- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: 4 Approvals - One Day - All DP's

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

4 Approvals - One Day - All DP's (UPDATED)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

4 Approvals - One Day - All DP's (UPDATED)

First, I would like to extend my most sincere thanks to @UncleB and @Birdman7 for all of their sage advice and support over the last few weeks as I prepared for this. I also want to show my appreciation to the entire myFICO forum for all of the DP's and posts which I used as a guide to make my decisions. This community is outstanding and invaluable, and I am posting all of my DP's in return so that they might help someone else.

My credit DP's at the start of the day:

FICO: 765 across all 3 Current: SmartOption Visa (0/$2,500) - Local Bank, Low APR

AAoA: 3y2m Citi DC (0/$5,500) - 2% everything

UT%: 18% Discover It ($3,000/9,000) - 5% Rotate

INQ: EQ/2 TU/0 EX/0 Truck Loan - July 2018

Income: 52k

Last CC App: Sept. 2015

Location: SC

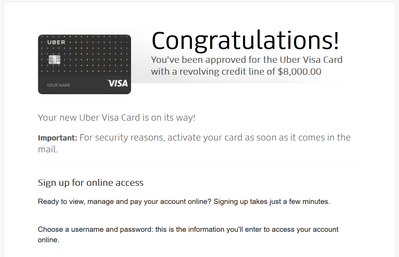

1 - Barclay Uber Visa - Instant Approval $8,000 - (9:45am EST)

Pulled TU - (as they usually do)

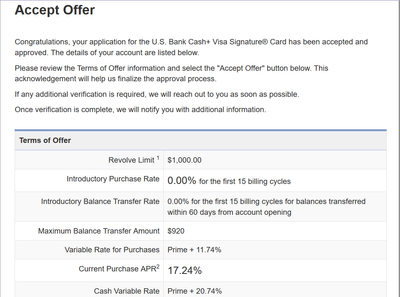

2 - US Bank Cash+ - Instant Approval $1,000 - (10:15am EST)

Pulled TU - (Did not seem to conflict with the Uber Visa app, thankfully)

From my understanding this is considered an instant approval, not a manual review. I do plan to Recon the SL for this one, however, I don't know if I can do this now or if I have to wait for the card?

Edit: Recon SL adjusted to $7,000

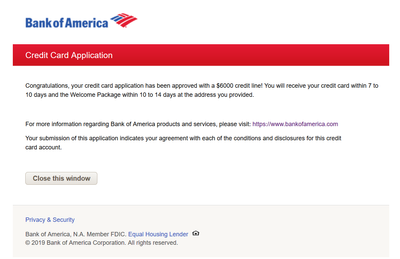

3 - BoA Cash Rewards - Instant Approval $6,000 - (11:00am EST)

Pulled EX - (I had a preselect mailer with an invitation code for this one)

4 - FNBO Ducks Unlimited - Instant Approval [Ammt TBD] - (9:30pm EST)

Pulled EX - (I took a chance on this one, but the prior BoA pull didn't seem to affect it)

I did notice on the splash page as I submiited my app, there was a picture of the DU platinum Visa. However, the approval I received states Signature Visa which I think indicates a $5,000+ SL ??

Edit: After checking the online approval site, SL received is $6,000

I think I covered most everything I can think of. If anyone has any questions I'd be happy to offer any other feedback I can. And if anyone knows about the US Bank Recon SLI (whether I can Recon now, or if I have to wait for the card) could you please let me know? I will edit later to reveal the results of the Recon.

This has been quite a satisfying day and if you'll excuse me, I will be at the Home Depot purchasing fertilizer and some shiny new spades and hoes for my 2-yr hiatus. Cheers! ![]()

![]()

![]()

![]()

UPDATE: As of today (3/26/2019) My Recon with the US Bank Cash+ SLI was successful! ![]() The SL for the card has been adjusted to $7,000. In addition, I also received in the mail today my Barclay Uber Visa and my BoA Cash Rewards cards.

The SL for the card has been adjusted to $7,000. In addition, I also received in the mail today my Barclay Uber Visa and my BoA Cash Rewards cards. ![]() Finally, regarding Ducks Unlimited, I checked the online approval site for my SL and it states $6,000.

Finally, regarding Ducks Unlimited, I checked the online approval site for my SL and it states $6,000. ![]()

So, prior to 3/11/2019 my overall revolving CL was $14,500. I received $2,500 total CLI's between my Discover and Citi DC taking me to $17,000. And now with these new additions my overall revolving CL is $44,000, tripling over the course of 15 days.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

Absolutely fantastic!

Congrats on the strong approvals, and come on over to the Garden... you'll be in good company! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

Congrats, that is a nice mini spree. Tons of new bonuses to play with too

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

@UncleB

Move over.....(hands you a Jack-n-Coke)....I need to be facing the beach.

The really ironic thing: I've been sitting here looking at my wallet thinking.....my first purchase may very well have to be a new wallet. Lol!

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

Hopefully Barclays doesn’t get jealous of your other cards but otherwise, a very nice spree!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

@Anonymous wrote:

Congratulations!

Hopefully Barclays doesn’t get jealous of your other cards but otherwise, a very nice spree!

+1, Congrats on the Great Approvals. The great part was that you got instant gratification as you went thru them -- straight to cloud 9.

@Saeren is right though, Barclays is know to take a 2nd look after they approve someone. If other new accounts are posting they freak out and give the "credit seeking behavior" reason and will close your account. Hopefully you'll squeeze by as it sounds like you stepped out of the garden for these and won't show any more activity. Congrats again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

@Saeren and @credit_is_crack

Well if that's the case, then I'll have to tactfully Recon them, as well. I understand the argument regarding "credit seeking behavior" but every one of the cards I applied for has a specific purpose for me. It was a calculated process to get cards that give a return on my monthly expenses, and although some may see it as excessive, it was by no means abusive behavior. I can only hope for the best.

Citi Dc - 2% everything

Discover - 5% Rotate

US Bank - 5% Utilities and Cell Phones

Ducks Unlimited - 5% Gas , Sporting Goods

Uber Visa - 4% Restaurant/Fast Food 3% Travel/Hotel/Airfare

BoA - 3% Online Retail Shopping (also needed for a BT from my Discover)

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

@Taurus22 wrote:@Saeren and @credit_is_crack

Well if that's the case, then I'll have to tactfully Recon them, as well. I understand the argument regarding "credit seeking behavior" but every one of the cards I applied for has a specific purpose for me. It was a calculated process to get cards that give a return on my monthly expenses, and although some may see it as excessive, it was by no means abusive behavior. I can only hope for the best.

Citi Dc - 2% everything

Discover - 5% Rotate

US Bank - 5% Utilities and Cell Phones

Ducks Unlimited - 5% Gas , Sporting Goods

Uber Visa - 4% Restaurant/Fast Food 3% Travel/Hotel/Airfare

BoA - 3% Online Retail Shopping (also needed for a BT from my Discover)

A recon with US Bank will likely be another HP now. You can certainly go unscathed from Barclays but I can't tell you how often threads appear where they have brought the hammer down. That is what the others are referencing. A joke around here is that Barclays is like a jealous girlfriend. You start hanging around other women and she breaks up with you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4 Approvals - One Day - All DP's

@Overmedicated

I have read through most of those posts during my research and it is discouraging, but worst-case senario, if they do retract the credit line then I can simply re-apply in 2 years if I choose. Or I can simply apply for the Cap1 SavorOne or the next flavor of the month credit card that comes out with restaurant spend. They will come. Barclay would only be hurting themselves as my dining expenses are the highest spend I have just above utilities.

And I will argue that I haven't opened a CC since Sept. 2015 (3.5 years) so I'm obviously not a churner or an abusive card user, as I also PIF each month. (The only exception being the Discover which was unexpected expenses while we are currently saving for a house, so a BT allows me to stretch that debt a little.)

And honestly, I see no difference in myself applying for all the cards that are useful to me at one time to age my accounts together, than someone who applies for a new card every 6 months like clockwork and holds 31 total CC's (and in most cases I would argue that those are the people who don't really need that much credit and are actually abusing the system) I live within my means.

But for now I am relatively happy with my results and will cross whatever bridge I come to. And I will be getting CB on the way to that bridge...

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently