- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Double Approvals!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Double Approvals!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Double Approvals!!

Congratulations on your approvals!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Double Approvals!!

@ocheosa wrote:

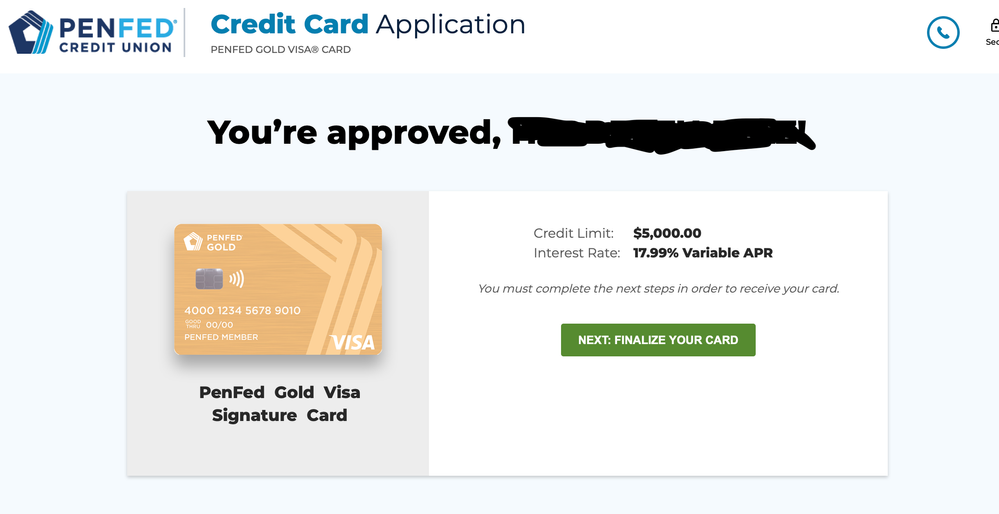

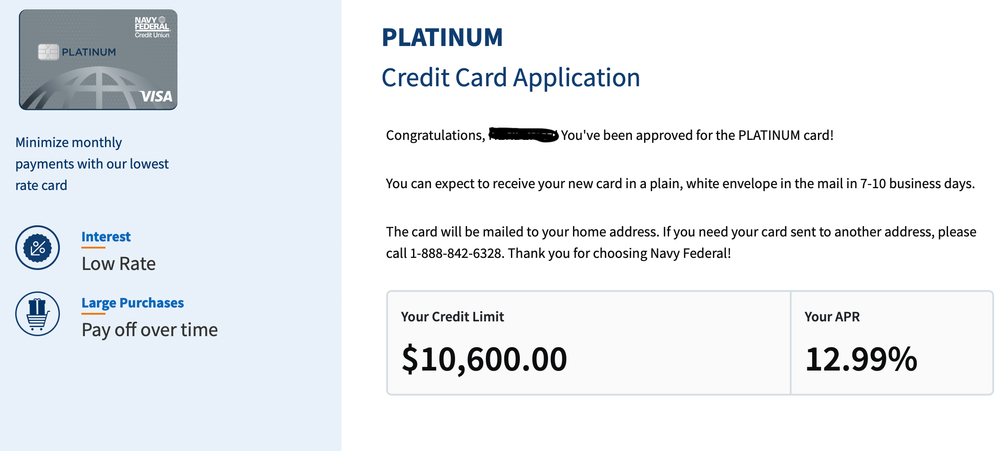

@Anonymous wrote:Today I hit my 91/3 from my second NFCU and it was time to go for the 3rd and last navy card. I currently hold a balance on a closed account with American Airlines CU about $9400.00. So It will only make sense to go for the Platinum and take advantage of the BT 0% for 12mths. TU shows 714 on F8. I was really hoping for something like my 2nd Navy card 20k but it was not the case. I was approved for $10600.00 not so bad at all. I know 10600 is not going to cut it so I need it another BT card. EX is my lower score F8 690 but didn't want to get a hard pull from EX I'm trying to build up for my second AMEX. On JUL13 I applied for the Penfed CR and was denied with a F8 714. Since I know penfed only pulls EQ decided to give it another shot this time. I went for the Gold and was approved for 5k with even a lower score F8 688. The apr on both cards are not the lowest Navy-12.99 PEN-17.99 but at least it will be 0% for the next 12 months. I really wanted to get into chase with the 80K Bonus for the CSP but I'm way far for that 5/24 rule. So I decided to get everything I need this year that way by 2022 I"ll be having a really strong score on all 3 bureaus and get some of that chase love. Recently opened a Savings with chase threw in $300 in there and I'll add some more down the road to establish some relationship. I don't really want any more cards in the future except for the Amex Gold. I'm just waiting for my EX score to hit mid 700 before applying. Here are some DP and quick facts about my credit journey have 4 accounts closed do to late payments and delinquency back from 2019 with KAY JWRLS, BOA, WF and AACU. Late payments in some of those accounts with 30,60,90 and even 120 days. All accounts were PIF except for the AACU ($9600 balance there ACCT CLOSED). This is the only thing affecting me right now UT on this card is about 68%. My overall UT is 2% on all my active cards always PIF. I think I've done a pretty good job this year. Started my rebuilding back on OCT 2019. Capital PLAT open 01/20 $750, Comenity EXP 01/20 $250, Comenity VICSC 01/20 $500, Comenity WAyF 01/20 $750, Discover 02/20 $2k, NFCU CR 02/20 $2k, NFCU MR 06/20 $20K and AMEX HSurpass 06/20 $1k. I hope this helps anyone out there in the same boat and remember try to include as much DP as possible on your approvals post. Do not post just the Bank and amount you got approved for just to get congrats replies. We all learn from each other here is good always to contribute some data. Thank you all in the community and be safe.

Congratulations!!!

Just an FYI, if you want to take advantage of the NFCU Platinum BT Offer (0% APR with no balance transfer fee) -

You can reallocate a good chunk of your 20k limit from the 2nd card to the platinum. Once you've completed paying it down then just move the limit back to that card if you want. It's a seamless process. Just note once the funds have been moved you have to wait 6 months to request a CLI on either card. If you qualify now, ask for the CLI on card #2 before reallocating funds.

To request reallocation you only need send a secured message with Credit Line Increse/Decrease as subject and ask that they reallocate $XXX to the Platinum from card #2. Just a bit of advice, try not to max out the limit. If you can get 15 of that 20k over to the Platinum it would be great. That would be 36.7% utilization (9400/25600). Easier to manage so you could get that below 30% quickly. I've read many stories of folks who maxed out a balance transfer and had problems after

Just a suggestion.

Thanks I was actually planning to do that to keep a low UT. I requested a CLI the same day to my 20k but got the 24 hrs message. Thank you very much for your suggestion reallocating some of that to my PLATINUM sounds like a good idea. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Double Approvals!!

Congrats!

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores: