- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Now hiring: Forensic CapOne Application Analyst

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Now hiring: Forensic CapOne Application Analyst

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Now hiring: Forensic CapOne Application Analyst

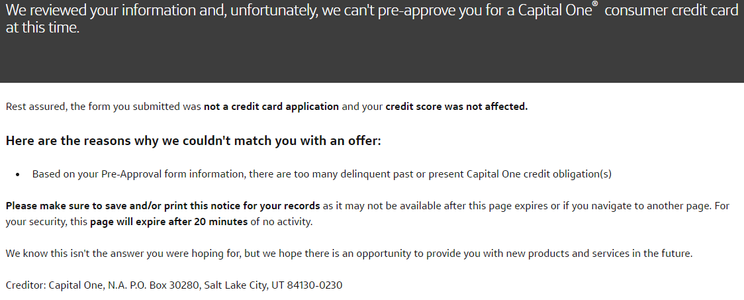

Last night I prequalled my spouse for CapOne (trying to pair Savor w/VentureX) which results in this:

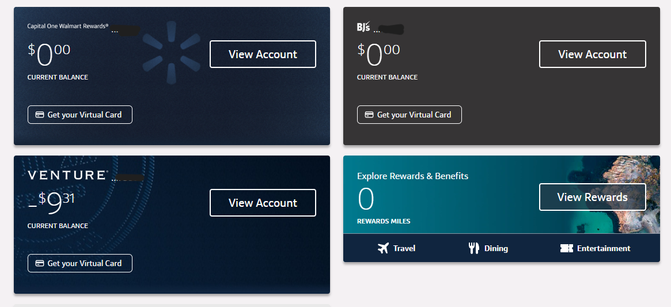

I cannot for the life of me figure this out. There are absolutely no historical late payments with either the current or closed credit lines with anyone especially Capital One. Captial One is Paid in full ALWAYS with the exception of the Venture AF which hit when the last statement cut and was promptly paid with redemptions. CapOne inherited a 9 year old Walmart M/C for $10K and a 8 year old BJ's One+ for $6,750 (both were always PIF before statement dates. I have access to Pacer and of course online court information. There is nothing, nada. Am I overthinking this and maybe just running into a glitch? I'd like some feedback before I have to throw a triple pull at it.

The only thing I that can think of is there is a credit balance of $9.31 on this 8 year old $11K Venture account from OVERPAYMENT. Could this be causing a problem in their algorhythm?

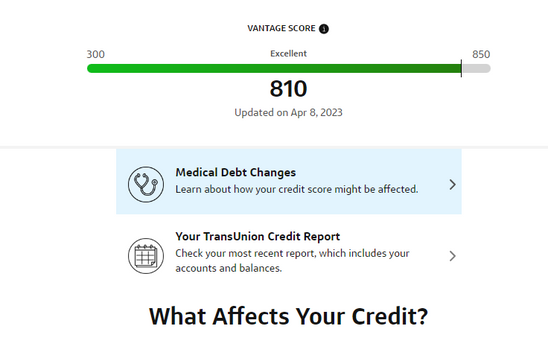

This is from CapOne Creditwise (Vantage):

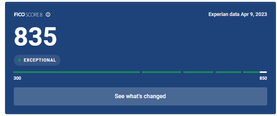

And the CRA's FICO 08 Transunion / Equifax / Experian

August 28, 2023 FICO BankCard 8

August 28, 2023 FICO Auto 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

For some reason cap1 and disco aren't fans of people with scores in the 800s. :/

Regarding your question, a reason needs to be given, it doesn't have to be THE reason for denial. If it's anything like any other job with letters, there's probably a drop down list of reasons and someone chose the one that they felt was closest to the actual reason, or they chose the wrong one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@fury1995 wrote:Captial One is Paid in full ALWAYS with the exception of the Venture AF which hit when the last statement cut and was promptly paid with redemptions.

Something in Cap1's sytem thought the statement that your AF was on wasn't paid on time because you used redemptions to pay for it? Yet that didn't result in a late or otherwise on your reports or with Cap1?

As for what I think the real reason is, it's just that they don't want you, and they spit out a random, nonsensical reason code to justify it

I would use up the credit, or a get a check issued and see if that clears it up though

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@GZG wrote:

@fury1995 wrote:Captial One is Paid in full ALWAYS with the exception of the Venture AF which hit when the last statement cut and was promptly paid with redemptions.

Something in Cap1's sytem thought the statement that your AF was on wasn't paid on time because you used redemptions to pay for it? Yet that didn't result in a late or otherwise on your reports or with Cap1?

As for what I think the real reason is, it's just that they don't want you, and they spit out a random, nonsensical reason code to justify it

I would use up the credit, or a get a check issued and see if that clears it up though

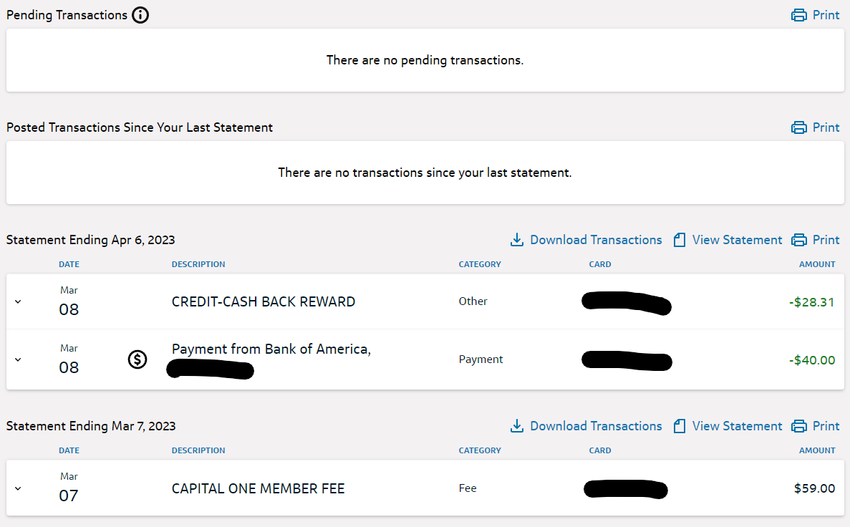

This is how it went down. The statement cut March 7 the day the fee posted. It was never a pending charge so there wasn't a balance to pay until March 8 the day after the statement cut. Either way, the balance was $59. The minimum payment due was $40 for April 7th that was made and posted March 8th leaving a statement balance of $19 which then was covered by the redemption and then some.

Is it possible their system sees something different with the credit as a negative?

August 28, 2023 FICO BankCard 8

August 28, 2023 FICO Auto 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@Brian_Earl_Spilner wrote:For some reason cap1 and disco aren't fans of people with scores in the 800s. :/

Regarding your question, a reason needs to be given, it doesn't have to be THE reason for denial. If it's anything like any other job with letters, there's probably a drop down list of reasons and someone chose the one that they felt was closest to the actual reason, or they chose the wrong one.

It was automated. This was prequal decision, thankfully. No HP's spent on this... yet.

I put the call out for all of you resident CapOne expert analysts!

August 28, 2023 FICO BankCard 8

August 28, 2023 FICO Auto 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

Even for the VentureX where you'd think Capital One would want prime customers they routinely turn people down that are 800+. It's bonkers but that's how they operate. I'm glad I've finally cut Capital One out of my life as I have closed both of my accounts with them over the last few days.

8/8/25

8/8/25- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

To the best of my knowledge Cap1 has never shown any preapprovals for the Venture X. Either you have to get an invite to upgrade or you need to apply and take the three hard pulls. Since you already have three cards with Cap1 that could also be a reason why there are no preapprovals. The bottom line is if you want the Venture X you're going to have to apply for it. In my opinion the Venture X is a great card and likely worth the hard pull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@C6 wrote:To the best of my knowledge Cap1 has never shown any preapprovals for the Venture X. Either you have to get an invite to upgrade or you need to apply and take the three hard pulls. Since you already have three cards with Cap1 that could also be a reason why there are no preapprovals. The bottom line is if you want the Venture X you're going to have to apply for it. In my opinion the Venture X is a great card and likely worth the hard pull.

Thanks for the feedback.

The preapproval attempt was for my spouse.

That negative result was for any card.. even secured, not the VentureX.

I'd get the Venture X, the Savor (for my spouse) was for pairing with it.

August 28, 2023 FICO BankCard 8

August 28, 2023 FICO Auto 8

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@fury1995 wrote:Now hiring: Forensic CapOne Application Analyst

SERIOUSLY! Just imagine if we had legitimate people on these forums (anonymously, of course) that had access to the real backend at each major card issuer - with the ability to share actual decision info, blacklists, correspondence, and override automatic denials.

I Am Not My Credit Score - it's just a made-up number that we all have to live with.

NOW HIRING - senior credit analyst, account manager, or high-end specialist from American Express National Bank.

Don't Listen To Anyone In The Delta SkyMiles-AmEx Facebook Group

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now hiring: Forensic CapOne Application Analyst

@SKBirdmind wrote:

@fury1995 wrote:Now hiring: Forensic CapOne Application Analyst

SERIOUSLY! Just imagine if we had legitimate people on these forums (anonymously, of course) that had access to the real backend at each major card issuer - with the ability to share actual decision info, blacklists, correspondence, and override automatic denials.

We do. We just don't because access is tracked and could lead to termination. The best we can do is give insight to the process and rules.