- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: When to apply to get higher Starting Limits?

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When to apply to get higher Starting Limits?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

11:16 AM

01-18-2020

11:16 AM

Re: When to apply to get higher Starting Limits?

@GApeachy

Wish I could learn how to quote on mobile! Lol

I’m hovering around 40% on my Nav card and that’s when I decided to back off until I pay it down. I feel that’s a lot to charge in the first month. Not running amuck charging it, had a situation with my housing I had to take care of plus some dental work

Wish I could learn how to quote on mobile! Lol

I’m hovering around 40% on my Nav card and that’s when I decided to back off until I pay it down. I feel that’s a lot to charge in the first month. Not running amuck charging it, had a situation with my housing I had to take care of plus some dental work

Message 21 of 26

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

11:40 AM

01-18-2020

11:40 AM

Re: When to apply to get higher Starting Limits?

@OP, why not try to get a refurbished laptop for now on EBay or Dell? You have PayPal Credit...they are always emailing with special 100% interest free offers. Why not use one of them?. Who says you need to spend $2K on a laptop? Right now, you just need something without a broken screen. You can get a like new laptop for under $500 on Best Buy, Dell, EBay...just make sure to get one with a warranty. I have a MacBook Air I bought for under $500 thru one of those daily deal sites and I’ve used it no problem for a few years now. You are just out of a serious rebuild...keep your costs low and garden and those limits will grow in no time. And even when you have higher limits you should still operate like you don’t have the cards...Use them like a debit card and PIF.

Message 22 of 26

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

01:29 PM

01-18-2020

01:29 PM

Re: When to apply to get higher Starting Limits?

Another thought - you can look into cards that show you your potential SL before you app. Apple Card does that...SP will show you what your limit will be. It’s a HP if you accept the offer. I still think you should garden for a while and let the small limits grow but this is a way to see what kind of limit you might get when you are ready to come out of the garden.

Message 23 of 26

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

04:59 PM

01-18-2020

04:59 PM

Re: When to apply to get higher Starting Limits?

I would focus on Navy and PenFed for the next 12 months and forget everyone else for now.

Rebuild started in 2014 - $100k unsecured credit in 2017 - $500k unsecured credit in 2024.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

Message 24 of 26

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

05:53 PM

01-18-2020

05:53 PM

Re: When to apply to get higher Starting Limits?

Thanks for all the input everyone.

I spent the day thinking it over and you’re all right. I’m going to hold off on getting a subprime card just to get a laptop, and focus on PenFed, NFCU, Discover, and Cap 1 for the next year. I can tough it out with the busted screen for another couple months while I pay down my NFCU balance, then either buy a new machine cash or with the 1.99% BT as many have suggested.

Thanks again for patiently working with me and explaining all my options. I now know this is the best decision and I can’t wait to see what kind of limits I’ll be at a year from now!

I spent the day thinking it over and you’re all right. I’m going to hold off on getting a subprime card just to get a laptop, and focus on PenFed, NFCU, Discover, and Cap 1 for the next year. I can tough it out with the busted screen for another couple months while I pay down my NFCU balance, then either buy a new machine cash or with the 1.99% BT as many have suggested.

Thanks again for patiently working with me and explaining all my options. I now know this is the best decision and I can’t wait to see what kind of limits I’ll be at a year from now!

Message 25 of 26

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2020

07:29 PM

01-18-2020

07:29 PM

Re: When to apply to get higher Starting Limits?

@PerArduaAdAstra wrote:

@GApeachy

Wish I could learn how to quote on mobile! Lol

I’m hovering around 40% on my Nav card and that’s when I decided to back off until I pay it down. I feel that’s a lot to charge in the first month. Not running amuck charging it, had a situation with my housing I had to take care of plus some dental work

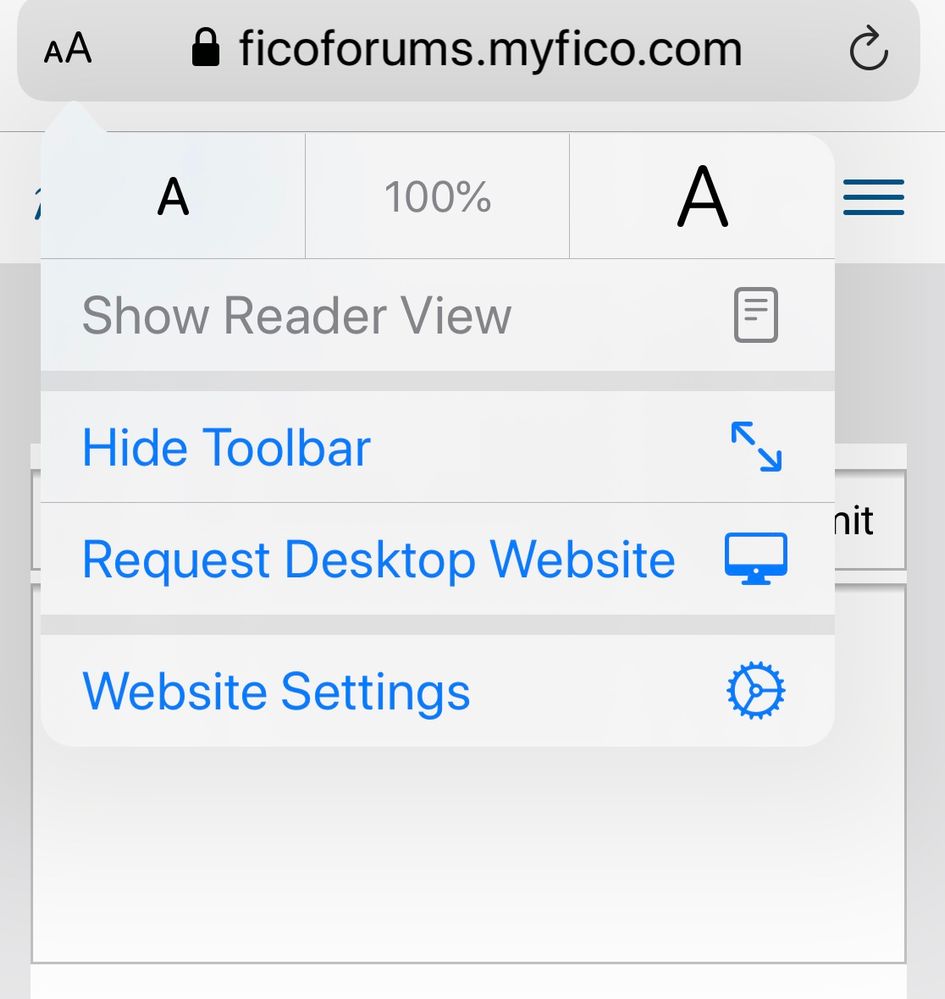

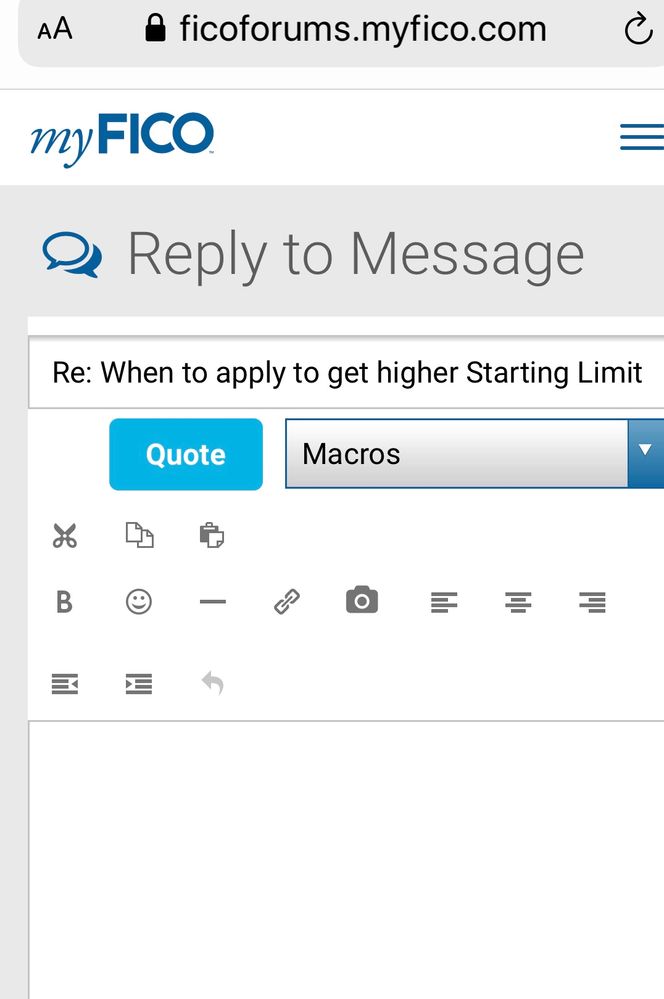

If you're using an iphone:

*Hit reply

*Go to top left-hand corner of screen and tap the AA

*click "Request Desktop Website"

click "Quote"

Pictures below

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

Message 26 of 26

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.