- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Weird Comenity/Ulta Denial

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Weird Comenity/Ulta Denial

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Weird Comenity/Ulta Denial

I recently applied for a Comenity Ulta credit card and got the 7-10 days message. I shop there a lot and did some calculations on the rewards, and it turned out to be a pretty good rewards amount (close to 10% when stacked on base earning). I often get coupons and free gifts with purchase from there, so I stack all those with my points and end up getting stuff a lot cheaper than other places. I'll often walk out of there paying like 50% of the actual prices for stuff, which is great even without the credit card rewards. This card had been on my list for a while, especially since Comenity is a bit more friendly to profiles with baddies. I had been declined for this card about a year ago, but for credit reasons that made sense. So that's why I recently applied again after my profile improved significantly. They pulled Experian, where my recent FICO is hovering around 660, FYI. I have 5 paid charge-offs and 1 unpaid one showing. 5 inquiries.

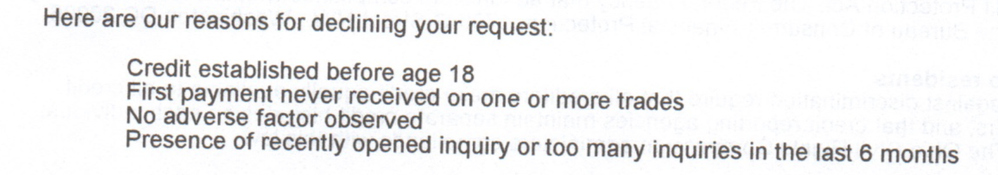

The denial letter said I was declined for four reasons:

They also mentioned my "behavioral risk score," which was 226 on a scale of 0 to 999. All the same reasons were listed below this score. My score seems pretty bad on this scale. I can see the inquires being a reason for denial, but some of the other stuff does not really make much sense. For one, my credit file was established before 18 due to identity theft. Experian is the only bureau that mentions this, but I have never in my life been denied credit for this reason. And I imagine that some people who were added to their parents' credit cards as authorized users might also have this, which doesn't mean it is necessarily a negative thing. "No adverse factor observed" doesn't make any sense to me at all, because there are definitely a few negative items on my report. Lastly, they reference a comment mentioned on one of my negative (also inaccurate) accounts mentioning the first payment not being received. Likewise, I have never been denied credit for this specific issue.

I just find all these reasons strange, except for the inquiries. I am continuing to dispute the inaccurate stuff in my credit file and will add this "before the age of 18" comment to my disputes. I am thinking the inquires are the real reason I was declined, because the other stuff was just plucked out very specifically from my file. They could have mentioned late payments, charge-offs, etc, but they picked these other weird reasons.

Has anyone else been declined by Comenity for weird reasons like this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

The reasons given look like you have to many recent inquiries, don't apply for anything else for 6 months to a year and you should have better odds.

It also appears that you currently have an account with comenity. If you have defaulted on a Comenity account you'll need to fix it and or let it age.

It is possible that the before age 18 comment is because Comenity was directly involved or became an account holder of the fraud.

I have never been denied for the reasons you were given with the exception of "too many inquiries", with a thin file Comenity (seems to) gets spooked from inquiries; even as your file thickens they will deny for inquiries and new accounts when attempting to get a Visa/Mastercard from them.

Best of luck!

Starting Score: EQ:608, EX:617, TU:625

Current Score 3/11/2020: EQ:695, EX:703, TU:720

Goal Score: 740+

Take the myFICO Fitness Challenge

Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.

Newest Account July 8, 2020 -- Last HP October 24, 2020 -- Gardening Goal: August 2022 and reach 0/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

@chiefone4u wrote:The reasons given look like you have to many recent inquiries, don't apply for anything else for 6 months to a year and you should have better odds.

It also appears that you currently have an account with comenity. If you have defaulted on a Comenity account you'll need to fix it and or let it age.

It is possible that the before age 18 comment is because Comenity was directly involved or became an account holder of the fraud.

I have never been denied for the reasons you were given with the exception of "too many inquiries", with a thin file Comenity (seems to) gets spooked from inquiries; even as your file thickens they will deny for inquiries and new accounts when attempting to get a Visa/Mastercard from them.

Best of luck!

I have had Comenity accounts in the past, but they were all paid in full and never late. That's one reason why I was surprised by the denial. In the past, I have had accounts with J.Crew, Express, and Beall's, but not defaults or late payments. The under 18 comment is specificaly referencing a comment on my Experian report on the personal information page. Maybe they think that I am higher risk becuase that comment is listed there? I know they are much more data driven than they used to be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

I think Ulta is one of their "tougher" portfolio's. 2 years ago I applied for a few different cards and the credit limits varied:

Ulta $300

Zale's $1,850

Big Lots $750

Meijer $500

I maxed out my Capital One and Target Card and my score lowered to 560 or so. Of the cards, Ulta was reduced to $250 because of the recent dip in my credit score. The next month Meijer increased to $860.

I'm not sure if Ulta set the rules or if their Ulta card is more prone to fraud than say Big Lots. But certainly Ulta is a weird one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

@chiefone4u wrote:The reasons given look like you have to many recent inquiries, don't apply for anything else for 6 months to a year and you should have better odds.

It also appears that you currently have an account with comenity. If you have defaulted on a Comenity account you'll need to fix it and or let it age.

It is possible that the before age 18 comment is because Comenity was directly involved or became an account holder of the fraud.

I have never been denied for the reasons you were given with the exception of "too many inquiries", with a thin file Comenity (seems to) gets spooked from inquiries; even as your file thickens they will deny for inquiries and new accounts when attempting to get a Visa/Mastercard from them.

Best of luck!

The same just occurred to me. I applied this past Monday for a My BJ's Perks MC & was approved for $11k, but when I called the 800 number just now I received a notification that the account was closed by the bank. I never even received the card. I believe it was for the best after all of the derogatory post left regarding Comenity's practices.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

@Anonymous wrote:

@chiefone4u wrote:The reasons given look like you have to many recent inquiries, don't apply for anything else for 6 months to a year and you should have better odds.

It also appears that you currently have an account with comenity. If you have defaulted on a Comenity account you'll need to fix it and or let it age.

It is possible that the before age 18 comment is because Comenity was directly involved or became an account holder of the fraud.

I have never been denied for the reasons you were given with the exception of "too many inquiries", with a thin file Comenity (seems to) gets spooked from inquiries; even as your file thickens they will deny for inquiries and new accounts when attempting to get a Visa/Mastercard from them.

Best of luck!

The same just occurred to me. I applied this past Monday for a My BJ's Perks MC & was approved for $11k, but when I called the 800 number just now I received a notification that the account was closed by the bank. I never even received the card. I believe it was for the best after all of the derogatory post left regarding Comenity's practices.

I will still never understand why Comenity does this instead of just denying the application. I get that perhaps the secondary review that closes the card down is a different department, but whatever inquiry threshold they have should just be programmed into the application algorithim in the first place. It's just bad business to approve an account and close it before it even arrives (or shortly thereafter, after the bank wasted time printing you a card) and they've been doing it for a few years now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

What you're nt taking into consideratrion is that we are in the middle of a unique situation.... a pandemic. Businesses including restaurants, retailers and more are on a mandatory shut down.... with no specific timeline of re-opening, but many of which may never re-open.

This puts business owners and their employees totally out of work. Millions of people have applied for unemployment, in numbers this country has never seen before.... and food banks are being over run. People that are in a tough situation will pay for their food, medical, mortgage and other necessary bills before paying their credit cards.

So..........

The card issueing banks are (and righfully so) limiting their exposure & risk..... there is a great concern for the credit they have already issued and have outstanding and worry about collecting on the credit they have outstanding. So, I believe you will see issuers cutting back on credit lines as well as slowing down or not adding new accounts and additional exposure..... until this situation sees some light at the end of the tunnel. Until this resolves even partially we are in unprecedented & unchartered territory, I wouldn't waste hard pulls on credit card applications right now unless it was "absolutely necessary" to acquire additional credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Weird Comenity/Ulta Denial

so a few years back after i had had overstock and wayfair and also brylane home and full beauty. i decided to do the shopping cart trick, which doesnt seem to work anymore. so anyway. i was approved for 4 new accounts in like a week. they even sent me out the cards but then before i ever got to use them they closed all the new accounts. without a reason. So i get that, maybe they were nervous why i applied and was approved for many in a short period. i dont know. I stopped applying for anything else from comenity. i did dispute why they were closed but got a okie doke stupid answer which made no sense. So i applied for an ikea card which i really wanted but was turned down months later , The first denial letter said because of derogotory info which they didnt say why, and was dated three month before i applied. So comenity likes to evaluate if they approve you not from current info but from info from 2-6 monthe prior. Stupid. They also said i was denied credit for a bad credit management of my comenity accounts. Which is stupid considering i received regular credit increases on all 4 accounts i still had with them, and also my score had climbed almost 60 pys upward as well. i never was late on any account with them or anybody else i always paid more than the minimum due, many times paying it off right away and never has used anymore than most 5 % of my available credit. So actually i handle my accounts impeccably and responsibly always. i asked the credit dept and all they say is its done by a computer generated algorythm. So i told comenity i guess the only people they approve are dead beats who never pay there bill on time, always pay less than due, run up sky high balances etc. because i was doing everything right and they say because of prior derogatory handling of my accounts. i told the agent that i happen to know that according to the fair debt reporting act they have to give you specific reasons to turn you down. Im keeping the cards i have with them for now, but will never ever apply for another one from that joke of a bank. They cant even give accurate legitimate reasons for turning people down. it seems that either they get their account holders confused with other account holders or they just make up any reason to turn someone down. Do yourself a favor and never consider them they are not honest people.