- myFICO® Forums

- Types of Credit

- Credit Card Applications

- SDFCU Visa & LOC approved . Membership denied?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

SDFCU Visa & LOC approved . Membership denied?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SDFCU Visa & LOC approved . Membership denied?

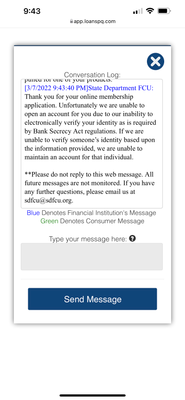

I want to share my experience with SDFCU. State department federal credit union. What a joke! I saw these videos of how generous they are and so on. Applied for membership verified with documents. Saw a hard pull on my credit not what I was expecting since I wanted to establish a relationship with them before applying. However called in and asked if they could use that hard pull for their products. Rep said absolutely submitted for their visa sig and PLOC. $20k limit on visa and ploc pending.. next day membership was denied due to electronic identity could not be verified? Now I'm irate so I call in and the rep literally reads the denial reason.. I ask how I can fix it and he said u can't? Now my two credit products will be denied since my membership is! So I turned up the heat because I wasted a hard pull at this point. He emailed his "manager" to remove my hard pull and I told him I want a copy of this email. So if HP doesn't get removed in 30 days I will attach to bureaus and dispute! STAY AWAY FROM SDFCU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

With SDFCU lot of things are done manually. Did you call the CSR and see if they can help you out? It is worth giving them a call.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

@Anonymous wrote:I want to share my experience with SDFCU. State department federal credit union. What a joke! I saw these videos of how generous they are and so on. Applied for membership verified with documents. Saw a hard pull on my credit not what I was expecting since I wanted to establish a relationship with them before applying. However called in and asked if they could use that hard pull for their products. Rep said absolutely submitted for their visa sig and PLOC. $20k limit on visa and ploc pending.. next day membership was denied due to electronic identity could not be verified? Now I'm irate so I call in and the rep literally reads the denial reason.. I ask how I can fix it and he said u can't? Now my two credit products will be denied since my membership is! So I turned up the heat because I wasted a hard pull at this point. He emailed his "manager" to remove my hard pull and I told him I want a copy of this email. So if HP doesn't get removed in 30 days I will attach to bureaus and dispute! STAY AWAY FROM SDFCU!

Well for your sake I hope the pull gets recoded but you DID apply for credit so your odds of disputing the HP are slim. A denial doesn't mean that the HP shouldn't have happened....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

@Anonymous wrote:I want to share my experience with SDFCU. State department federal credit union. What a joke! I saw these videos of how generous they are and so on. Applied for membership verified with documents. Saw a hard pull on my credit not what I was expecting since I wanted to establish a relationship with them before applying. However called in and asked if they could use that hard pull for their products. Rep said absolutely submitted for their visa sig and PLOC. $20k limit on visa and ploc pending.. next day membership was denied due to electronic identity could not be verified? Now I'm irate so I call in and the rep literally reads the denial reason.. I ask how I can fix it and he said u can't? Now my two credit products will be denied since my membership is! So I turned up the heat because I wasted a hard pull at this point. He emailed his "manager" to remove my hard pull and I told him I want a copy of this email. So if HP doesn't get removed in 30 days I will attach to bureaus and dispute! STAY AWAY FROM SDFCU!

Not sure what videos stated how generous they were but going off what I've read here they are pretty conservative. Sorry about the bad experience but as stated upthread it was a legitimate credit pull. If I could take back all my credit denials because I was denied I'd be a happy camper![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

Filing disputes with the credit reporting agencies to withdraw a hard pull when there is no allegation or evidence of fraud is a wasted effort. You've already admitted that you submitted an application for membership and credit products so there was permissible purpose for them to perform the inquiry.

If you filed a consumer complaint directly with the NCUA that may possibly result in SDFCU making another attempt at verifying your identity, but much like filing a dispute with a CRA such a complaint in the context of trying to force a withdrawal of the inquiry has a high probability of being designated and treated as being frivolous.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

As everyone unthread has stated... the inquiry is vaild. You applied for membership, which in itself appeared to be a hard pull. You weren't expecting that.... called in to ask if that hard pull could be used for credit products. They said, "Yes." You applied for the credit products before getting approved for the membership.

As a courtesy.... maybe they'll remove the inquiry, but they DID have permissible purpose.

Goal: FICO 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

@Anonymous wrote:I want to share my experience with SDFCU. State department federal credit union. What a joke! I saw these videos of how generous they are and so on. Applied for membership verified with documents. Saw a hard pull on my credit not what I was expecting since I wanted to establish a relationship with them before applying. However called in and asked if they could use that hard pull for their products. Rep said absolutely submitted for their visa sig and PLOC. $20k limit on visa and ploc pending.. next day membership was denied due to electronic identity could not be verified? Now I'm irate so I call in and the rep literally reads the denial reason.. I ask how I can fix it and he said u can't? Now my two credit products will be denied since my membership is! So I turned up the heat because I wasted a hard pull at this point. He emailed his "manager" to remove my hard pull and I told him I want a copy of this email. So if HP doesn't get removed in 30 days I will attach to bureaus and dispute! STAY AWAY FROM SDFCU!

It costs them nothing to remove the HP. You did nothing wrong since the problem was on their end with electronic verification. Had they approved you for membership but denied you for loan products, well that's life. It is not common anymore to do an HD for CU membership. That is completely optional on their part and easy to fix. I had my original loan wth Alliant wheir their loan app program froze up and every time I hit submit I got yet another HP! I had eight HPs for one credit card loan from the same session! When I called and spoke with a real person in the loan department he just laughed and said, "Taken care of," and he removed all of the INQ's -- including the one that I actually deserved. You have every right to go to the mat for this. You may not win but the sound of your name should cause them to all want to go to lunch or call in sick.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

@CH-7-Mission-Accomplished wrote:

@Anonymous wrote:I want to share my experience with SDFCU. State department federal credit union. What a joke! I saw these videos of how generous they are and so on. Applied for membership verified with documents. Saw a hard pull on my credit not what I was expecting since I wanted to establish a relationship with them before applying. However called in and asked if they could use that hard pull for their products. Rep said absolutely submitted for their visa sig and PLOC. $20k limit on visa and ploc pending.. next day membership was denied due to electronic identity could not be verified? Now I'm irate so I call in and the rep literally reads the denial reason.. I ask how I can fix it and he said u can't? Now my two credit products will be denied since my membership is! So I turned up the heat because I wasted a hard pull at this point. He emailed his "manager" to remove my hard pull and I told him I want a copy of this email. So if HP doesn't get removed in 30 days I will attach to bureaus and dispute! STAY AWAY FROM SDFCU!

It costs them nothing to remove the HP. You did nothing wrong since the problem was on their end with electronic verification. Had they approved you for membership but denied you for loan products, well that's life. It is not common anymore to do an HD for CU membership. That is completely optional on their part and easy to fix. I had my original loan wth Alliant wheir their loan app program froze up and every time I hit submit I got yet another HP! I had eight HPs for one credit card loan from the same session! When I called and spoke with a real person in the loan department he just laughed and said, "Taken care of," and he removed all of the INQ's -- including the one that I actually deserved. You have every right to go to the mat for this. You may not win but the sound of your name should cause them to all want to go to lunch or call in sick.

Except you don't know what their internal policies are. This isn't about cost, it's about how they conduct day-to-day operations. Last I checked, SDFCU wasn't Alliant. Plus, no one is saying the OP did anything wrong, it's the OP being unfamiliar with their process and not tempering expectations, especially when those expectations are misguided by watching 'sketchy' [unproven methods] videos from YouTube bloggers (or whatever the source).

If their identity couldn't be verified via the means the OP submitted their data, then it is what it is. Not every CU will have the same identification protocols nor share the same platform or software. We've seen plenty of similar identity verification instances and DPs for Alliant, Affinity, PSECU, SECU, BECU, and even PenFed and NFCU.

Hopefully, a lesson learned for the OP, but most individuals go the route of establishing a membership first (or be compliant with eligibility) before obtaining any additional products, because all of this could've been avoided, even if the membership was declined from the get-go. If SDFCU decides to recode or remove the HP great, but if not, then that's that. At least a DP for the community.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

Yea that's those backaward fools at SDFCU. I apped soley for membership and got the same bull**bleep** that they could not ID me. Despite sending ID and all sorts of documents to them. A generous CU if you can get in but a pain in the ass to join with how low tech they are.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: SDFCU Visa & LOC approved . Membership denied?

I went through this with them, too. SDFCU is a joke and they yanked me around, I send bank statements with my addy, cable bills, had my lawyer write in, all to no avail.