- myFICO® Forums

- Types of Credit

- Credit Card Applications

- What Credit Cards could I be approved for?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What Credit Cards could I be approved for?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What Credit Cards could I be approved for?

----------

I currently have two Credit Cards.

1st: Capital One Secured

Opened: November 2017

Status: Still Secured

Credit Limit: $600

2nd: Discover It

Opened: December 2017

Status: Unsecured July 2018

Credit Limit: $2,400

The only Hard Pull Inquiries on my Credit Reports are from applying for the two above Credit Cards.

My FICO Credit Scores:

TransUnion: 720 as of March 13, 2019

Experian: 718 as of March 7, 2019

Utilization: 26% - $778/$3,000 - as of March 13, 2019 when my TransUnion FICO Credit Score updated.

At its highest, my TransUnion FICO Credit Score was 747 in August 2018 with a Utilization of 1%.

At its lowest, my TransUnion FICO Credit Score was 654 in November 2018 with a Utiization of 78%.

At its highest, my Experian FICO Credit Score was 733 in January 2019 with a Utilization of 5%.

At its lowest, my Experian FICO Score was 639 in November 2018 with a Utiization of 78%.

I will be paying my March Statement Balance [$344.84] in full after April 1st.

Since my Statement Cut on March 19th, around 7% [$210] has been used so far.

If my Utilization can stay low, I should see my FICO Credit Scores increase somewhat when they update in April.

Anyway..

Telling you everything above may or may not help you answer my following question..

I am interested in applying for the Chase Freedom. I really like the 5% Rotating Categories of the Discover, so I am drawn to the Chase Freedom for that reason. It would be nice to potentially save 5% on Groceries for SIX MONTHS! Though, that only works if Chase and Discover have Grocery Stores for different Quarters and don't overlap..

Would it be beneficial to open up a Chase Checking Account to, kind of, get in the door with Chase before I apply for the Chase Freedom?

I am also interested in the U.S. Bank Cash+ due to the fact that they allow you to choose your Categories. I like that they allow you to potentially earn 5% for paying your Mobile Carrier. The Earning Potential could vary depending on what Categories they offer each Quarter, since I know there's a chance that the same Categories may not be offered each Quarter.

I did notice though, with the US Bank Cash+, that you cannot redeem your Cashback for Direct Deposit unless you have a US Bank account..? At least that's how I interpreted what it said on the website. That's my only Con about the Cash+.. I don't know if I like the idea of opening a US Bank Checking Account specifically just to be able to redeem the Cashback Rewards for Direct Deposit. I'm not completely opposed to the idea.. I would prefer the Direct Deposit over a Statement Credit.. It just seems like a weird requirement, in my opinion..

I already have 1 Checking Account.. I don't know if it would look strange if I have 3 Checking Accounts. My Main Checking Account, then Chase Total Checking [to get in the door with Chase,] and then US Bank [to Direct Deposit the Cash+ Cashback Rewards]. Would that look strange to anyone looking into my Banking/Credit History?

The Uber Credit Card also interests me due to the fact that I will be having to use Uber a lot in the coming future.

I like the idea of having a Visa Credit Card in my Wallet just in case a location I'm ever at doesn't take Discover or Mastercard for some reason.

I've been very lucky so far because just about every place I've been to has accepted Discover. Very few places don't accept Discover in my area, but I'm glad I had my Mastercard for those random times.

Are there any Visa Cards that don't have Foreign Transaction Fees? I did notice that both the Chase Freedom and the US Bank Cash+ charge Foreign Transaction Fees. This really isn't a big deal at the moment, since I don't have any foreign travel plans, but if I were to Travel overseas I don't want to be charged a Foreign Transaction Fee if the places that I visit only accept Visa. I'm not sure if Mastercard is widely accepted overseas, but my Capital One Secured Mastercard doesn't charge a Foreign Transaction Fee..

----------

A few Notes:

-I am Unemployed, so that may work against me when applying.

-Shared Income is around $18,000/Year.

----------

What are some Data Points from others that have gotten approved for the Chase Freedom or the US Bank Cash+?

What would you say my chances are at getting approved?

What other Credit Cards would you suggest for me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

Sorry, OP, but you will not be approved if you’re unemployed. What does shared income mean?

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

@CreditInspired wrote:Sorry, OP, but you will not be approved if you’re unemployed. What does shared income mean?

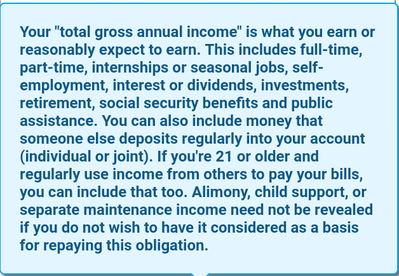

The reason I say I am unemployed is because I am Disabled. I would want to be honest on my Credit Card Applications and state that I am Unemployed because I technically am, and saying that I am Disabled isn't an option. The closest thing would be saying "Other".

As far as what I meant by "Shared Income".. I claim a Parent or Spouse's Income as part of my own. Capital One and Discover allows applicants to include any Shared Income when applying for their Credit Cards. Chase allows you to include shared income, as well..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

Honestly I think you could try for either the Uber or the Freedom. Your credit history is over a year long and is in decent shape. Another good thing is that, even if you’re denied for one, you can try for the other. If your only HPs are from those cards, you obviously don’t have many inqs. Good luck and let us know!

Amex Cash Magnet: 18k

Fidelity Visa: 16.5k

Apple Card: 4.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

@pinkandgrey wrote:Honestly I think you could try for either the Uber or the Freedom. Your credit history is over a year long and is in decent shape. Another good thing is that, even if you’re denied for one, you can try for the other. If your only HPs are from those cards, you obviously don’t have many inqs. Good luck and let us know!

Thank you for your reply!

I think I will wait until either:

1. June or July to apply. I heard that Chase likes you to have between 12-18 Months Credit History, so maybe having exactly 18 Months of Credit History could be good.

OR

2. April to apply when my FICO Credit Scores update. Having my Credit Scores reflect a higher Score before I apply could be good.

I will definitely update my post with my Approval or Denial Status whenever I decide to apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

If you are planning to get the Uber card simply for taking Uber rides then there are better choices for this. You mentioned the Cash+ and if you choose the transportation category, you'll earn 5% on Uber rides. The Barclays Uber card will give you only 2% but you can use your rewards earned from this card to get free rides.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

@Anonymous wrote:If you are planning to get the Uber card simply for taking Uber rides then there are better choices for this. You mentioned the Cash+ and if you choose the transportation category, you'll earn 5% on Uber rides. The Barclays Uber card will give you only 2% but you can use your rewards earned from this card to get free rides.

Thank you for your reply!

The Uber Card would also be used for Restaurants. My Household tends to eat out fairly often each month, so earning more than 1% back on that would be great.

I also like the fact that the Uber Visa Credit Card offers $600 towards a replacement[?] Mobile Phone when you pay your Phone Bill with the Credit Card. I would have to look more into the Terms&Conditions on that though to see what the qualifications are for that.

Online Shopping is a near monthly occurrence, also.

But yes, the Cash+ does have some pretty good categories that I use a lot.

I will have to calculate everything to see which Credit Card will be more beneficial.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Credit Cards could I be approved for?

One other piece of advice I would like to share, in the quest for the best cards, keep in mind how much time you'll spend working different cards and their angles. I was originally going down this path as well to help maximize every expense to get the maximum CB I could but realized, I would drive myself insane on managing and maintaining that. So, I ended up putting a decent amount of charges to maximize the larger amounts, but for smaller amounts, I have a 2% card that I use frequently everywhere. I know I can possibly get 3% on a different card or 4%, but the time and energy to manage it, is not worth the few pennies more that I'll get in return CB wise.

Scores - All bureaus 770 +

TCL - Est. $410K