- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Preparing for Sapphire App

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Preparing for Sapphire App

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Preparing for Sapphire App

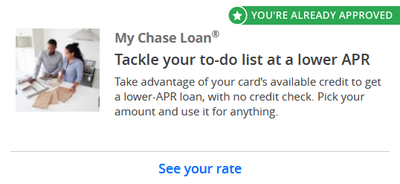

I'll be 4/24 on January 16. I've read some posts that say you're good to go with Chase on that day or the next, and others that say you should wait until the beginning of the following month. I'm planning to wait until the evening of February 1, just to be safe. I might apply a little sooner if I get a "You are already approved" with a green/black check/star thingy. I have one for a loan, but not for any cards. Besides, I want to wait until statements cut on some cards that will show lower balances on this month's statements than they did last month. So no sooner than the 20th.

Yeah, I'd really like to see something like that with CSP and/or CSR on it.

I'm planning to get the Sapphire Preferred. But it wouldn't take much motivation to push me towards the Sapphire Reserve. If the Reserve offered a slightly higher SUB, a reduced annual fee for the first year, 0% APR for a little while. Just a little something, and I'd try the Reserve for a year anyway. But I really think the Preferred is going to be a better fit for me with my spending and travel.

People often suggest applying in branch to get the first-year annual fee waved on the Preferred. I know that was a limited-time promotional deal for a while that some people got even after that time period had supposedly expired. But, has anyone actually gotten that deal in the past year and a half or so? All accounts I read of it are from a while back, yet some still insist that's the way to go. Anyone know of any other in-branch incentives? Getting to a branch to apply could be a pain in the behind from where I live. I wouldn't make the trip just to save a $95 annual fee because it would cost me half that much in gas and several hours of my time. I could find other reasons to be in the city where the nearest Chase is located, and stop by there while I'm in town. But most of the time I go would be on a Saturday. Would the people I need to talk to even be there on Saturday? I could arrange to be there on a week day, but I don't want to make the effort if they're going to give me the same deal I can get online. And it's somewhat unpredictable when I could be there on a week day. Like we get rained out at work and sent home. So I go shopping while most other people are at work.

I don't think getting approved will be a challenge once I'm under 5/24, even if I go for the Reserve which has a $10k minimum CL. I'm mostly playing for style points now, hoping for a higher SL.

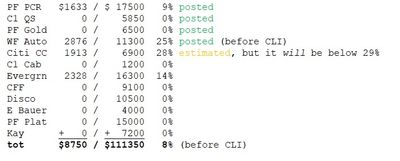

My scores should be a little higher by application time due to my utilization dropping from 11% to 8%.

@Remedios wrote:. . . Chase is very sensitive to raw dollar amounts, they don't play utilization percentage games.

That's one thing I'm concerned about. When I got my CFF, which was the highest limit of any of my cards at that time, my EX8 was 748. It's 762 now and will probably be a little higher still. But when I got that one, my total debt was $459. Now I owe $8750 on credit cards and $5647 of a $10k PenFed personal loan. My income has gone up. Was $52k, now $72k. Rent still the same at $700. And when I opened that CFF, it was my first Chase account of any kind. Now I have 20 months as a Chase customer. Maybe that will count for something.

Your input is welcome. Yes, you, if you've taken the time to read this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@mgood, I applied for a CSP in the branch in late December and did NOT get the annual fee waived.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@Horseshoez wrote:@mgood, I applied for a CSP in the branch in late December and did NOT get the annual fee waived.

Thanks. I suspect the people saying to do that are basing it on old news that may no longer be applicable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@mgood wrote:

@Horseshoez wrote:@mgood, I applied for a CSP in the branch in late December and did NOT get the annual fee waived.

Thanks. I suspect the people saying to do that are basing it on old news that may no longer be applicable.

Agreed.

Regarding the visit to a branch, I wonder if doing so might nudge them to give you a slightly higher starting limit; I was delightfully surprised with the limit they approved me for.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@mgood wrote:I'll be 4/24 on January 16. I've read some posts that say you're good to go with Chase on that day or the next, and others that say you should wait until the beginning of the following month. I'm planning to wait until the evening of February 1, just to be safe. I might apply a little sooner if I get a "You are already approved" with a green/black check/star thingy. I have one for a loan, but not for any cards. Besides, I want to wait until statements cut on some cards that will show lower balances on this month's statements than they did last month. So no sooner than the 20th.

Yeah, I'd really like to see something like that with CSP and/or CSR on it.

I'm planning to get the Sapphire Preferred. But it wouldn't take much motivation to push me towards the Sapphire Reserve. If the Reserve offered a slightly higher SUB, a reduced annual fee for the first year, 0% APR for a little while. Just a little something, and I'd try the Reserve for a year anyway. But I really think the Preferred is going to be a better fit for me with my spending and travel.

People often suggest applying in branch to get the first-year annual fee waved on the Preferred. I know that was a limited-time promotional deal for a while that some people got even after that time period had supposedly expired. But, has anyone actually gotten that deal in the past year and a half or so? All accounts I read of it are from a while back, yet some still insist that's the way to go. Anyone know of any other in-branch incentives? Getting to a branch to apply could be a pain in the behind from where I live. I wouldn't make the trip just to save a $95 annual fee because it would cost me half that much in gas and several hours of my time. I could find other reasons to be in the city where the nearest Chase is located, and stop by there while I'm in town. But most of the time I go would be on a Saturday. Would the people I need to talk to even be there on Saturday? I could arrange to be there on a week day, but I don't want to make the effort if they're going to give me the same deal I can get online. And it's somewhat unpredictable when I could be there on a week day. Like we get rained out at work and sent home. So I go shopping while most other people are at work.

I don't think getting approved will be a challenge once I'm under 5/24, even if I go for the Reserve which has a $10k minimum CL. I'm mostly playing for style points now, hoping for a higher SL.

My scores should be a little higher by application time due to my utilization dropping from 11% to 8%.

@Remedios wrote:. . . Chase is very sensitive to raw dollar amounts, they don't play utilization percentage games.

That's one thing I'm concerned about. When I got my CFF, which was the highest limit of any of my cards at that time, my EX8 was 748. It's 762 now and will probably be a little higher still. But when I got that one, my total debt was $459. Now I owe $8750 on credit cards and $5647 of a $10k PenFed personal loan. My income has gone up. Was $52k, now $72k. Rent still the same at $700. And when I opened that CFF, it was my first Chase account of any kind. Now I have 20 months as a Chase customer. Maybe that will count for something.

Your input is welcome. Yes, you, if you've taken the time to read this.

For me, applying for chase card a few days after going below 5/24 worked. I am certain they go by exact date but a lot of people here wait till following month to be on a safer side of things.

I also believe your time with Chase counts for something but I wouldn't lean on that too hard, there are other checkmarks that need to be placed

Chase has pre-qual portal now. So, check it out a few days after 16th (I'd recommend 19th), and go from there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@Horseshoez wrote:

@mgood wrote:

@Horseshoez wrote:@mgood, I applied for a CSP in the branch in late December and did NOT get the annual fee waived.

Thanks. I suspect the people saying to do that are basing it on old news that may no longer be applicable.

Agreed.

Regarding the visit to a branch, I wonder if doing so might nudge them to give you a slightly higher starting limit; I was delightfully surprised with the limit they approved me for.

I would be a little surprised if the local branch had much, if any, influence on credit limits.

I would not be at all surprised if they had some small amount of leeway in offering incentives to get someone to sign up for a product (like waiving the first-year annual fee even after that deal had expired).

But I'm just speculating. I also speculate that being there with someone, face-to-face, who has phone numbers and contacts could help smooth out any delays that may come after an app but before an approval, like ID verification, POI and such. Someone who knows who to call to save you multiple phone calls and a lot of time on hold. But that convenience, weighed against the inconvenience of me actually going to a branch, sort of cancel each other out. And I don't anticipate any problems like that since I already have an account with Chase, but who knows?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@Remedios wrote:For me, applying for chase card a few days after going below 5/24 worked. I am certain they go by exact date but a lot of people here wait till following month to be on a safer side of things.

I also believe your time with Chase counts for something but I wouldn't lean on that too hard, there are other checkmarks that need to be placed

Chase has pre-qual portal now. So, check it out a few days after 16th (I'd recommend 19th), and go from there.

Thanks. I've seen you in the 4/24 date vs following month discussions but didn't remember for sure which side you were on.

And I will thaw the CRAs and try the pre-quals around that time.

I've used the Amazon Prime pre-qual as a bellwether in the past. When it pre-qualified me I took that to mean that hopefully I'd qualify for a Chase core card if I were under 5/24 ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@mgood wrote:

@Remedios wrote:For me, applying for chase card a few days after going below 5/24 worked. I am certain they go by exact date but a lot of people here wait till following month to be on a safer side of things.

I also believe your time with Chase counts for something but I wouldn't lean on that too hard, there are other checkmarks that need to be placed

Chase has pre-qual portal now. So, check it out a few days after 16th (I'd recommend 19th), and go from there.

Thanks. I've seen you in the 4/24 date vs following month discussions but didn't remember for sure which side you were on.

And I will thaw the CRAs and try the pre-quals around that time.

I've used the Amazon Prime pre-qual as a bellwether in the past. When it pre-qualified me I took that to mean that hopefully I'd qualify for a Chase core card if I were under 5/24

That's exactly what I did for CFU and Amazon card. It worked 🤷♀️

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

@Remedios wrote:

@mgood wrote:

@Remedios wrote:For me, applying for chase card a few days after going below 5/24 worked. I am certain they go by exact date but a lot of people here wait till following month to be on a safer side of things.

I also believe your time with Chase counts for something but I wouldn't lean on that too hard, there are other checkmarks that need to be placed

Chase has pre-qual portal now. So, check it out a few days after 16th (I'd recommend 19th), and go from there.

Thanks. I've seen you in the 4/24 date vs following month discussions but didn't remember for sure which side you were on.

And I will thaw the CRAs and try the pre-quals around that time.

I've used the Amazon Prime pre-qual as a bellwether in the past. When it pre-qualified me I took that to mean that hopefully I'd qualify for a Chase core card if I were under 5/24

That's exactly what I did for CFU and Amazon card. It worked 🤷♀️

X2

Same for me last year. Got Amazon and CSP with decent SLs

Also Chase use their own internal score which would effect your SL. Not sure if you can get that in branch or other ways!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Preparing for Sapphire App

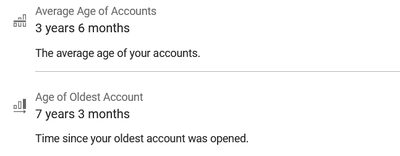

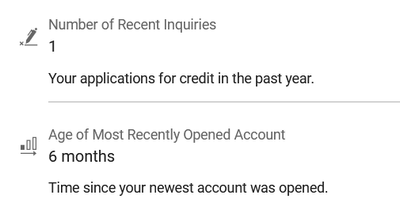

From my reports I pulled on Jan 1. This is Experian, from the myFICO site. That one inquiry was for my Evergreen on Jan 16, 2022. I'm not sure if it becomes 0/12 for inquiries on Jan 16, 2023 or Feb 1, 2023.

The six month old account is the Custom Cash from Jul 16, 2022. So I think I've read that for aging metrics, they are all considered to have opened on the first of the month. So it became 6 months old on Jan 1, and I'm 0/6 for new accounts now. (Someone tell me if that's wrong.)

Yeah, I have a lot of things opened on Jan 16 and Jul 16. That's why it's CLI season too. Cards that allow CLI at 6 month intervals come up in January and July ![]()