- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Need CareCredit advice (noob)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need CareCredit advice (noob)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need CareCredit advice (noob)

So I do not have any credit, but my BF has 750 credit score. Looking into care credit, and wonder if anyone has any advice, regrets, tips, or recommended alternatives. I want to have 23k~ of plastic surgery that I've been trying to save for a couple of years but have ultimately failed. (practices shut down due to Covid19 of course, but I want to be ready)

my BF has told me point and he'll shoot, so he will do whatever I think is best for financing this. I'm recently 23 and he's 27. He's willing to also help with with the payments and he makes $15 an hour (40 hour work week) and I make $30-80 an hour streaming online (but with less hours in) and I can make 1600 a month being conservative. Our rent when we move together soon will be around 650-700 from each of us. Our savings are kind of low, he has 3k~ and I have 1k~. Should we co-sign for CareCredit or should it just be him, (I don't have credit, I know it's important but I applied when I was 20 and they said come back when ur 21 and we'll give you a card but I never did)

any advice on getting CLI from care credit to cover the 17k-23k? is it possible with 750? I know it's probably best to pay more as the down payment, but I guess it feels very overdue, so I don't mind paying extra over time for having the surgeries as soon as possible (I will do my best to cover the payments by myself)

-have not told him to apply yet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

With his income, it'll take a year or two to get that high.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

Hi and welcome to the forums

You cannot cosign credit card app, and I'm not sure if joint account is an option.

While he may get approved, starting limit will depend on his entire profile.

While $20K is possible (hard to tell without knowing more about his profile), card would most likely be maxed out for prolonged period of time, which may in turn cause AA from his other lenders.

I dont think that's a fair request to make.

Also, care credit carries very high interest.

If you havent been able to save, what's your repayment plan?

I dont want to sound rude, but I dont think your income allows for $23,000.00 in elective procedure.

It will take you years to pay it off, and if you grab a calculator and account for interest, it's a mind numbing amount.

Wait till you have enough money saved, or apply yourself. Your BF should not carry this burden.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

Hi OP and welcome to my FICO

This is not the answer you want to hear but since you asked for any advice, etc, here is mine. I beg you not to do this for many reasons:

1. The income is not there--$23K in credit could take 10-12 years to pay off, especially depending on interest rate and making only minimum payments.

2. Borrowing this kind of money for elective surgeries is not the way to proceed, even if we weren't in the economic climate we are in now.

3. You've tried unsuccesssfully for 2 years to save. Let this be a forewarning to forget this idea. You will be putting you and your BF's credit in a kind of hell that will and can affect your lives for many, many years to come. What if you cannot pay this loan back or godforbid, the relationship goes belly up--something else to think about.

So bottom line--and in my humble opinion--this is absolutely and unequivocally not a good decision. Please dont go forward with this.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

Rather than guess, carecredit has a calculator on their site to show payments under deferred 0% and regular circumstances. Based on the numbers you've given for a bad month, probably not a good idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

thank you!

and yea I read somewhere that you could co-sign but idk, can I ask what AA is?

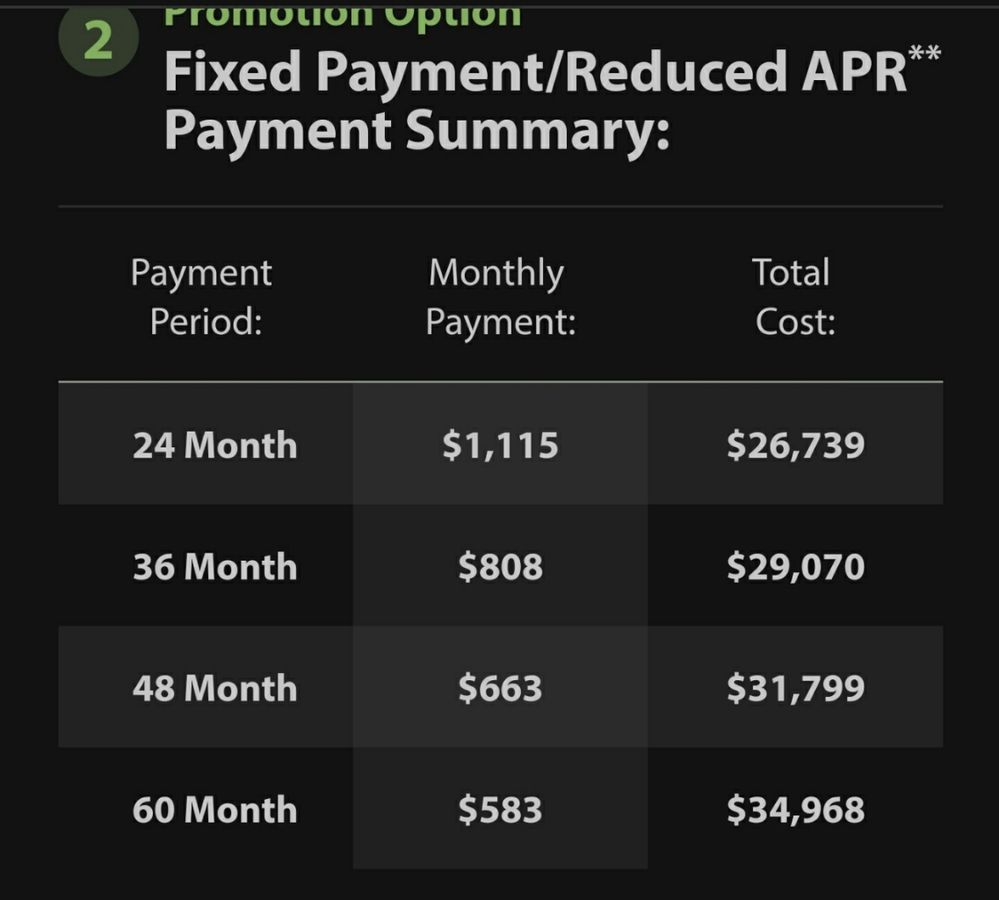

And as far as the repayment plan I'd like to cover the payments by myself in the first place though he has offered to help. Is there anyway that I could make it work, or do you think it's definitely a bad idea, in mind that I'd want to save a few thousand and do the rest with creditcare, he's said he would also be willing to put a chunk of his money in initially. the surgeon I want to go to accepts 24 and 36 month plans, 36 months being more affordable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

thank you for replying, I guess based on my income alone I thought I would be able to cover a monthly $800 unless I understand incorrectly, 1600 being a conservative month for me, my living expenses around equal $800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

thank you for the advice

I guess I am rather desperate for these surgeries, as ideal as it would have been to save up for the total. I do still want the surgeries ASAP, is there any advice you have for making it do the least damage, and stay with the 14.9% fixed apr? Because according to the plans it should take 36 months to pay off in whole. (I know I don't know much about it and if you miss a payment the apr will apply retroactively)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

@Anonymous wrote:thank you for replying, I guess based on my income alone I thought I would be able to cover a monthly $800 unless I understand incorrectly, 1600 being a conservative month for me, my living expenses around equal $800

You should always assume you'll have a string of bad months when figuring out if you can consistently afford something. If you can't afford to ride out 3-6 months of bad months, you'll end up hurting him in the long run and yourself by association.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need CareCredit advice (noob)

I guess that's true, I do work from home though, and also these surgeries would probably boost my income overall. And I do still have time to save with everything going on, as his practice is shut down anyway