLE that my account being 'dormant' with them for 2 years is the reason for decline. So they DO look at account activity...SUPPOSEDLY. So my take from this is if you guys have plans on applying for their cards and your credit is not super strong. You should start using their services. Maybe a small personal loan. Maybe just regular deposits. Whatever you do, make sure you are not a dormant account when you apply.

Note, they approved me for $1M morgage last year. I did not take it, but being dormant did not affect that.

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%