- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Wells Fargo CLI so soon?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Wells Fargo CLI so soon?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wells Fargo CLI so soon?

| ||||

|

This may be a silly question, but i would like to know any outcome of others. I recieved the above email from WF within the last hour. Has anyone recieved it before? If so did you get the CLI? Part of feel like that would be way too soon for anyone except Lowe's/Sync. Everything I've read of WF CLI says it is too soon as well, but I've also never received a random email to update my annual income from any of the 7-8 banks I do business with either. Idk. I submitted the requested info so we will find out one way or the other. Just trying to see if this is common or what? This is my first card with WF.

Background: I app'd for the WF Active Cash on 08/01/21, then approved 08/02/21 (forgot to thaw) at $7k/24.99% 😐. EX pulled, F8/F9 735/745 when I app'd. $120k HH income. $55k individual.

I've put probably 4k spend through the card since (insurance and taxes) and currently have a balance of $450ish that I will pay off within the next couple of months. Aggregate UTI 2% because of the $450 balance, but far more often than not it's less than 1%.

Note: I tried to post the screenshot of the email but uploader says it's too large to attach.

Thanks!

Bank/Loans:

Future Apps:

04/27/2023

FICO 8 - EX: 744 | TU: 772 | EQ: 763

VS 3.0 - EX: 759 | TU: 792 | EQ: 811

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

DH received a same email in June of this year and provided his income and 3 weeks later got an email and mail congratulating his CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

Considering that most "customer initiated CLI's" are SP and obviously any "bank initiated CLI's" would also be SP, it certainly doesn't hurt to accomodate their request. Though your account has only been open 45 days, it does "feel" early but I would let them do their thing...there's no harm in that

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

Well, I also received the email, called first to make sure it was not a phishing attempt.

The WF rep said it was good. So we'll see what happens in 3 weeks?? .. (not holding my breath)

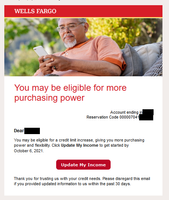

1st email

2nd email

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

I recieved the same for my active cash. Its only been open a month or two. I did have the same thing happen to my propel card earlier this year and after the statement cut they gave me an increase so who knows. I am not holding my breath but I guess it is possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

I received that same thing for my card this week. We see what happens. I'm curious to see if anything comes of it. Thanks!

@dcp0524 wrote:

Dear Devon:

You may be eligible for a credit limit increase, giving you more purchasing power and flexibility. Click Update My Income to get started by October 6, 2021.

Thank you for trusting us with your credit needs. Please disregard this email if you provided updated information to us within the past 30 days.

This may be a silly question, but i would like to know any outcome of others. I recieved the above email from WF within the last hour. Has anyone recieved it before? If so did you get the CLI? Part of feel like that would be way too soon for anyone except Lowe's/Sync. Everything I've read of WF CLI says it is too soon as well, but I've also never received a random email to update my annual income from any of the 7-8 banks I do business with either. Idk. I submitted the requested info so we will find out one way or the other. Just trying to see if this is common or what? This is my first card with WF.

Background: I app'd for the WF Active Cash on 08/01/21, then approved 08/02/21 (forgot to thaw) at $7k/24.99% 😐. EX pulled, F8/F9 735/745 when I app'd. $120k HH income. $55k individual.

I've put probably 4k spend through the card since (insurance and taxes) and currently have a balance of $450ish that I will pay off within the next couple of months. Aggregate UTI 2% because of the $450 balance, but far more often than not it's less than 1%.

Note: I tried to post the screenshot of the email but uploader says it's too large to attach.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

In my case i dont have an WF cc but earlier this year one of my cards emailed me asking for a income update and did give me a cli.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization above 50 pct.

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

WF is being truthful when they say that updating your income could lead to a(n auto-) CLI but it's boilerplate commentary. A big motivating factor behind the ask is that issuers in the US are legally required to regularly ask cardholders to update your income, but they do take current income into consideration when evaluating accounts to see if auto-CLIs are justified.

A number of other issuers use similar phrasing when sending out these requests as it's an incentive to follow up, as while they have to ask you don't have to respond as you are not actually applying for additional credit.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

I got this the other day too - twice as a matter of fact.

Had the Propel since January 2020.

Let's see what a couple of weeks brings ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wells Fargo CLI so soon?

From my experience WF will randomly do auto credit limit increases without you asking. For limit increases we request, we usually only can be approved every 6 months. Since they're the ones initiating this potential limit increase though anything's possible. Best wishes to you!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $15,900 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)