- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Cap One CLI

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap One CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

wrote:

wrote:Wow, congrats!

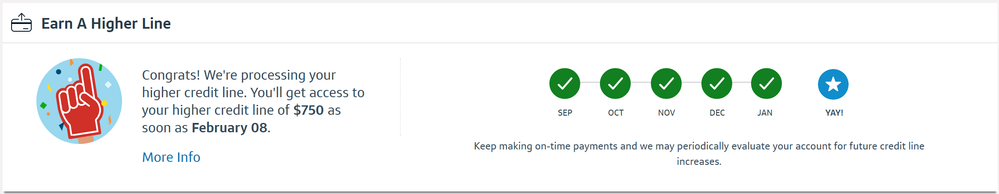

I just saw this on Cap1 QS1 login today, so it's interesting.

I hope I don't get a measly $150 CLI to $750. That card is getting combined with my Platinum ($3300 CL) once that one graduates.

could be worse dude, mines at 300 and will only go to 500 in march (on my little graphic the fourth checkmark is green and the fifth i assume is the statement cut coming in a week). ive tried for early CLIs on it and they keep telling me too many recent inquiries, even though i hadnt had one for 90 days (still havent, the discover approval i mention below was a SP)

its dumb, my score has gone up almost 100 points since i opened this card, and i just got approved for a 3500 SL discover... i dont get why capone is so **bleep** stingy, ive put so much spend through that QS1 too, over 4000 worth (yes max and paid off 2-3 times a month)

if they dont unsecure my platinum this month also, i am probably sockdrawering both of them and just going plain disco, since they actually gave me a reasonable CL.

To put this into perspective. I have two capital one cards, one is almost a year old, the other is almost six months old. Their combined limit is 800 dollars (500 and 300), and on the bigger one, they are still holding a 99 dollar deposit. My fico scores have gone from 550 when i was originally approved for the secured card to 625 when i was approved for the QS1 to now just about 700 on all three, and they arent budging, whereas one of the more difficult issuers to get approved for, just gave me a 20 percent interest rate (19.24 after the 0 14 month intro) and FOUR AND A HALF TIMES THE LIMIT.

Im so done with capone if they dont give me serious love this March when my first card turns 1 year old.

Im legit angry about it, considering ive been so **bleep** good to them and put massive spend through their cards, dozens if not hundreds of swipes, pay on time, etc etc. The tier system is real. It actually turns me off thinking id have to close and reapply for anything better.

Hell CREDIT one gave me a bigger CLI than Capital one is going to be giving my QS1, and i closed that POS.

Don't take it personally, CapOne's just been having a really bad time: http://www.foxbusiness.com/features/2017/12/15/capital-one-credit-card-charge-off-rate-tops-5-in-nov...

As for Disco... Well let's just say they gave me a $2500 SL when I had a 780 EQ. So I don't exactly much love for them. (and by "much" I really mean zero ![]() )

)

Closed:

6/8/20:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

wrote:Wow! Congrats!

OP, can you provide some data points, your score, did you pay in full each month or carry a balance?

wrote:Wow! Congrats!

OP, can you provide some data points, your score, did you pay in full each mo to nth or carry a balance?

I charged anywhere from $400 to $600 each month, paying it off before the statement cut date leaving only a small balance. I did not pay any interest on this card. I also have a Cap one seIcured card that I was using for a small reccruing payment each month.

When I got the QS1 My EX Fico was 612, and as of 1/1/18 it is 690. I did not request any CLI from Cap One durring this time, and I had NO new hard inquires. I have been gardening since applying for this card.

I plan to apply for a Discover in March, and possibly one other card at the same time. As long as I get at least one more card I plan to see if I can combine my secured card with my QS1 and get my deposit back.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

I charged anywhere from $400 to $600 each month, paying it off before the statement cut date leaving only a small balance. I did not pay any interest on this card. I also have a Cap one seIcured card that I was using for a small reccruing payment each month.

Hmm.

...I am trying to figure out best way to go about CLI with them, as people around here complain they are stingy. Yet I read a thread that suggested many got upgrades and CLI by high usage of the card.

By what you are saying, one can make high usage of card, yet pay it off before statement cut, to keep UTIL rates low, and still get love from Cap One? I can have my cake and eat it, too?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

oops looks like I already said the same thing before and forgot I had replied.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

@Anonymouswrote:Wow! Congrats!

OP, can you provide some data points, your score, did you pay in full each month or carry a balance?

Yes, are you willing to say what score range your FICO is?

And is your overall card UTIL low, or what? Even though you say you used the Cap One card a lot?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

@MakingProgresswrote:Six months ago I got a Cap One QS1 with a baby CL of $300. I was expecting an automatic CLI to $500 after 6 months of on time payments. I just hit that six months and instead of getting a bump to $500 I was given a CLI of $3000. Can't complain about that. The CLI is roughly equivilent to the amount I charged on this card in the last 6 months, coincidence? Most likely but interesting.

How did you charge "roughly" $3000 on a $300 card over six months (or $400-600 each month, as you answered in a previous post)?

Or did you make multiple payments each month, to release your credit availability?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

Charge and pay, charge and pay, charge and pay. Thats how its done.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

sorry about you situation...just hoping to grow my venture one...had it for 7mths ask for increase..

they only raised by 500...couple a yrs ago they auto increase my platinum by several thousand when i paid in full via blance transfer..

i will pif over the next six mths and see what happens

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One CLI

@MakingProgresswrote:Charge and pay, charge and pay, charge and pay. Thats how its done.

Hi. ...Yes, I've since been reading today about that strategy here. ...I get it now! Hmm. Gonna try it for my Platinum card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content